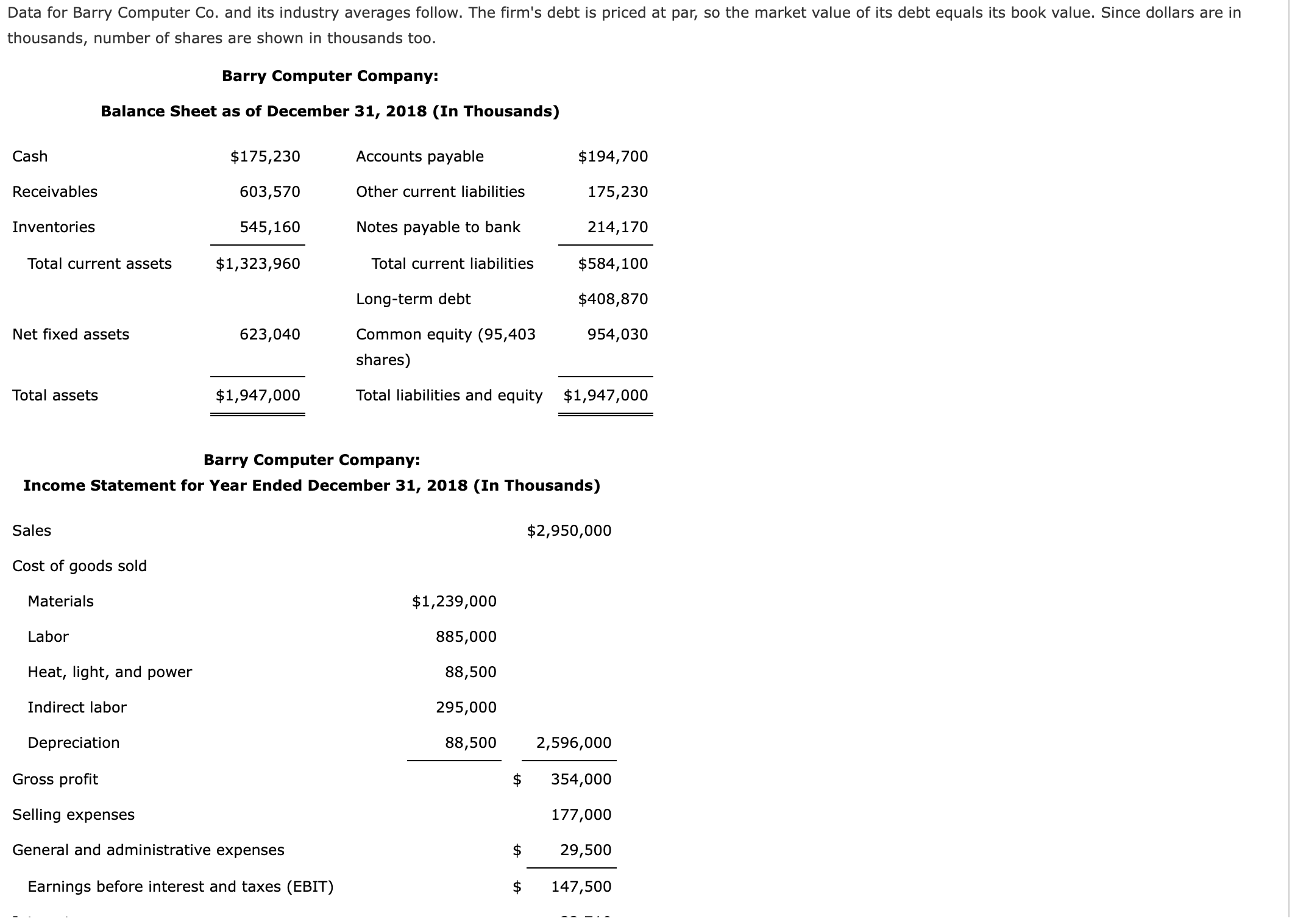

Question: Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals

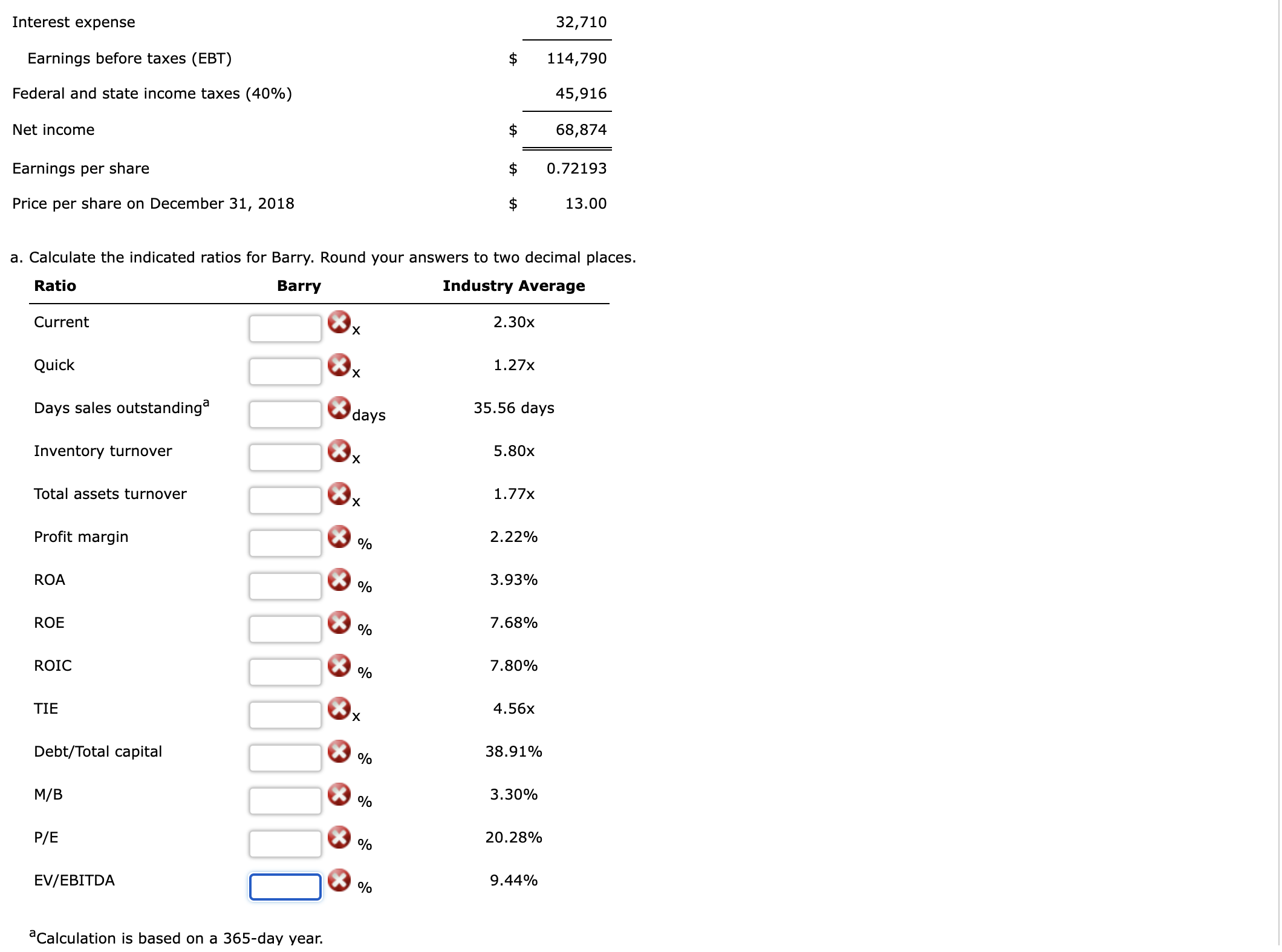

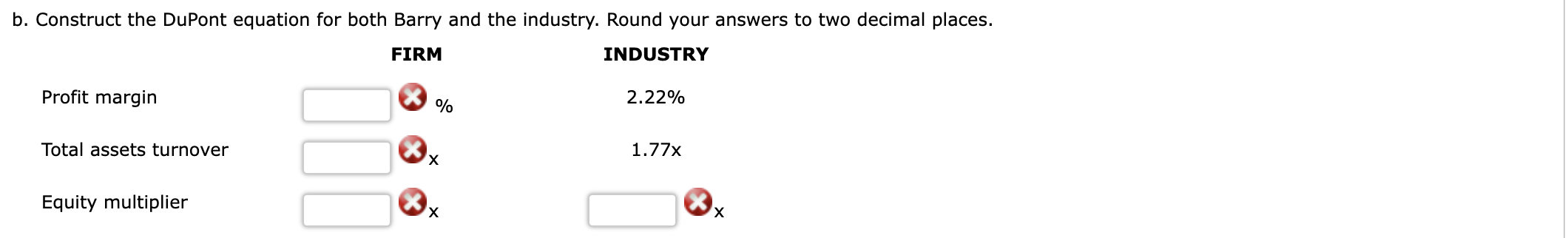

Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, number of shares are shown in thousands too. Barry Computer Company: - Calculate the indicated ratios for Barry. Round your answers to two decimal places. a Calculation is based on a 365 -day year. b. Construct the DuPont equation for both Barry and the industry. Round your answers to two decimal places. FIRM Profit margin Total assets turnover Equity multiplier INDUSTRY 2.22% 1.77x Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, number of shares are shown in thousands too. Barry Computer Company: - Calculate the indicated ratios for Barry. Round your answers to two decimal places. a Calculation is based on a 365 -day year. b. Construct the DuPont equation for both Barry and the industry. Round your answers to two decimal places. FIRM Profit margin Total assets turnover Equity multiplier INDUSTRY 2.22% 1.77x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts