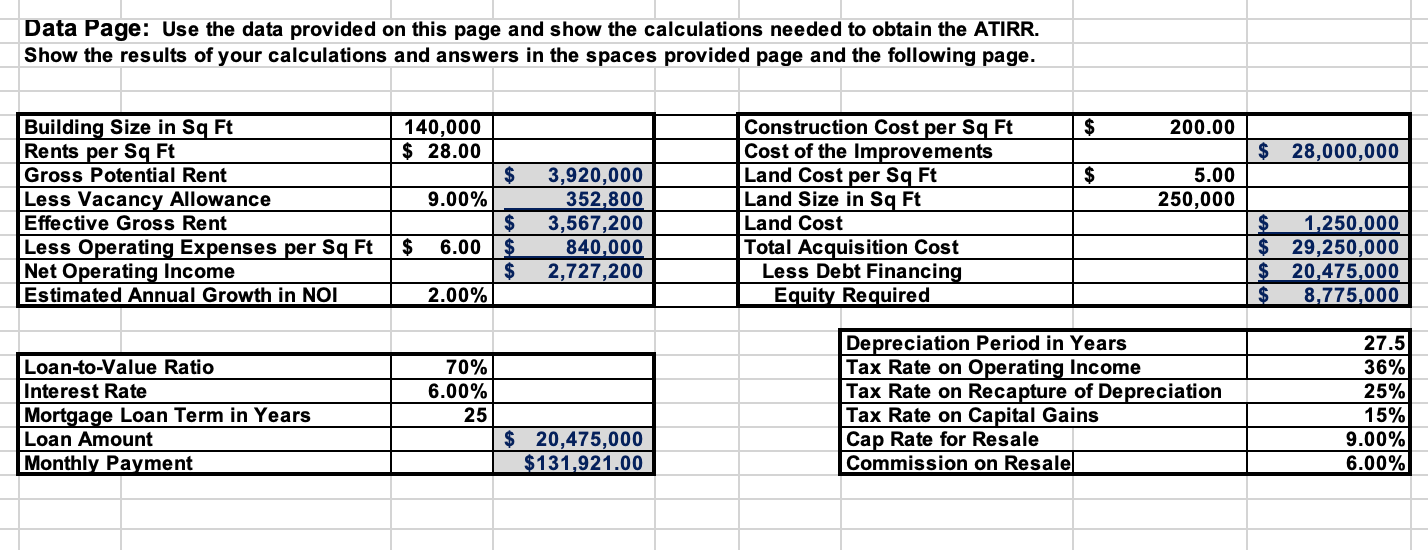

Question: Data Page: Use the data provided on this page and show the calculations needed to obtain the ATIRR. Show the results of your calculations and

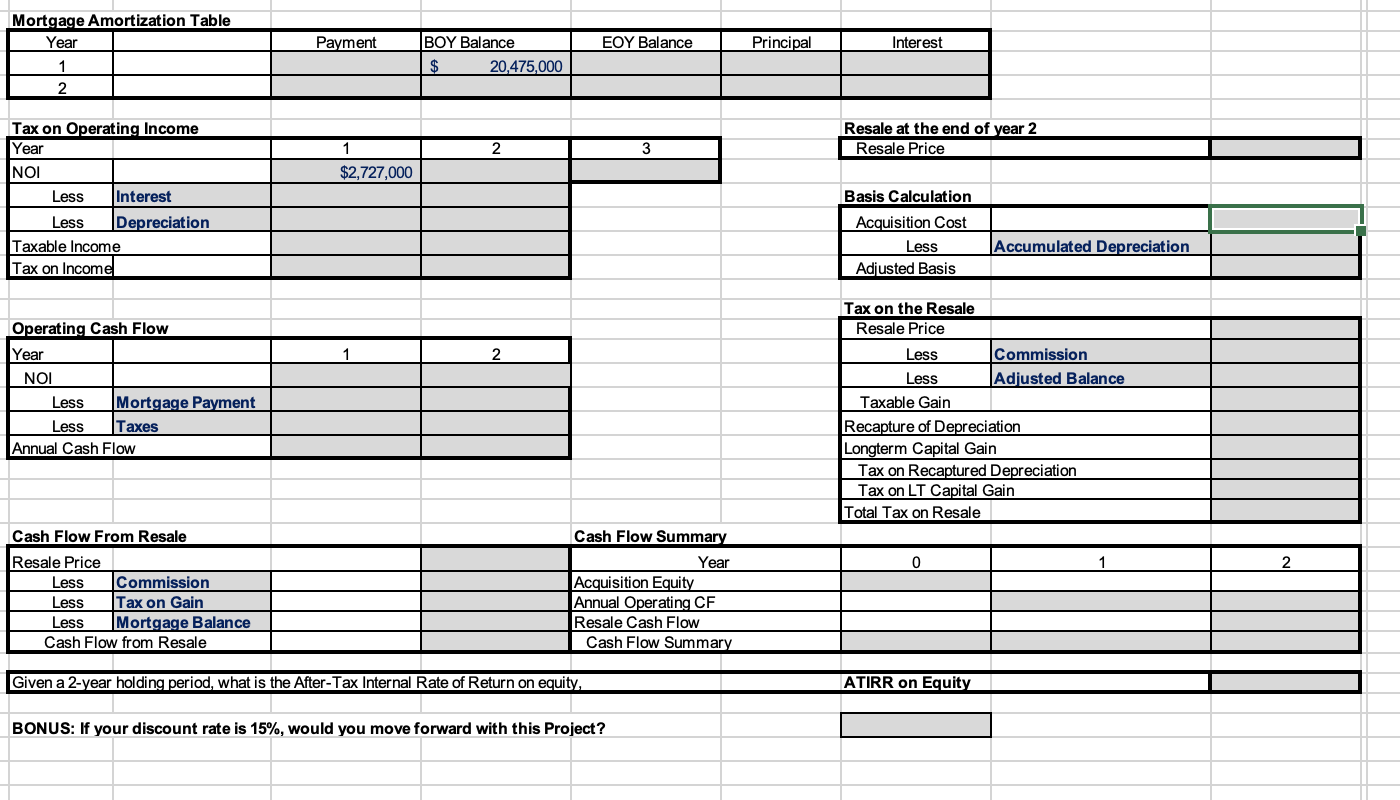

Data Page: Use the data provided on this page and show the calculations needed to obtain the ATIRR. Show the results of your calculations and answers in the spaces provided page and the following page. $ Building Size in Sq Ft Rents per Sq Ft 140,000 $28.00 Construction Cost per Sq Ft Cost of the Improvements Land Cost per Sq Ft Land Size in Sq Ft $ $ Gross Potential Rent Less Vacancy Allowance Effective Gross Rent 3,920,000 352,800 9.00% $ 3,567,200 Land Cost $ 6.00 $ Less Operating Expenses per Sq Ft Net Operating Income 840,000 2,727,200 $ Total Acquisition Cost Less Debt Financing Equity Required Estimated Annual Growth in NOI 2.00% Depreciation Period in Years Loan-to-Value Ratio 70% Tax Rate on Operating Income Interest Rate 6.00% Tax Rate on Recapture of Depreciation 25 Mortgage Loan Term in Years Loan Amount $ 20,475,000 $131,921.00 Tax Rate on Capital Gains Cap Rate for Resale Commission on Resalel Monthly Payment 200.00 5.00 250,000 $ 28,000,000 $ 1,250,000 $ 29,250,000 $ 20,475,000 8,775,000 $ 27.5 36% 25% 15% 9.00% 6.00% Mortgage Amortization Table Year 1 2 Tax on Operating Income Year NOI Less Interest Less Depreciation Taxable Income Tax on Income Operating Cash Flow Year Payment 1 $2,727,000 BOY Balance $ 20,475,000 2 2 EOY Balance 3 NOI Less Mortgage Payment Less Taxes Annual Cash Flow Cash Flow From Resale Resale Price Less Commission Less Tax on Gain Less Mortgage Balance Cash Flow from Resale Given a 2-year holding period, what is the After-Tax Internal Rate of Return on equity, BONUS: If your discount rate is 15%, would you move forward with this Project? Cash Flow Summary Year Acquisition Equity Annual Operating CF Resale Cash Flow Cash Flow Summary Principal Interest Resale at the end of year 2 Resale Price Basis Calculation Acquisition Cost Less Adjusted Basis Tax on the Resale Resale Price Less Less Taxable Gain Recapture of Depreciation Longterm Capital Gain Tax on Recaptured Depreciation Tax on LT Capital Gain Total Tax on Resale 0 ATIRR on Equity Accumulated Depreciation Commission Adjusted Balance 1 2 Data Page: Use the data provided on this page and show the calculations needed to obtain the ATIRR. Show the results of your calculations and answers in the spaces provided page and the following page. $ Building Size in Sq Ft Rents per Sq Ft 140,000 $28.00 Construction Cost per Sq Ft Cost of the Improvements Land Cost per Sq Ft Land Size in Sq Ft $ $ Gross Potential Rent Less Vacancy Allowance Effective Gross Rent 3,920,000 352,800 9.00% $ 3,567,200 Land Cost $ 6.00 $ Less Operating Expenses per Sq Ft Net Operating Income 840,000 2,727,200 $ Total Acquisition Cost Less Debt Financing Equity Required Estimated Annual Growth in NOI 2.00% Depreciation Period in Years Loan-to-Value Ratio 70% Tax Rate on Operating Income Interest Rate 6.00% Tax Rate on Recapture of Depreciation 25 Mortgage Loan Term in Years Loan Amount $ 20,475,000 $131,921.00 Tax Rate on Capital Gains Cap Rate for Resale Commission on Resalel Monthly Payment 200.00 5.00 250,000 $ 28,000,000 $ 1,250,000 $ 29,250,000 $ 20,475,000 8,775,000 $ 27.5 36% 25% 15% 9.00% 6.00% Mortgage Amortization Table Year 1 2 Tax on Operating Income Year NOI Less Interest Less Depreciation Taxable Income Tax on Income Operating Cash Flow Year Payment 1 $2,727,000 BOY Balance $ 20,475,000 2 2 EOY Balance 3 NOI Less Mortgage Payment Less Taxes Annual Cash Flow Cash Flow From Resale Resale Price Less Commission Less Tax on Gain Less Mortgage Balance Cash Flow from Resale Given a 2-year holding period, what is the After-Tax Internal Rate of Return on equity, BONUS: If your discount rate is 15%, would you move forward with this Project? Cash Flow Summary Year Acquisition Equity Annual Operating CF Resale Cash Flow Cash Flow Summary Principal Interest Resale at the end of year 2 Resale Price Basis Calculation Acquisition Cost Less Adjusted Basis Tax on the Resale Resale Price Less Less Taxable Gain Recapture of Depreciation Longterm Capital Gain Tax on Recaptured Depreciation Tax on LT Capital Gain Total Tax on Resale 0 ATIRR on Equity Accumulated Depreciation Commission Adjusted Balance 1 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts