Question: Data table (Click on the following icon ( square ) in order to copy its contents into a spreadsheet.) Dong and Chen are a married

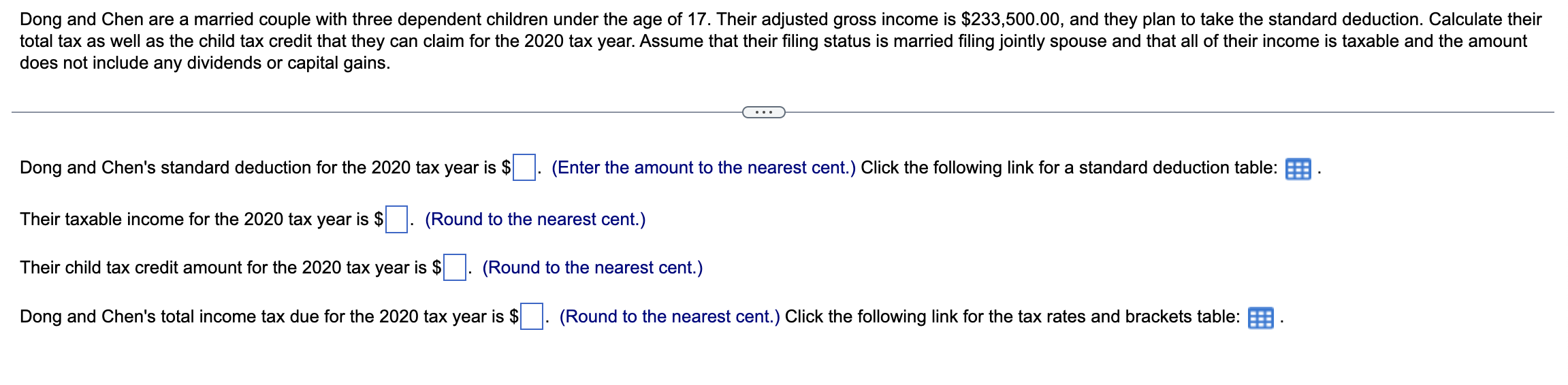

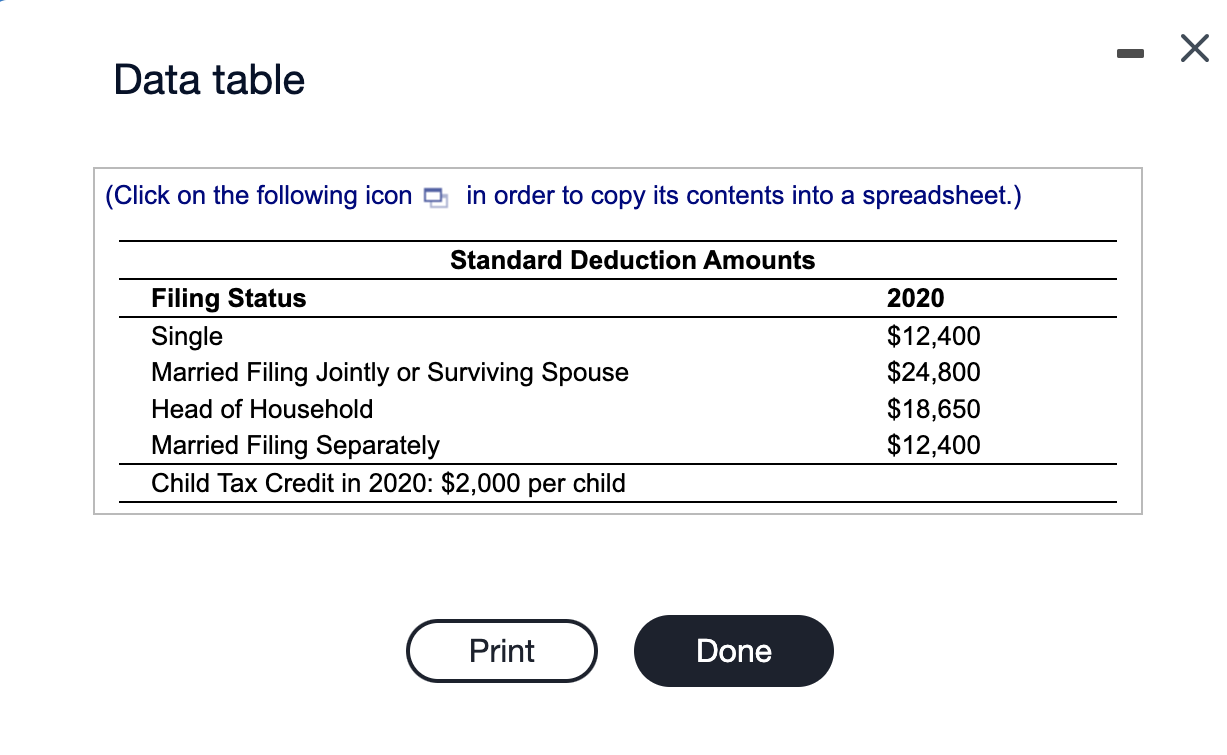

Data table (Click on the following icon \\( \\square \\) in order to copy its contents into a spreadsheet.) Dong and Chen are a married couple with three dependent children under the age of 17 . Their adjusted gross income is \\( \\$ 233,500.00 \\), and they plan to take the standard deduction. Calculate the total tax as well as the child tax credit that they can claim for the 2020 tax year. Assume that their filing status is married filing jointly spouse and that all of their income is taxable and the amount does not include any dividends or capital gains. Dong and Chen's standard deduction for the 2020 tax year is \\( \\$ \\) (Enter the amount to the nearest cent.) Click the following link for a standard deduction table: Their taxable income for the 2020 tax year is \\( \\$ \\) (Round to the nearest cent.) Their child tax credit amount for the 2020 tax year is \\( \\$ \\) (Round to the nearest cent.) Dong and Chen's total income tax due for the 2020 tax year is \\( \\$ \\) (Round to the nearest cent.) Click the following link for the tax rates and brackets table: Data table (Click on the tollowing Icon \\( \\) in order to copy its contents into a spreadsneet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts