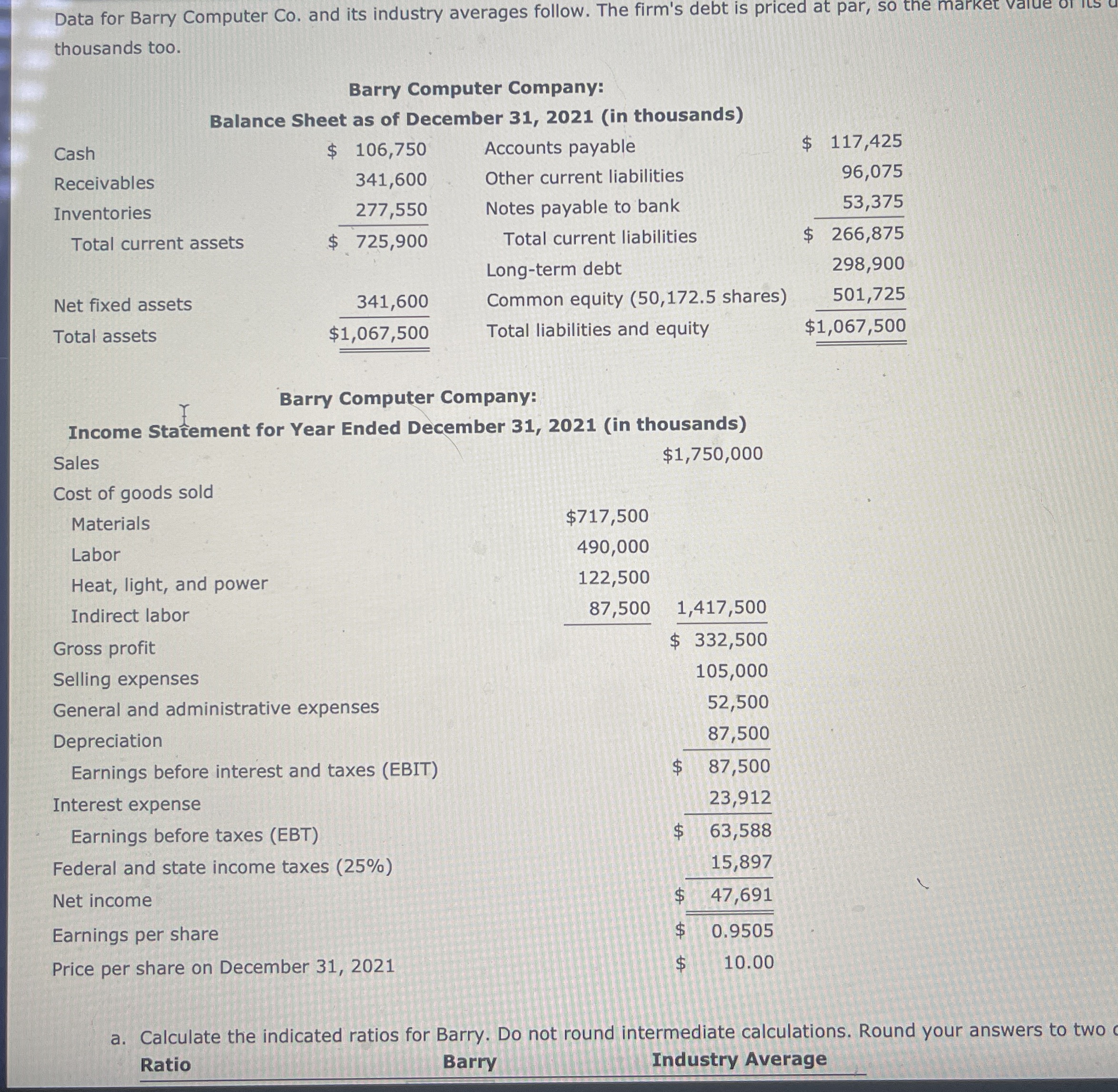

Question: Data for Barry Computer Co . and its industry averages follow. The firm's debt is priced at par, so the market value or ths thousands

Data for Barry Computer Co and its industry averages follow. The firm's debt is priced at par, so the market value or ths

thousands too.

Barry Computer Company:

Income Startement for Year Ended December in thousands

Sales

$

Cost of goods sold

a Calculate the indicated ratios for Barry. Do not round intermediate calculations. Round your answers to two

Ratio

Industry Average a Calculate the indicated ratios for Barry. Do not round intermediate calculations. Round your answers to two decimal places.

Calculation is based on a day year.

b Construct the DuPont equation for both Barry and the industry. Do not round intermediate calculations. Round your answers to tw

FIRM

Profit margin

Total assets turnover

Equity multiplier

INDUSTRY

c Select the correct option based on Barry's strengths and weaknesses as revealed by your analysis.

I. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm shou

assets turnover ratio is well below the industry average so sales should be increased, assets decreased, or both. While t

profitability ratios are low compared to the industry net income should be higher given the amount of equity, assets, a

industry averages. However, the company seems to be in an average liquidity position and financial leverage is similar

II The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm shou

turnover ratio is well below the industry average so sales should be increased; assets increased, or both. While the com

profitability ratios are low compared to the industry net income should be higher given the amount of equity, assets,

liquidity position and financial leverage is similar to others in the industry.

III. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit o

is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit r

high compared to the industry net income should be higher given the amount of equity, assets, and invested capital. I

financial leverage is similar to others in the industry.

IV The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock