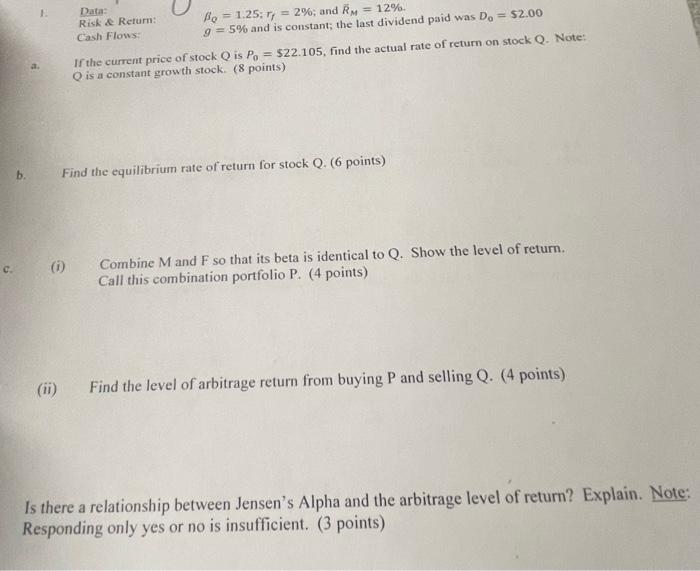

Question: Data: Risk Return: Bo = 1.25: 7) = 2%; and RM = 12%. Cash Flows: 9 = 5% and is constant; the last dividend paid

Data: Risk Return: Bo = 1.25: 7) = 2%; and RM = 12%. Cash Flows: 9 = 5% and is constant; the last dividend paid was Do = $2.00 If the current price of stock is po = $22.105, find the actual rate of return on stock Q. Note: Q is a constant growth stock. (8 points) b. Find the equilibrium rate of return for stock Q. (6 points) c (1) Combine Mand F so that its beta is identical to Q. Show the level of return. Call this combination portfolio P. (4 points) Find the level of arbitrage return from buying P and selling Q. (4 points) Is there a relationship between Jensen's Alpha and the arbitrage level of return? Explain. Note: Responding only yes or no is insufficient. (3 points) Data: Risk Return: Bo = 1.25: 7) = 2%; and RM = 12%. Cash Flows: 9 = 5% and is constant; the last dividend paid was Do = $2.00 If the current price of stock is po = $22.105, find the actual rate of return on stock Q. Note: Q is a constant growth stock. (8 points) b. Find the equilibrium rate of return for stock Q. (6 points) c (1) Combine Mand F so that its beta is identical to Q. Show the level of return. Call this combination portfolio P. (4 points) Find the level of arbitrage return from buying P and selling Q. (4 points) Is there a relationship between Jensen's Alpha and the arbitrage level of return? Explain. Note: Responding only yes or no is insufficient. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts