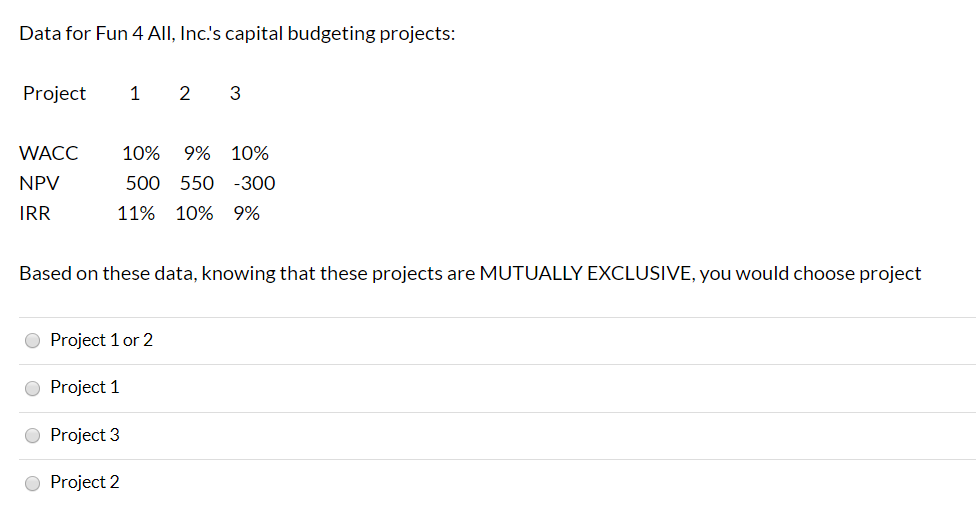

Question: Data for Fun 4 All, Inc.'s capital budgeting projects: Project 1 2 3 WACC NPV IRR 10% 9% 500 550 11% 10% 10% 300 9%

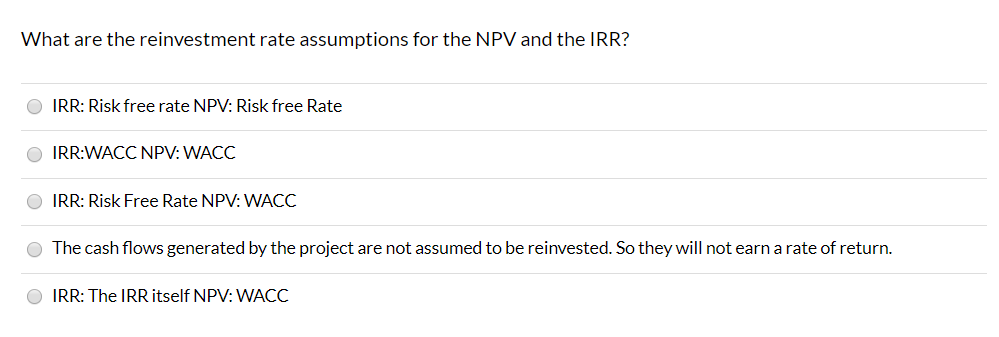

Data for Fun 4 All, Inc.'s capital budgeting projects: Project 1 2 3 WACC NPV IRR 10% 9% 500 550 11% 10% 10% 300 9% Based on these data, knowing that these projects are MUTUALLY EXCLUSIVE, you would choose project Project 1 or 2 O Project 1 Project 3 Project 2 What are the reinvestment rate assumptions for the NPV and the IRR? IRR: Risk free rate NPV: Risk free Rate O IRR:WACC NPV: WACC IRR: Risk Free Rate NPV: WACC The cash flows generated by the project are not assumed to be reinvested. So they will not earn a rate of return. IRR: The IRR itself NPV: WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts