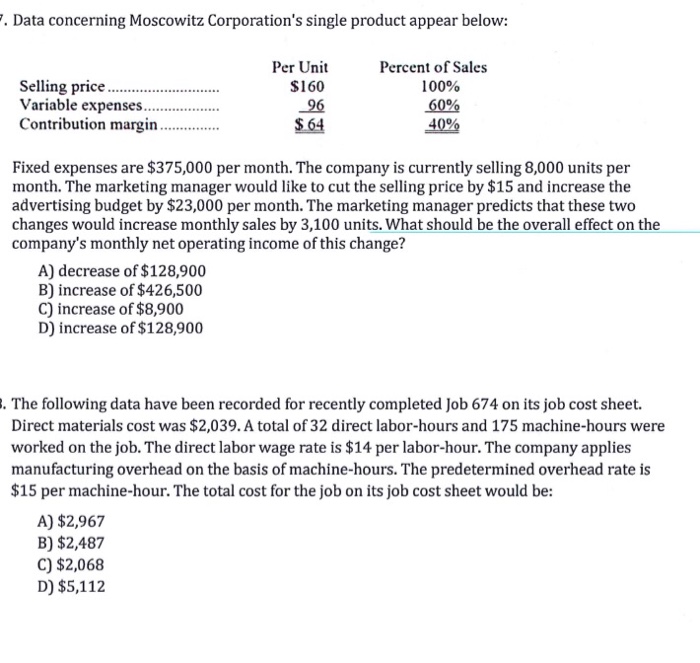

Question: . Data concerning Moscowitz Corporation's single product appear below: Per Unit $160 96 $64 Percent of Sales Selling price Variable expenses.. Contribution margin 100% 60%

. Data concerning Moscowitz Corporation's single product appear below: Per Unit $160 96 $64 Percent of Sales Selling price Variable expenses.. Contribution margin 100% 60% 40% Fixed expenses are $375,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to cut the selling price by $15 and increase the advertising budget by $23,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 3,100 units. What should be the overall effect on the company's monthly net operating income of this change? A) decrease of $128,900 B) increase of $426,500 C) increase of $8,900 D) increase of $128,900 . The following data have been recorded for recently completed Job 674 on its job cost sheet. Direct materials cost was $2,039. A total of 32 direct labor-hours and 175 machine-hours were worked on the job. The direct labor wage rate is $14 per labor-hour. The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $15 per machine-hour. The total cost for the job on its job cost sheet would be: A) $2,967 B) $2,487 C) $2,068 D) $5,112

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts