Question: DATA FOR Q2 DATA FOR Q3 Consider a 25 -year bond with a face value of $1,000 that has a coupon rate of 5.2%, with

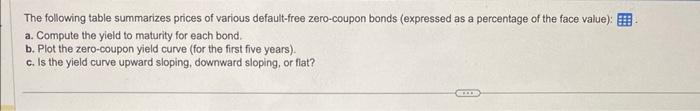

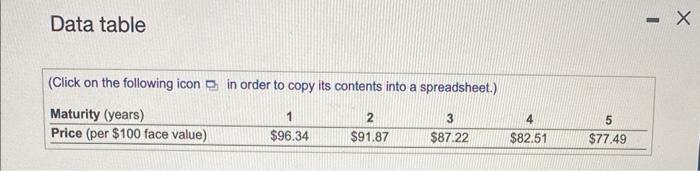

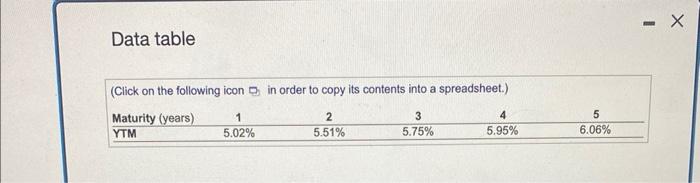

Consider a 25 -year bond with a face value of $1,000 that has a coupon rate of 5.2%, with semiannual payments. a. What is the coupon payment for this bond? b. Draw the cash flows for the bond on a timeline. The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100 face value of a two-year, zero-coupon, risk-free bond? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Data table (Click on the following icon D in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts