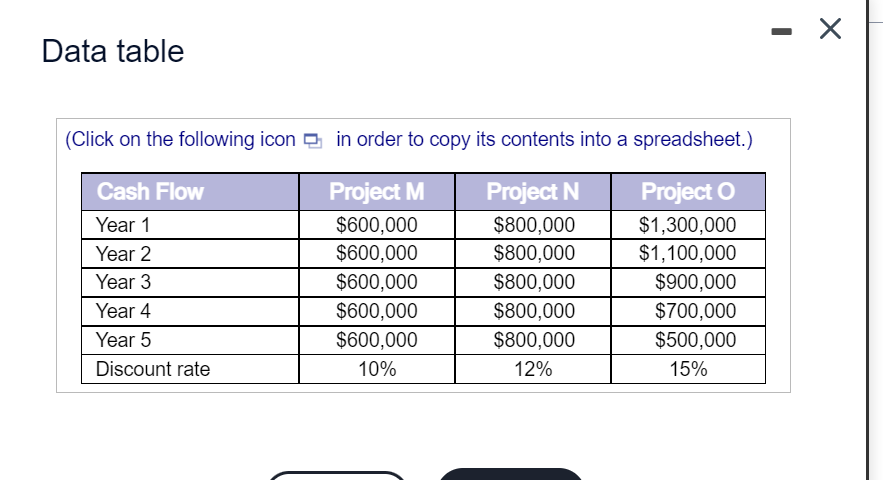

Question: _ Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Year 1 Year 2 Year 3

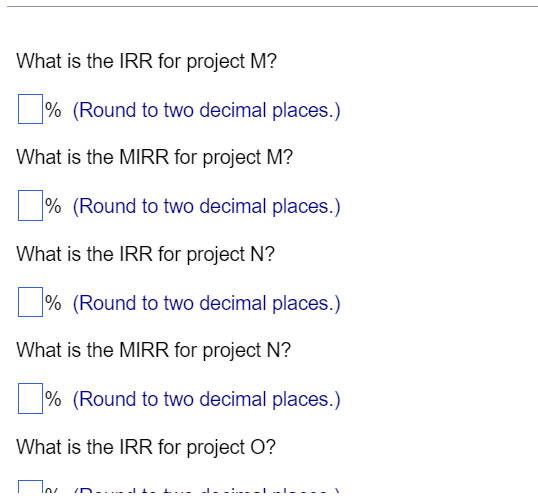

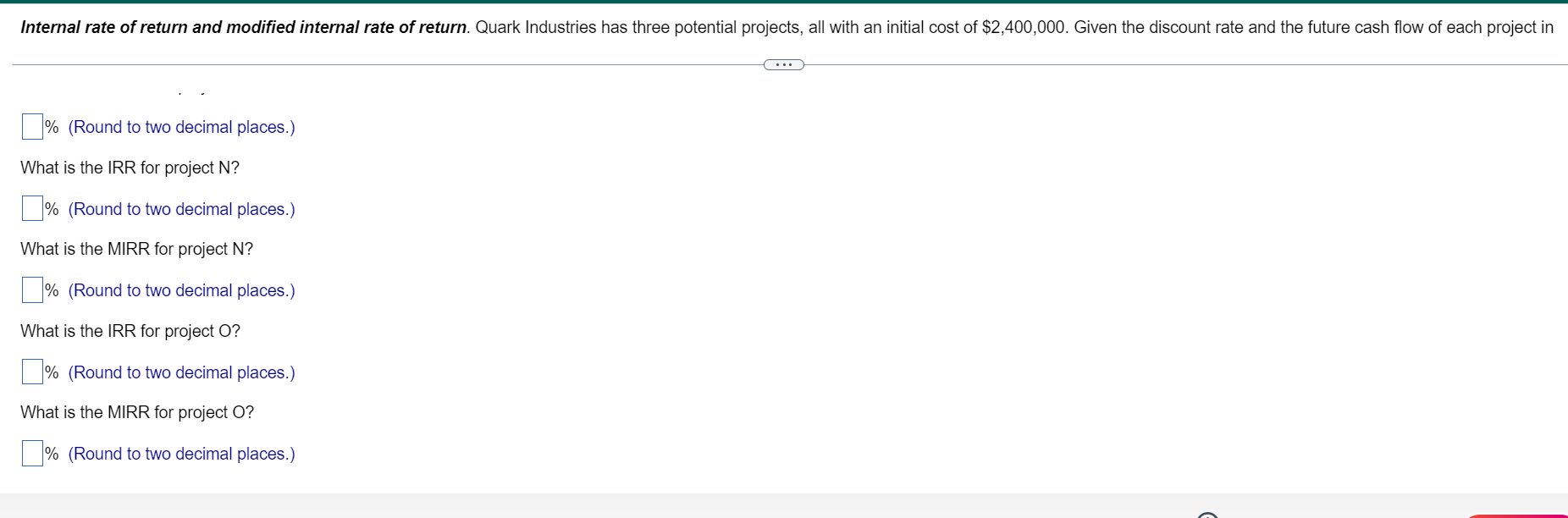

_ Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Year 1 Year 2 Year 3 Year 4 Year 5 Discount rate Project M $600,000 $600,000 $600,000 $600,000 $600,000 10% Project N $800,000 $800,000 $800,000 $800,000 $800,000 12% Project $1,300,000 $1,100,000 $900,000 $700,000 $500,000 15% What is the IRR for project M? 1 % (Round to two decimal places.) What is the MIRR for project M? 1( % (Round to two decimal places.) What is the IRR for project N? 1) % (Round to two decimal places.) What is the MIRR for project N? % (Round to two decimal places.) % ) What is the IRR for project O? To in 1. ---- --I---- Internal rate of return and modified internal rate of return. Quark Industries has three potential projects, all with an initial cost of $2,400,000. Given the discount rate and the future cash flow of each project in % (Round to two decimal places.) What is the IRR for project N? % (Round to two decimal places.) What is the MIRR for project N? % (Round to two decimal places.) What is the IRR for project O? % (Round to two decimal places.) What is the MIRR for project O? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts