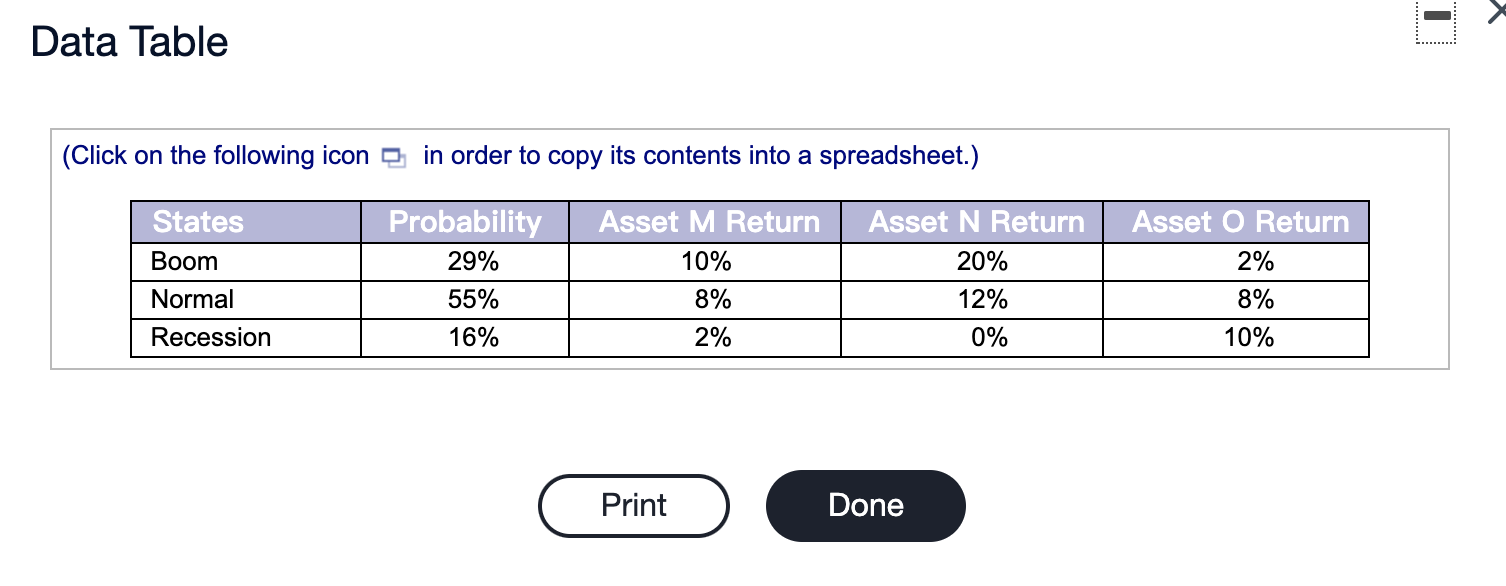

Question: - Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Normal Recession Probability 29% 55% 16%

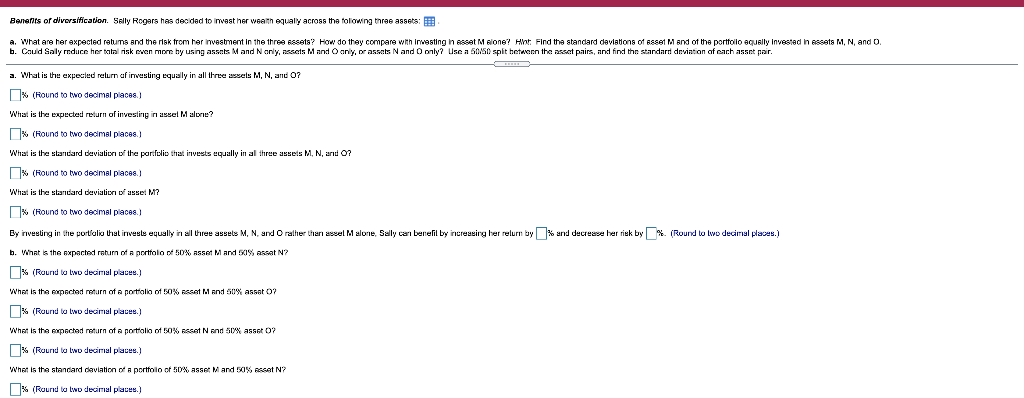

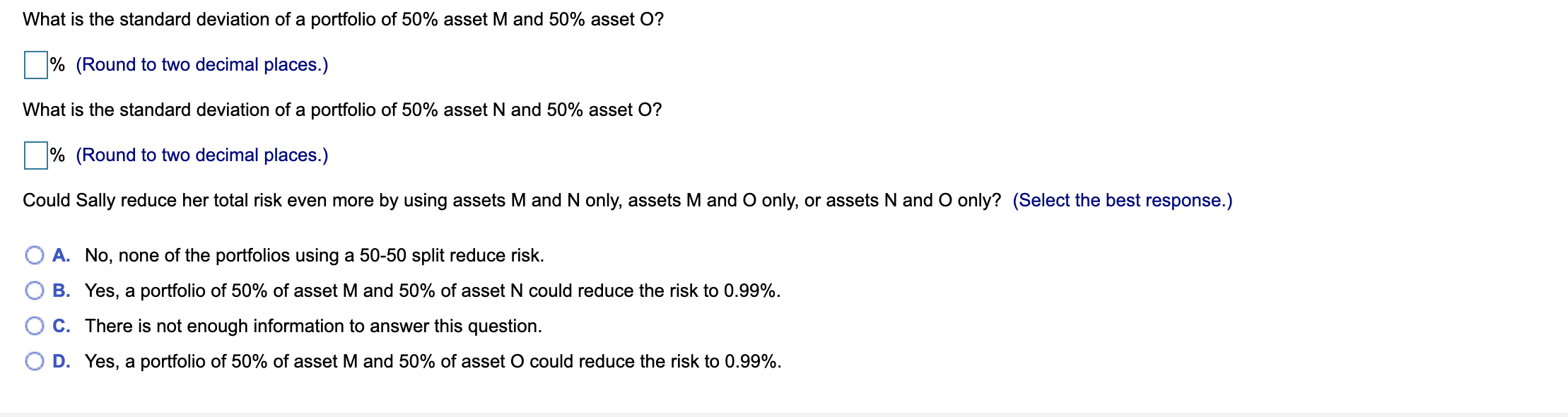

- Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) States Boom Normal Recession Probability 29% 55% 16% Asset M Return 10% 8% 2% Asset N Return 20% 12% 0% Asset O Return 2% 8% 10% Print Done Benefits of diversification. Solly Rogers has decided to invest her wealth equally across the flowing three assets: B a. What are her expected retums and the rak from her investment in the three assets? How do they compare with investing in esset Malone? Hint Find the standard deviations of esset M and of the portfolio equally invested in Essets MN, and o b. Caud Saly reduce her tatal risk even more by using assets. Mand N anly, assets M and Oany, or assets N and only? Use a 5050 split hetacon the asset pairs, and find the standard deviation of each asset pair. a. What is the expecled relur af investing equally in all three axels M, N, and O? % (Round to two decimal places What is the expected return of investing in asset Malone? 1% (Round to two decimal places.) What is the standard deviation of the portfolio that invests equally in all three assets M, N, arid O? % (Round to two decimal places. What is the standard deviation of asse: M? X (Round to two decimal places. By investing in the portfolio that invesle equally in all three assets M, N, and rather than esvel M alone. Sally cari benefit by increasing her relur by % and decrease her riek by * (Round to two decimal plaes.) b. What is the expected return of a portfolio of 10% Asset Mand 50% assat N? % (Roured to two decimal place.) What is the expached neturn of a portfolio of 50% reset M and 50% assato? % (Round to two decimal places.) What is the expected return of a portfolio of 50% reset N and 50% asset ? * (Round to two decimal places.) What is the standard deviation of a portfolo of 50%, asset M and 50% reset N? % (Round to two decimal places.) What is the standard deviation of a portfolio of 50% asset M and 50% asset O? % (Round to two decimal places.) What is the standard deviation of a portfolio of 50% asset N and 50% asset O? % (Round to two decimal places.) Could Sally reduce her total risk even more by using assets M and N only, assets M and O only, or assets N and O only? (Select the best response.) A. No, none of the portfolios using a 50-50 split reduce risk. B. Yes, a portfolio of 50% of asset M and 50% of asset N could reduce the risk to 0.99%. O C. There is not enough information to answer this question. OD. Yes, a portfolio of 50% of asset M and 50% of asset O could reduce the risk to 0.99%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts