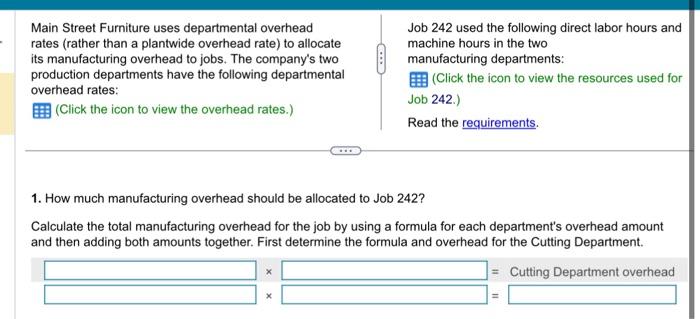

Question: Data table begin{tabular}{ll} hline Cutting Department: & $8 per machine hour Finishing Department: & $16 per direct labor hour hline end{tabular} Print Done

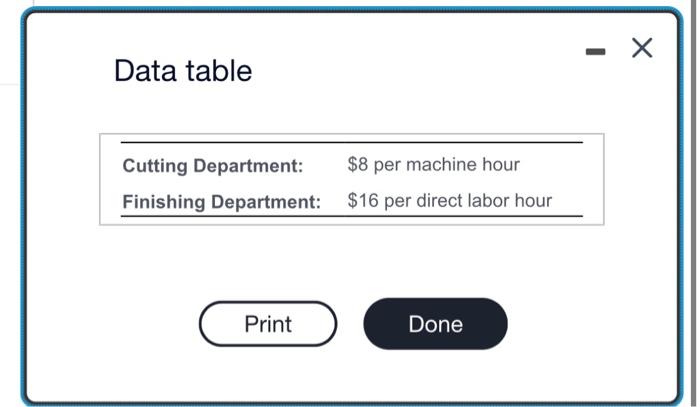

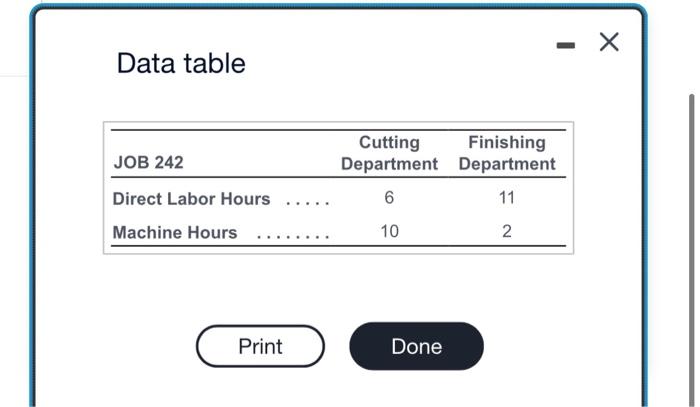

Data table \begin{tabular}{ll} \hline Cutting Department: & $8 per machine hour \\ Finishing Department: & $16 per direct labor hour \\ \hline \end{tabular} Print Done Main Street Furniture uses departmental overhead rates (rather than a plantwide overhead rate) to allocate its manufacturing overhead to jobs. The company's two production departments have the following departmental overhead rates: (Click the icon to view the overhead rates.) Job 242 used the following direct labor hours and machine hours in the two manufacturing departments: (Click the icon to view the resources used for Job 242.) Read the requirements. 1. How much manufacturing overhead should be allocated to Job 242 ? Calculate the total manufacturing overhead for the job by using a formula for each department's overhead amount and then adding both amounts together. First determine the formula and overhead for the Cutting Department. Data table Requirements 1. How much manufacturing overhead should be allocated to Job 242 ? 2. Assume that direct labor is paid at a rate of $26 per hour and Job 242 used $2,550 of direct materials. What was the total manufacturing cost of Job 242

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts