Question: Data for Problems #15 and #16: A corporation has issued a bond with the following characteristics: The current price of the bond is $859.94 The

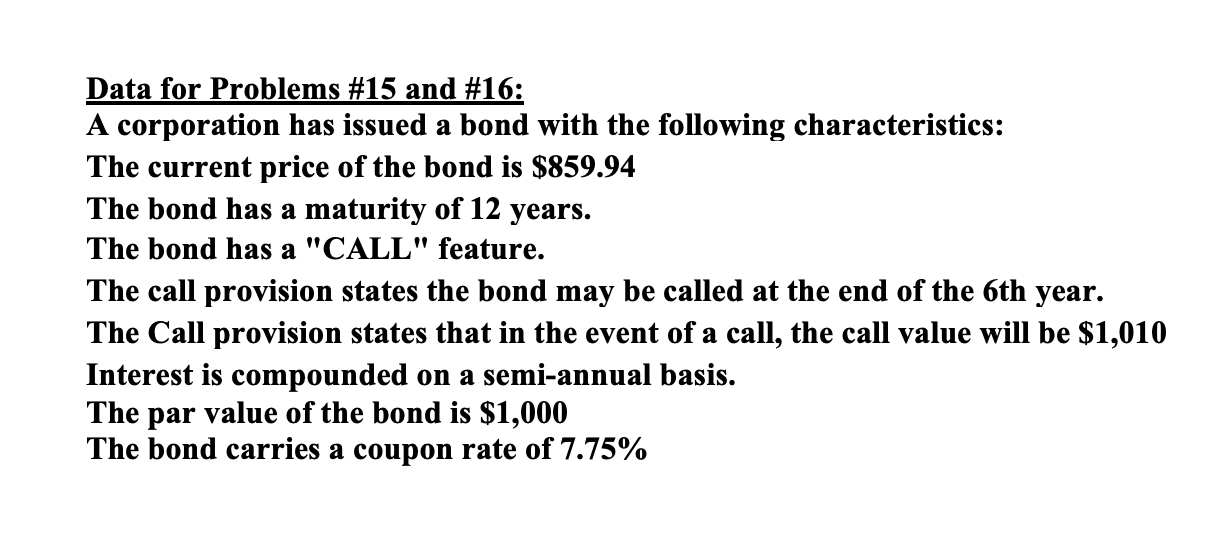

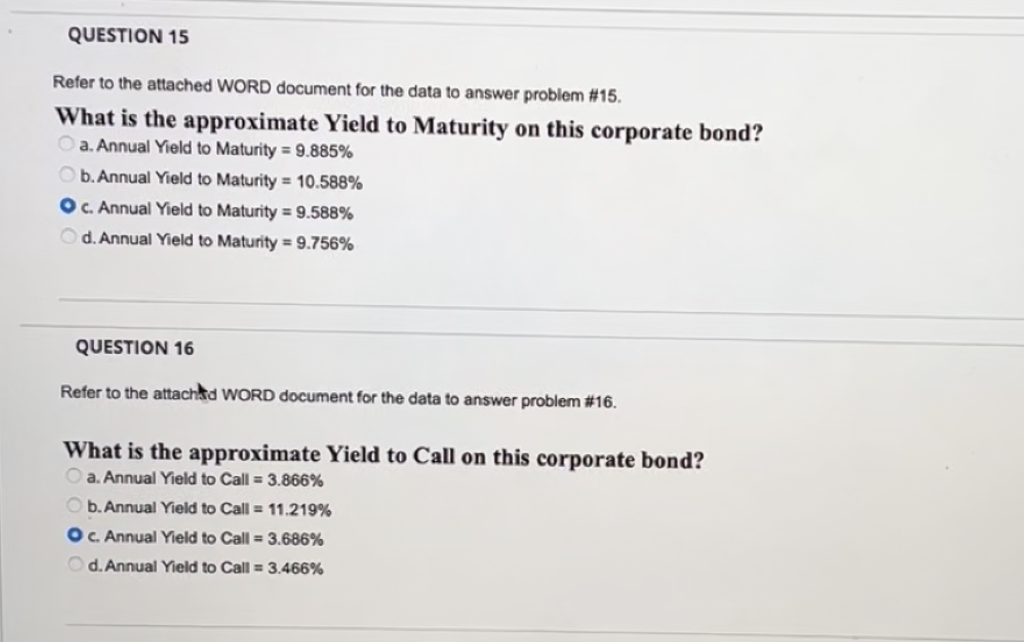

Data for Problems #15 and #16: A corporation has issued a bond with the following characteristics: The current price of the bond is $859.94 The bond has a maturity of 12 years. The bond has a "CALL" feature. The call provision states the bond may be called at the end of the 6th year. The Call provision states that in the event of a call, the call value will be $1,010 Interest is compounded on a semi-annual basis. The par value of the bond is $1,000 The bond carries a coupon rate of 7.75% QUESTION 15 Refer to the attached WORD document for the data to answer problem #15. What is the approximate Yield to Maturity on this corporate bond? a. Annual Yield to Maturity = 9.885% b. Annual Yield to Maturity = 10.588% O c. Annual Yield to Maturity = 9.588% d. Annual Yield to Maturity = 9.756% QUESTION 16 Refer to the attachta WORD document for the data to answer problem #16. What is the approximate Yield to Call on this corporate bond? a. Annual Yield to Call = 3.866% b.Annual Yield to Call = 11.219% O c. Annual Yield to Call = 3.686% d. Annual Yield to Call = 3.466%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts