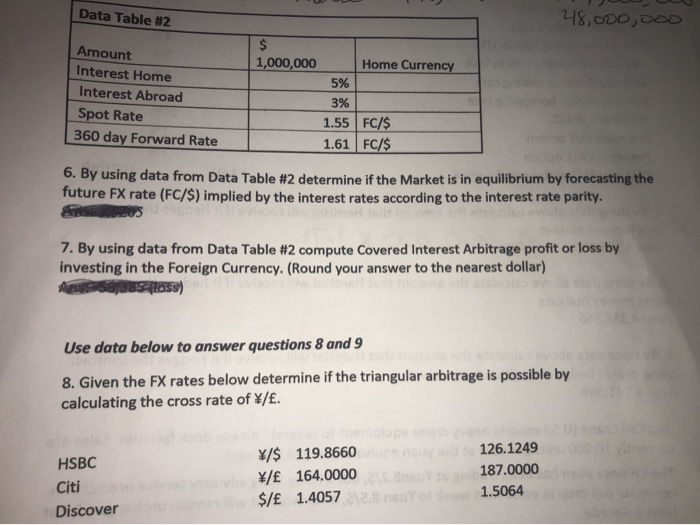

Question: Data Table #2 Amount Interest Home Interest Abroad Spot Rate 360 day Forward Rate 1,000,000 Home Currency 5% 3% 1.55 FC/S 1.61 FCIS 6. By

Data Table #2 Amount Interest Home Interest Abroad Spot Rate 360 day Forward Rate 1,000,000 Home Currency 5% 3% 1.55 FC/S 1.61 FCIS 6. By using data from Data Table #2 determine if the Market is in equilibrium by forecasting the future FX rate (FC/S) implied by the interest rates according to the interest rate parity. 7. By using data from Data Table #2 compute Covered Interest Arbitrage profit or loss by investing in the Foreign Currency. (Round your answer to the nearest dollar) Use data below to answer questions 8 and 9 8. Given the FX rates below determine if the triangular arbitrage is possible by calculating the cross rate of X/E 126.1249 187.0000 1.5064 X/$ 119.8660 Y/E 164.0000 $/E 1.4057 HSBC Citi Discover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts