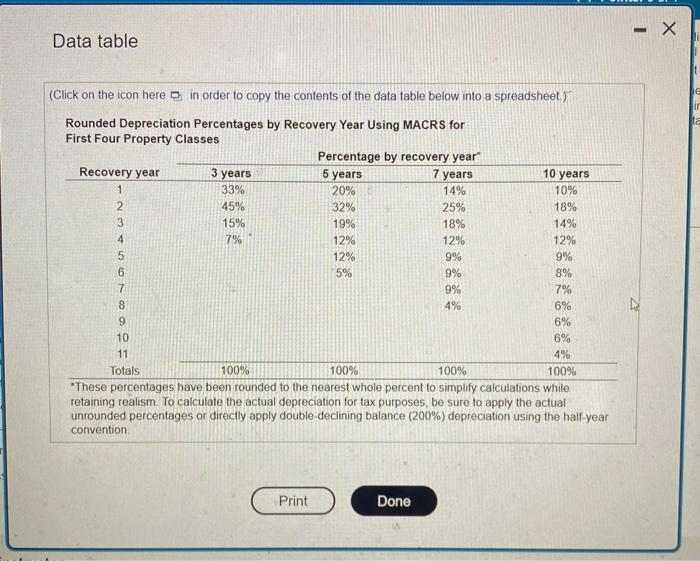

Question: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Rounded Depreciation Percentages by

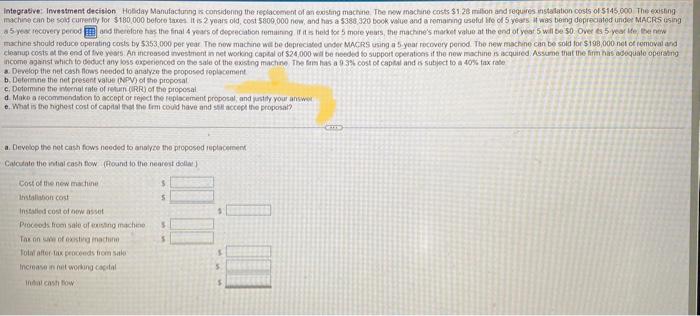

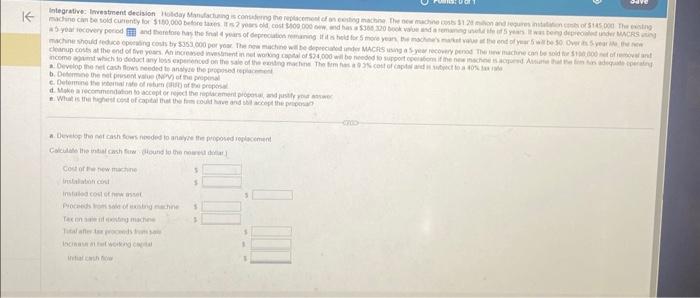

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention machine should roduce operating costs by 5353,000 per year The new machine wit be deprecinted under MACrs using a 5 .year recovery penod. The new machne can be sold for $198, 0e0 net of removal and income aganst ahich to poduct any loss expetienced on the sale of the existng mactine the frrm has a 93% cost ot captal and is subjoct to a 407 tax rase a. Develop the net cosh hoss needed to analyze the proposed replacement b. Deterenne the net present value (NPQv) of the proposal c. Determine the internat rate of returnciRRi of the proposal d. Mako a recommendition to accopt or reject the replocement proposal, and yustify your answe. e. What is the highest cort of capial frat se ferm covid have and set acceop the proposal? a. Develop the net cash fows neoded to anatyee tho proposed replacersing Catcuate the intial cassi fow (Alound to the nearest dollwy 2. Oevelop the tet cact flows needed to anslyde the proppsed ieplainhed b. bekimse the nit pirsem vilue ANp of of the propend a. Develop the cat cash fows noeded to anaye the ptoponed replacented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts