Question: Data needed for the adjusting entries include: a. Supplies on hand at month-end, $900. b. Service revenue accrued, $3,000. c. Wages owed but not yet

| Data needed for the adjusting entries include: |

| |||

| a. | Supplies on hand at month-end, $900. |

| ||

| b. | Service revenue accrued, $3,000. |

| ||

| c. | Wages owed but not yet paid, $400. |

| ||

| d. | Unearned service revenue that has been earned, $2,000. |

| ||

| e. | Depreciation on building, $2,500. |

| ||

| f. | Depreciation on furniture, $1,000. |

| ||

| g. | Paid $9,600 for 12 month insurance policy on February 1. |

| ||

| h. | On March 1, an office was rented for five months and $6,000 was paid in advance. | |||

|

| ||||

| Required: |

|

| ||

| 1 | Journalize the adjusting entries. |

| ||

| 2 | Prepare the adjusted trial balance. |

| ||

| 3 | Prepare the income statement, the statement of retained earnings, and the balance sheet. | |||

| 4 | Journalize the closing entries. |

| ||

| 5 | Prepare the after-closing trial balance. |

| ||

|

| ||||

|

| ||||

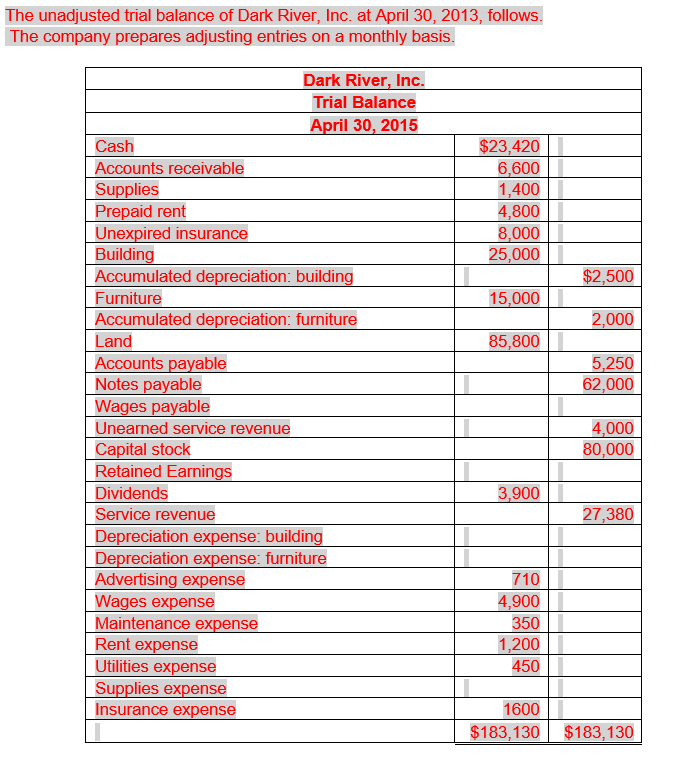

The unadjusted trial balance of Dark River, Inc. at April 30, 2013, follows. The company prepares adjusting entries on a monthly basis. $23,420 6,600 1,400 4,800 8,000 25,000 $2,500 15,000 2,000 85,800 Dark River, Inc. Trial Balance April 30, 2015 Cash Accounts receivable Supplies Prepaid rent Unexpired insurance Building Accumulated depreciation: building Furniture Accumulated depreciation: furniture Land Accounts payable Notes payable Wages payable Unearned service revenue Capital stock Retained Earnings Dividends Service revenue Depreciation expense: building Depreciation expense: furniture Advertising expense Wages expense Maintenance expense Rent expense Utilities expense Supplies expense Insurance expense 5,250 62,000 4,000 80,000 3,900 27,380 710 4,900 350 1,200 450 1600 $183,130 $183,130

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts