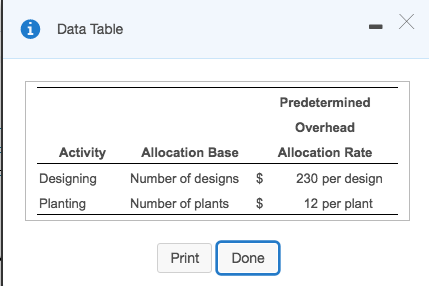

Question: Data Table 1 Predetermined Overhead Activity Allocation Base Allocation Rate DesigningNumber of designs 230 per design Planting Number of plants 12 per plant Print Done

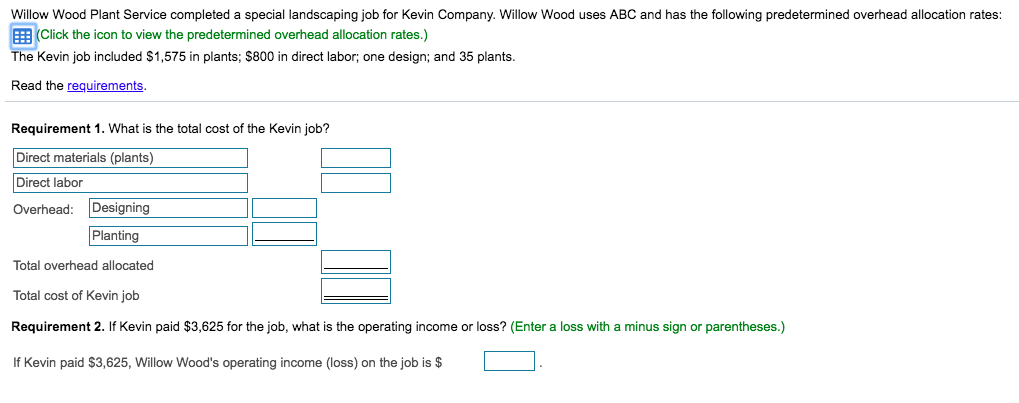

Data Table 1 Predetermined Overhead Activity Allocation Base Allocation Rate DesigningNumber of designs 230 per design Planting Number of plants 12 per plant Print Done Willow Wood Plant Service completed a special landscaping job for Kevin Company. Willow Wood uses ABC and has the following predetermined overhead allocation rates The Kevin job included $1,575 in plants; $800 in direct labor; one design; and 35 plants. Read the requirements Click the icon to view the predetermined overhead allocation rates.) Requirement 1. What is the total cost of the Kevin job? Direct materials (plants) Direct labor Overhead: Designing Planting Total overhead allocated Total cost of Kevin job Requirement 2. If Kevin paid $3,625 for the job, what is the operating income or loss? (Enter a loss with a minus sign or parentheses.) If Kevin paid $3,625, Willow Wood's operating income (loss) on the job is $ Requirement 3, If Willow Wood desires an operating income of 40% of cost, how much should the company charge for the Kevin job? If Willow Wood desires an operating income of 40% of cost, it should charge S | | for the Kevin job

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts