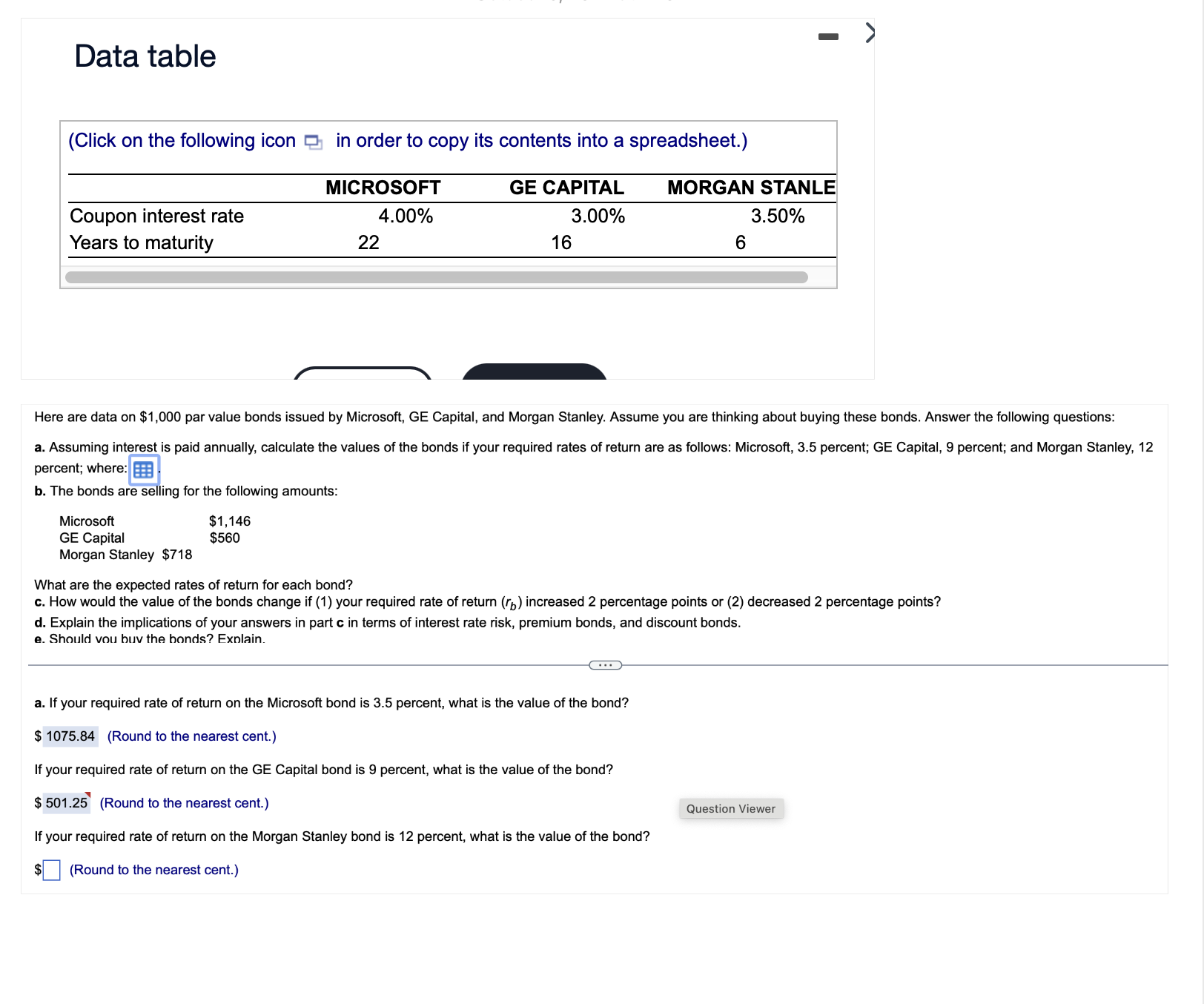

Question: Data table ( C l i c k o n the following icon i n order t o copy its contents into a spreadsheet. )

Data table

the following icon

order copy its contents into a spreadsheet.

Here are data $ par value bonds issued Microsoft, Capital, and Morgan Stanley. Assume you are thinking about buying these bonds. Answer the following questions:

Assuming interest paid annually, calculate the values the bonds your required rates return are follows: Microsoft, percent; Capital, percent; and Morgan Stanley,

percent; where:

The bonds are selling for the following amounts:

Microsoft $

Capital $

Morgan Stanley $

What are the expected rates return for each bond?

How would the value the bonds change your required rate return increased percentage points decreased percentage points?

Explain the implications your answers part terms interest rate risk, premium bonds, and discount bonds.

Should vou buv the bonds? Exnlain.

your required rate return the Microsoft bond percent, what the value the bond?

$ the nearest cent.

your required rate return the Capital bond percent, what the value the bond?

the nearest cent.

your required rate return the Morgan Stanley bond percent, what the value the bond?

the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock