Question: Data Problem 2 in eight years, Kent Duncan will retire. He is exploring the possibility of opening a self-service car wash. The car wash could

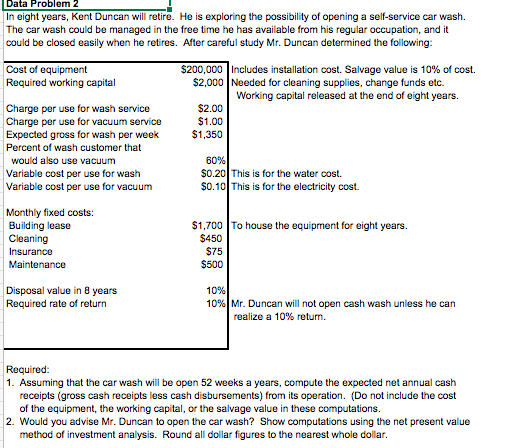

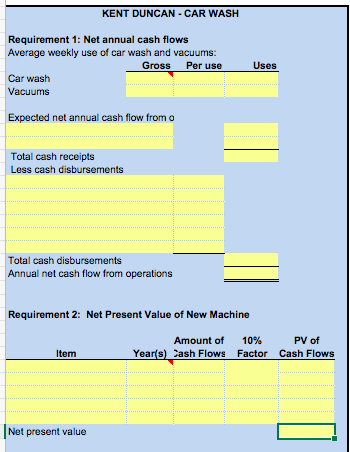

Data Problem 2 in eight years, Kent Duncan will retire. He is exploring the possibility of opening a self-service car wash. The car wash could be managed in the free time he has available from his regular occupation, and it could be closed easily when he retires. After careful study Mr. Duncan determined the following: Cost of equipment $200,000 Includes installation cost. Salvage value is 10% of cost. Required working capital $2,000 Needed for cleaning supplies, change funds etc. Working capital released at the end of eight years. $2.00 Charge per use for wash service Charge per use for vacuum service $1.00 Expected gross for wash per week $1,350 Percent of wash customer that would also use vacuum 60% Variable cost per use for wash $0.20 This is for the water cost. Variable cost per use for vacuum $0.10 This is for the electricity cost. Monthly fixed costs: Building lease $1,700 To house the equipment for eight years. Cleaning $450 $75 nsurance Maintenance $500 Disposal value in 8 years Required rate of return 10% Mr. Duncan will not open cash wash unless he can realize a 10% return. Required 1. Assuming that the car wash will be open 52 weeks a years, compute the expected net annual cash receipts (gross cash receipts less cash disbursements) from its operation. (Do not include the cost of the equipment, the working capital, or the salvage value in these computations. 2. Would you advise Mr. Duncan to open the car wash? Show computations using the net present value method of investment analysis. Round all dollar figures to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts