Question: Data Formulas Review View Help Home Insert Page Layout 10 AA === ab Wrap Text X Cut Format Painter te Merge & Center BIU A

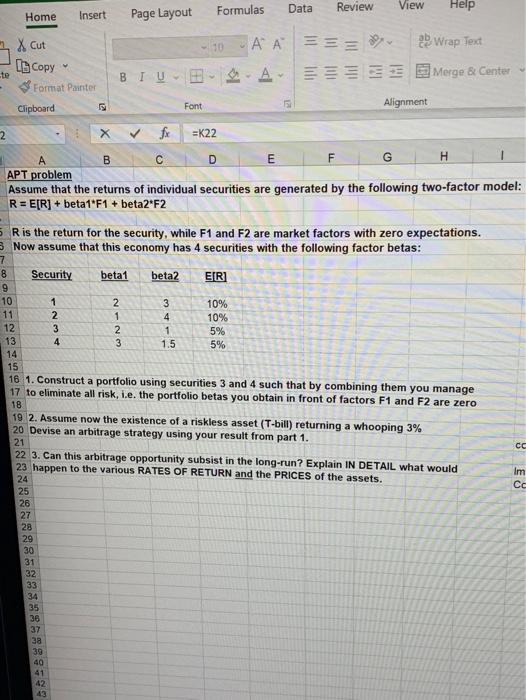

Data Formulas Review View Help Home Insert Page Layout 10 AA === ab Wrap Text X Cut Format Painter te Merge & Center BIU A Clipboard Font 5 Alignment 2 fe =K22 B C E F G I H APT problem Assume that the returns of individual securities are generated by the following two-factor model: R = E[R] + beta1"F1 + beta2*F2 R is the return for the security, while F1 and F2 are market factors with zero expectations. Now assume that this economy has 4 securities with the following factor betas: 7 8 Security beta1 beta2 ER 3 9 10 11 12 13 14 15 1 2 3 4 2 1 2 3 10% 10% 5% 5% 1 4 1.5 18 16 1. Construct a portfolio using securities 3 and 4 such that by combining them you manage 17 to eliminate all risk, i.e. the portfolio betas you obtain in front of factors F1 and F2 are zero 19 2. Assume now the existence of a riskless asset (T-bill) returning a whooping 3% 20 Devise an arbitrage strategy using your result from part 1. 22 3. Can this arbitrage opportunity subsist in the long-run? Explain IN DETAIL what would 23 happen to the various RATES OF RETURN and the PRICES of the assets. 21 Im 24 25 26 27 28 29 30 31 32 33 34 35 36 37 3a 39 40 41 42 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts