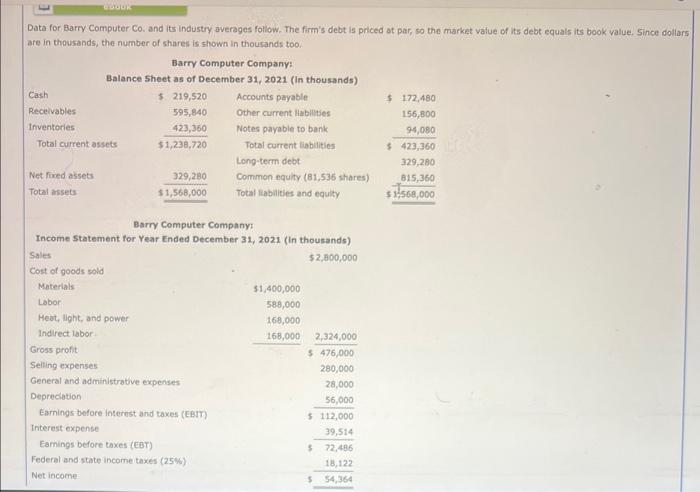

Question: Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals

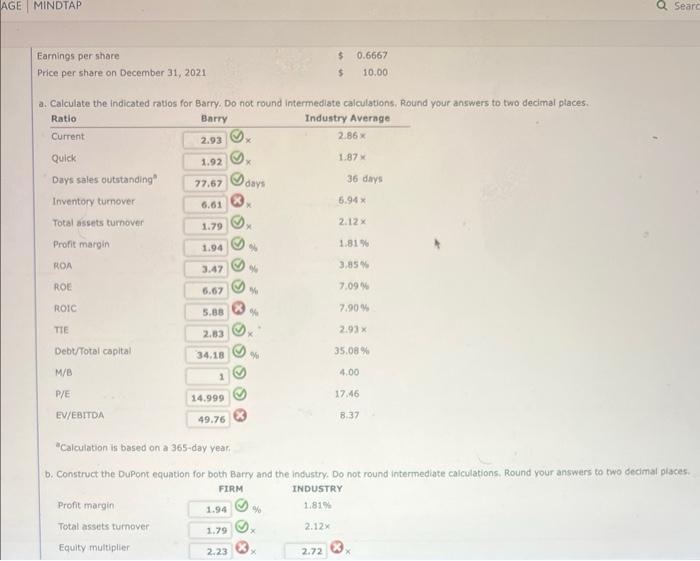

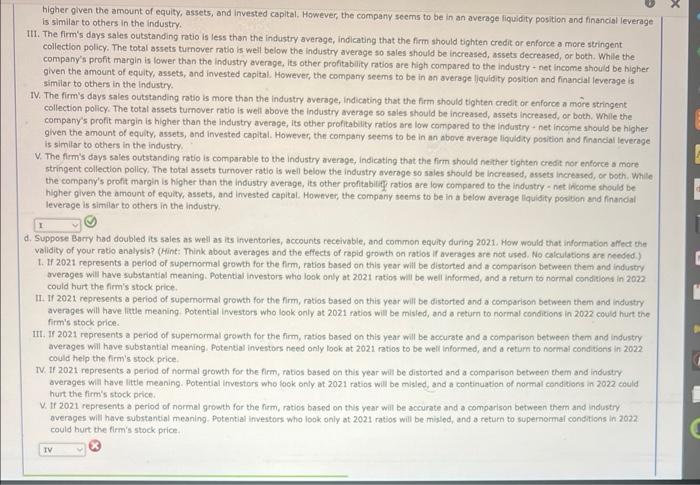

Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, the number of shares is shown in thousands too, Barry Computer Company Earnings per share Price per share on December 31,2021 550.666710.00 "Caiculation is based on a 365 -day year. b. Construct the Dupont equation for both Barry and the industry, Do not round intermediate calculations, Round your answers to two decimal places. stna TNDIETEV higher given the amount of equity, assets, and invested capital. However, the compary seems to be in an average fiquidity position and financial leverage is similar to others in the industry. III. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry average, its other profitability ratios are high compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. IV. The firm's deys sales outstanding ratio is more than the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratia is well aboye the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income ahould be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an above average liquidity. position and financial leverage is similar to others in the industry. V. The firm's days sales outstanding ratio is cormparable to the industry averoge, indicating that the firm should neither tighten credit nor enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, Its other profitabifit ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. Hownver, the company seems to be in a below average llquidity ponition and finandal leverage is similar to others in the industry. d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 202.1. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No caleulations are needtid.) 1. If 2021 represents a period of supernormal growth for the firm, ratios based on this year will be distorted and a comporiton between them and industry. averages will have substantial meaning. Potential investors who look only at 2021 ratios will be well informed, and a retum to normal conditions in 20z2. could hurt the firm's stock price. II If 2021 represents a period of supemormal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning potential lavestors who look only at 2021 ratios will be misled, and a return to normal condicions in 2022 covid hurt the firm's stock price. III. If 2021 represents a period of supemormal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages wil have substantial meaning, Potential investors need only look at 2021 ratios to be well informed, and a ceturn to normal conditions in 2022. could thelp the firm's stock price. TV. If 2021 represents a period of normel growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning. Potential ifvestors who look only at 2021 ratios will be misled, and a continuation of normal conditions in 2022 could hurt the firm's stock price. V. If 2021 represents a period of normal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry. averages will have substantial meaning- Potential investors who look only at 2021 ratios will be misled, and a return to supernermal condicions in 2022 . cogld hurt the firm's stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts