Question: Data for Problems #11 through #14: The ABC Company had issued a bond in 2009 with a twelve-year maturity. As an investor, at the end

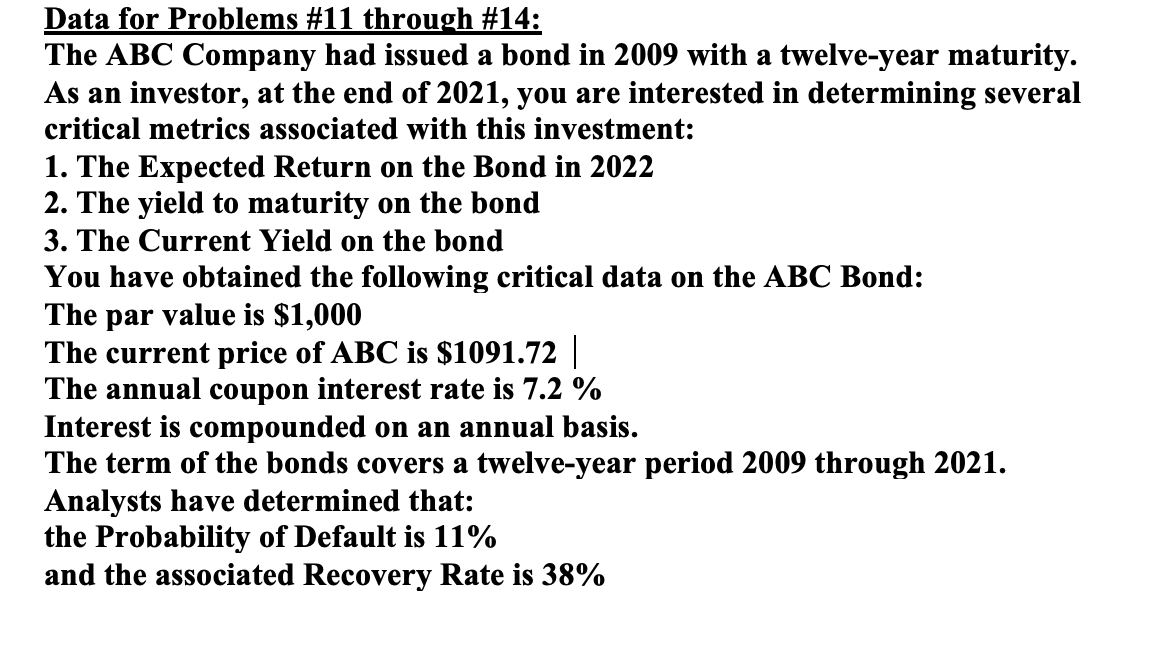

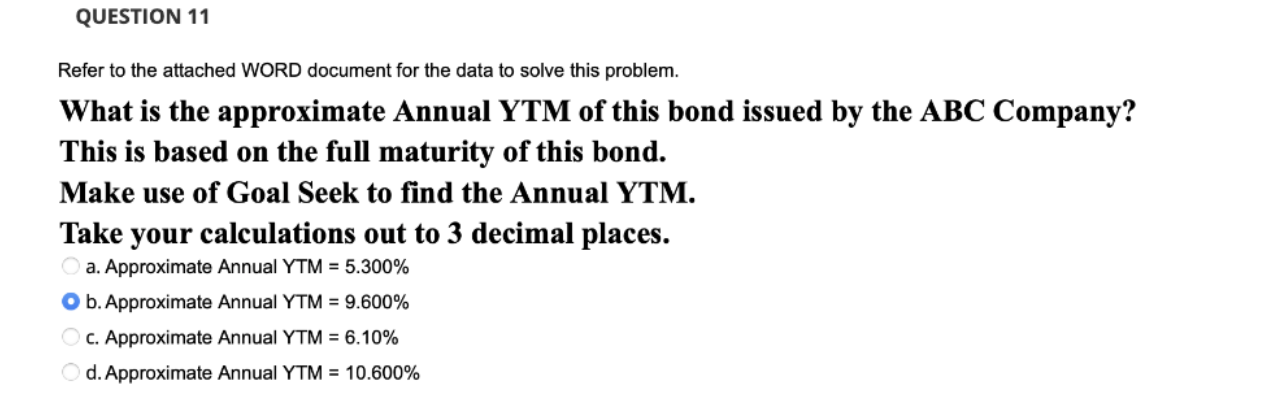

Data for Problems #11 through #14: The ABC Company had issued a bond in 2009 with a twelve-year maturity. As an investor, at the end of 2021, you are interested in determining several critical metrics associated with this investment: 1. The Expected Return on the Bond in 2022 2. The yield to maturity on the bond 3. The Current Yield on the bond You have obtained the following critical data on the ABC Bond: The par value is $1,000 The current price of ABC is $1091.72 | The annual coupon interest rate is 7.2 % Interest is compounded on an annual basis. The term of the bonds covers a twelve-year period 2009 through 2021. Analysts have determined that: the Probability of Default is 11% and the associated Recovery Rate is 38% QUESTION 11 Refer to the attached WORD document for the data to solve this problem. What is the approximate Annual YTM of this bond issued by the ABC Company? This is based on the full maturity of this bond. Make use of Goal Seek to find the Annual YTM. Take your calculations out to 3 decimal places. a. Approximate Annual YTM = 5.300% O b. Approximate Annual YTM = 9.600% C. Approximate Annual YTM = 6.10% d. Approximate Annual YTM = 10.600%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts