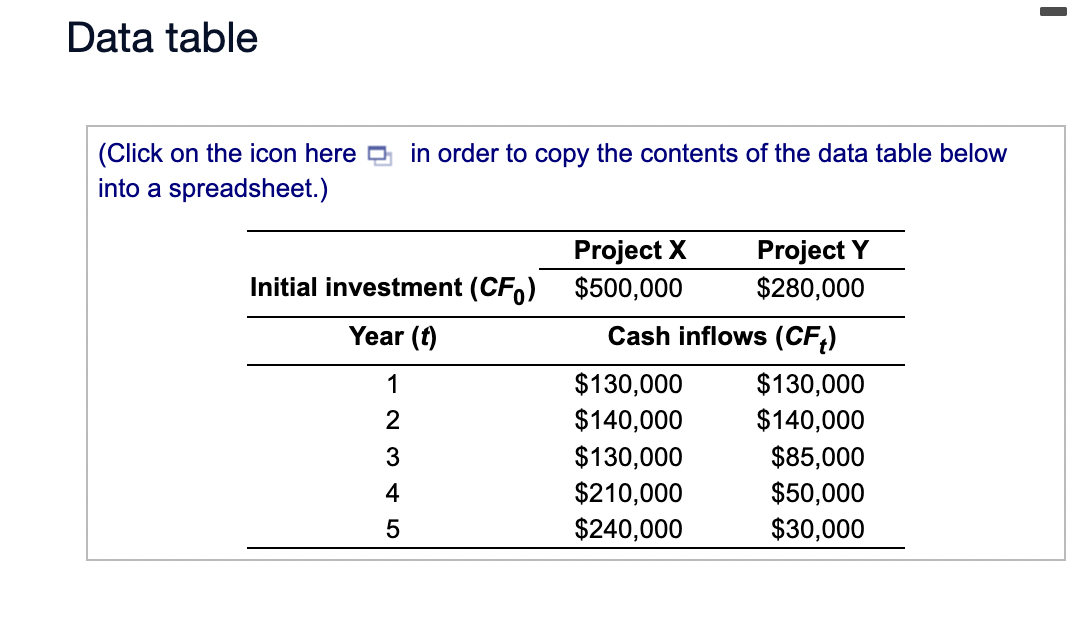

Question: Data table (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Initial investment (CF) Year

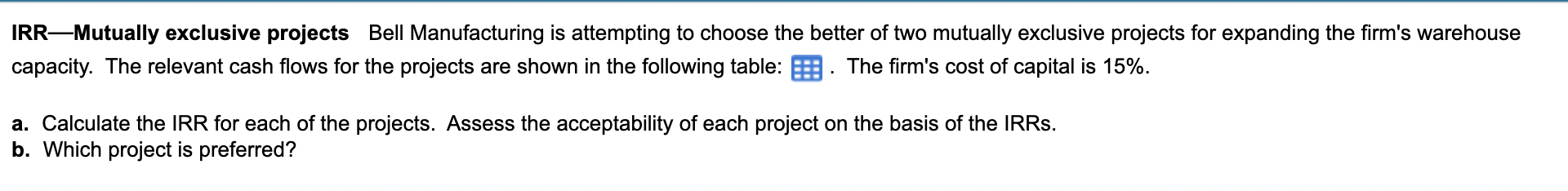

Data table (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below Initial investment (CF) Year (t) 1 2 3 45 Project X $500,000 Cash inflows (CF) $130,000 $140,000 Project Y $280,000 $130,000 $210,000 $240,000 $130,000 $140,000 $85,000 $50,000 $30,000 IRR-Mutually exclusive projects Bell Manufacturing is attempting to choose the better of two mutually exclusive projects for expanding the firm's warehouse capacity. The relevant cash flows for the projects are shown in the following table: The firm's cost of capital is 15%. a. Calculate the IRR for each of the projects. Assess the acceptability of each project on the basis of the IRRs. b. Which project is preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts