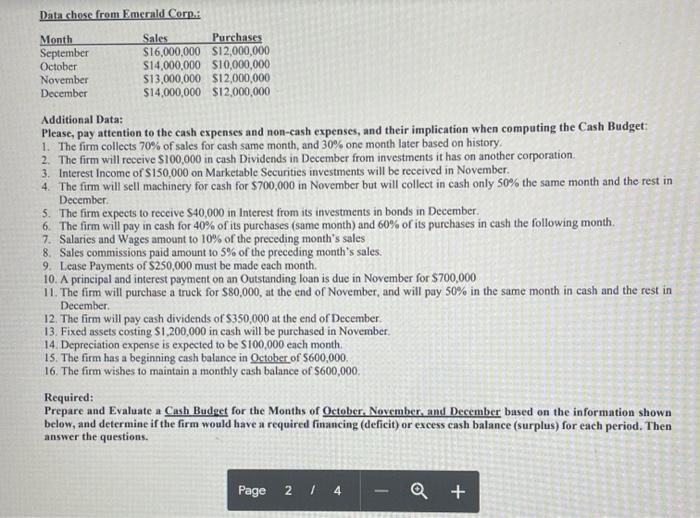

Question: Data chose from Emerald Corn.i Additional Data: Please, pay attention to the cash expenses and non-cash expenses, and their implication when computing the Cash Budget:

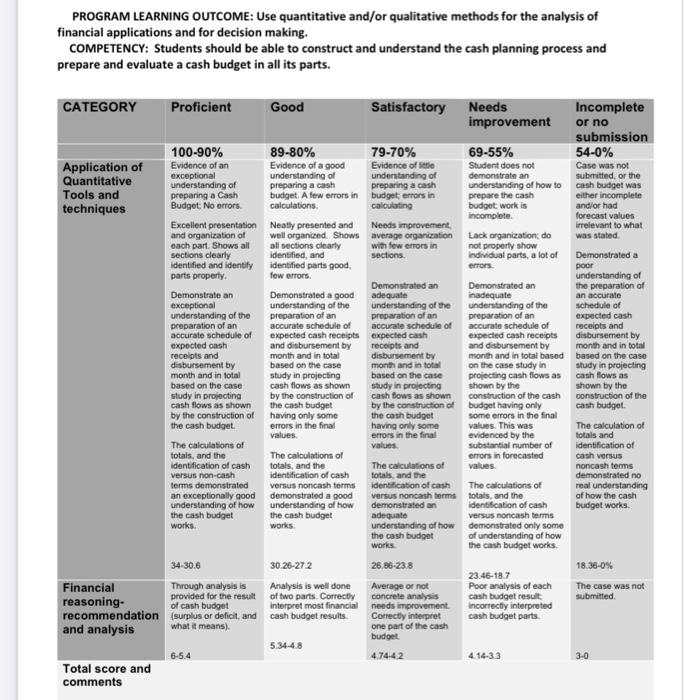

Data chose from Emerald Corn.i Additional Data: Please, pay attention to the cash expenses and non-cash expenses, and their implication when computing the Cash Budget: 1. The firm collects 70% of sales for cash same month, and 30% one month later based on history. 2. The firm will receive $100,000 in cash Dividends in December from investments it has on another corporation. 3. Interest Income of $150,000 on Marketable Securities investments will be received in November: 4. The firm will sell machinery for eash for $700,000 in November but will collect in cash only 50% the same month and the rest in December. 5. The firm expects to receive $40,000 in Interest from its investments in bonds in December. 6. The firm will pay in cash for 40% of its purchases (same month) and 60% of its purchases in cash the following month. 7. Salaries and Wages amount to 10% of the preceding month's sales 8. Sales commissions paid amount to 5% of the preceding month's sales. 9. Lease Payments of $250,000 must be made each month. 10. A principal and interest payment on an Outstanding loan is due in November for $700,000 11. The firm will purchase a truck for $80,000, at the end of November, and will pay 50% in the same month in cash and the rest in December. 12. The firm will pay cash dividends of $350,000 at the end of December. 13. Fixed assets costing $1,200,000 in cash will be purchased in November. 14. Depreciation expense is expected to be $100,000 each month. 15. The firm has a beginning cash balance in Q etober of $600,000. 16. The firm wishes to maintain a monthly cash balance of $600,000. Required: Prepare and Evaluate a Cash Budget for the Months of October. November. and December based on the information shown below, and determine if the firm would have a required financing (deficit) or excess cash balance (surplus) for each period. Then answer the questions. I. PREPARATION OF CASH BUDGET-34 POINTS II. Analyze the results obtained in the Cash Budget in a minimum of three sentences. What do the planned deficit or surplus results represent for each month? (6 points) PROGRAM LEARNING OUTCOME: Use quantitative and/or qualitative methods for the analysis of financial applications and for decision making. COMPETENCY: Students should be able to construct and understand the cash planning process and prepare and evaluate a cash budget in all its parts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts