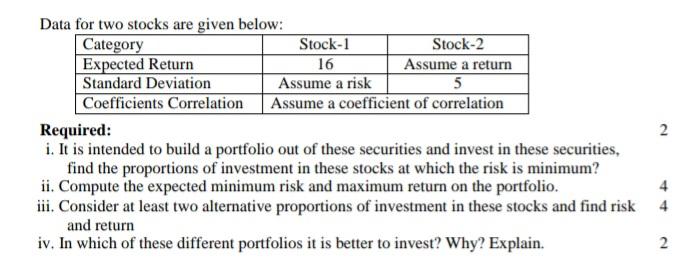

Question: Data for two stocks are given below: Category Stock-1 Stock-2 Expected Return 16 Assume a return Standard Deviation Assume a risk 5 Coefficients Correlation Assume

Data for two stocks are given below: Category Stock-1 Stock-2 Expected Return 16 Assume a return Standard Deviation Assume a risk 5 Coefficients Correlation Assume a coefficient of correlation Required: i. It is intended to build a portfolio out of these securities and invest in these securities, find the proportions of investment in these stocks at which the risk is minimum? ii. Compute the expected minimum risk and maximum return on the portfolio. iii. Consider at least two alternative proportions of investment in these stocks and find risk and return iv. In which of these different portfolios it is better to invest? Why? Explain. 2 4 4 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts