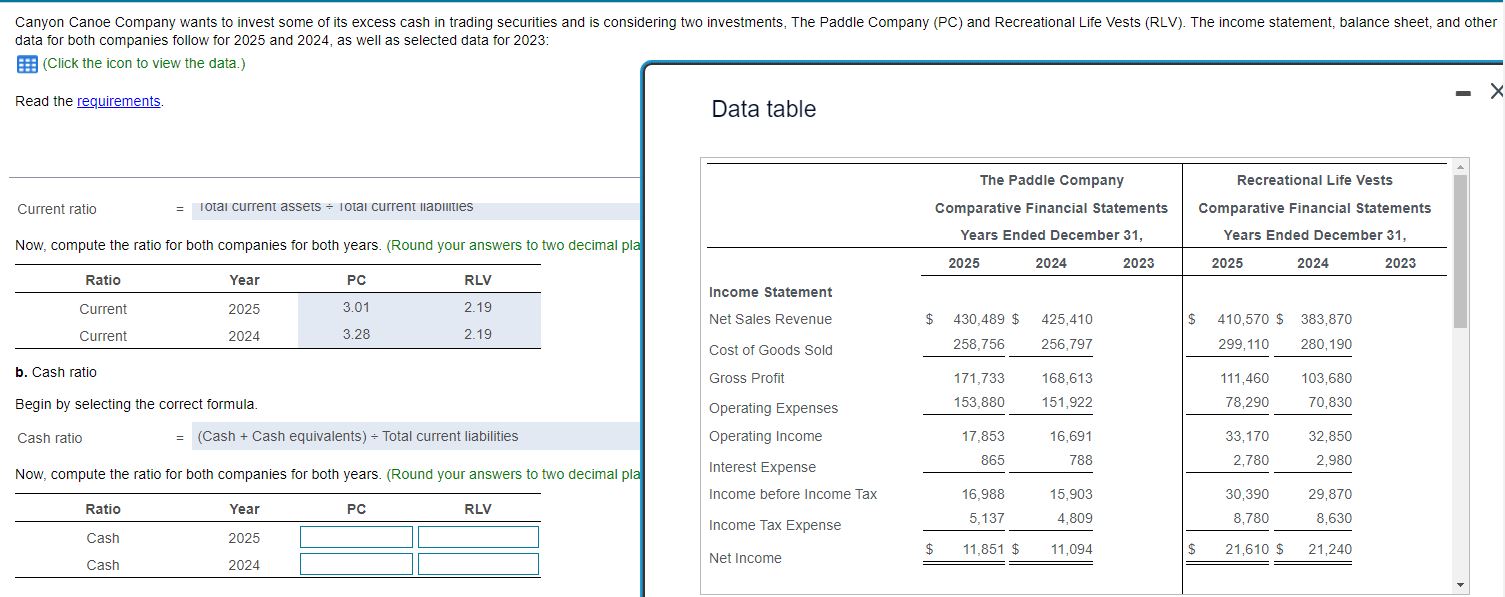

Question: Data table Current ratio = lotal current assets lotal current aptes Now, compute the ratio for both companies for both years. (Round your answers to

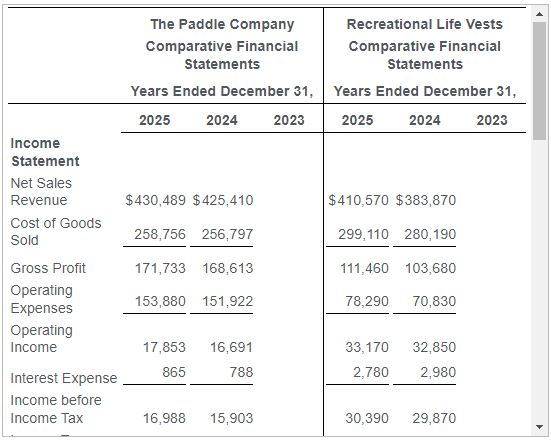

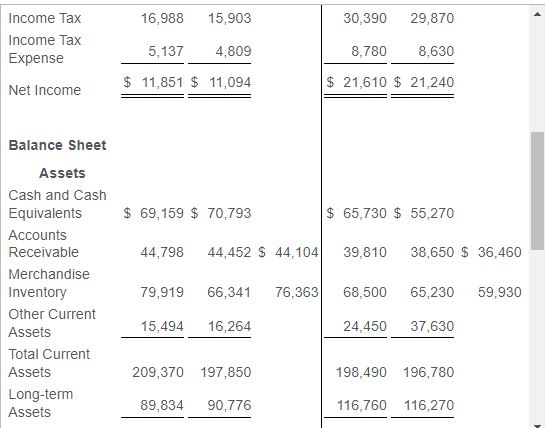

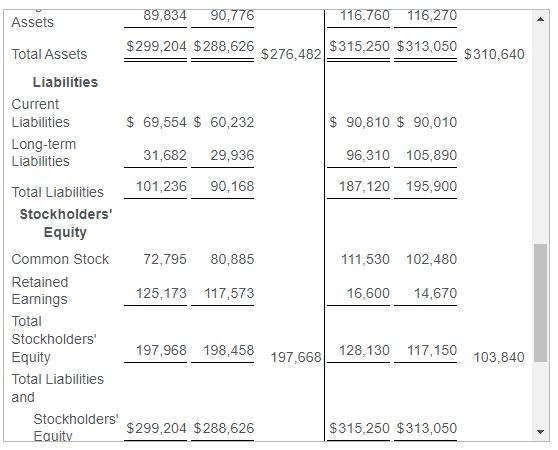

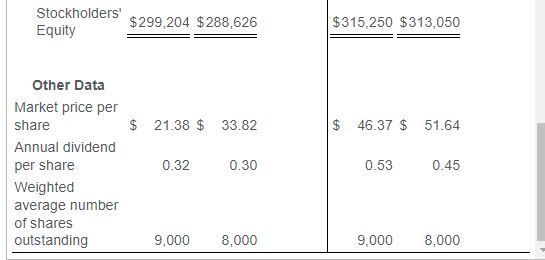

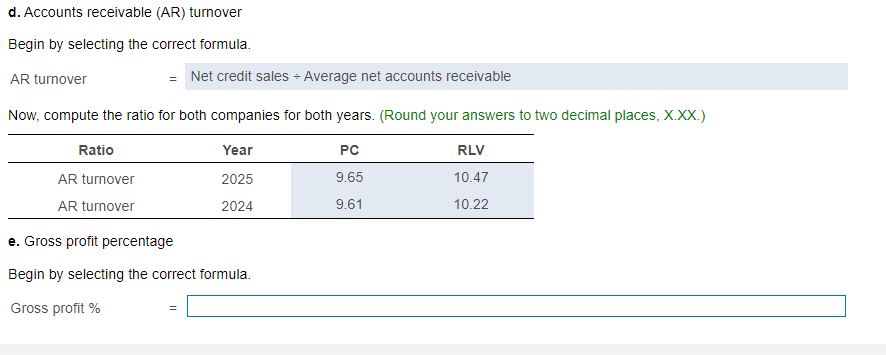

Data table Current ratio = lotal current assets lotal current aptes Now, compute the ratio for both companies for both years. (Round your answers to two decimal pla b. Cash ratio Begin by selecting the correct formula. Cash ratio =( Cash + Cash equivalents ) Total current liabilities \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{3}{|c|}{\begin{tabular}{l} The Paddle Company \\ Comparative Financial \\ Statements \\ Years Ended December 31 , \end{tabular}} & \multicolumn{3}{|c|}{\begin{tabular}{c} Recreational Life Vests \\ Comparative Financial \\ Statements \\ Years Ended December 31 , \end{tabular}} \\ \hline & 2025 & 2024 & 2023 & 2025 & 2024 & 2023 \\ \hline \begin{tabular}{l} Income \\ Statement \\ Net Sales \\ Revenue \end{tabular} & $430,489 & $425,410 & & $410,570 & $383870 & \\ \hline \begin{tabular}{l} Cost of Goods \\ Sold \end{tabular} & 258,756 & 256,797 & & 299,110 & 280,190 & \\ \hline Gross Profit & 171,733 & 168,613 & & 111,460 & 103,680 & \\ \hline \begin{tabular}{l} Operating \\ Expenses \end{tabular} & 153,880 & 151,922 & & 78,290 & 70,830 & \\ \hline \begin{tabular}{l} Operating \\ Income \end{tabular} & 17,853 & 16,691 & & 33,170 & 32,850 & \\ \hline Interest Expense & 865 & 788 & & 2,780 & 2,980 & \\ \hline \begin{tabular}{l} Income before \\ Income Tax \end{tabular} & 16,988 & 15,903 & & 30,390 & 29,870 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Income Tax & 16,988 & 15,903 & & 30,390 & 29,870 & \\ \hline \begin{tabular}{l} Income Tax \\ Expense \end{tabular} & 5,137 & 4,809 & & 8,780 & 8,630 & \\ \hline Net Income & $11,851 & $11,094 & & $21,610$ & $21,240 & \\ \hline Balance Sheet & & & & & & \\ \hline Assets & & & & & & \\ \hline \begin{tabular}{l} Cash and Cash \\ Equivalents \end{tabular} & $69,159 & $70,793 & & $65,730$ & $55,270 & \\ \hline \begin{tabular}{l} Accounts \\ Receivable \end{tabular} & 44,798 & 44,452$ & 5 44,104 & 39,810 & 38,650$ & \$ 36,460 \\ \hline \begin{tabular}{l} Merchandise \\ Inventory \end{tabular} & 79,919 & 66,341 & 76,363 & 68,500 & 65,230 & 59,930 \\ \hline \begin{tabular}{l} Other Current \\ Assets \end{tabular} & 15,494 & 16,264 & & 24,450 & 37,630 & \\ \hline \begin{tabular}{l} Total Current \\ Assets \end{tabular} & 209,370 & 197,850 & & 198,490 & 196,780 & \\ \hline \begin{tabular}{l} Long-term \\ Assets \end{tabular} & 89,834 & 90,776 & & 116,760 & 116,270 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \begin{tabular}{l} Stockholders' \\ Equity \end{tabular} & \multicolumn{2}{|c|}{$299,204$288,626} & \multicolumn{3}{|c|}{$315,250$313,050} \\ \hline Other Data & & & & & \\ \hline \begin{tabular}{l} Market price per \\ share \end{tabular} & $21.38$ & 33.82 & $ & 46.37$ & 51.64 \\ \hline \begin{tabular}{l} Annual dividend \\ per share \end{tabular} & 0.32 & 0.30 & & 0.53 & 0.45 \\ \hline \begin{tabular}{l} Weighted \\ average number \\ of shares \\ outstanding \end{tabular} & 9,000 & 8,000 & & 9,000 & 8,000 \\ \hline \end{tabular} d. Accounts receivable (AR) turnover Begin by selecting the correct formula. AR turnover = Net credit sales Average net accounts receivable Now, compute the ratio for both companies for both years. (Round your answers to two decimal places, X.XX.) \begin{tabular}{cccc} \hline Ratio & Year & PC & RLV \\ \hline AR turnover & 2025 & 9.65 & 10.47 \\ AR turnover & 2024 & 9.61 & 10.22 \\ \hline \end{tabular} e. Gross profit percentage Begin by selecting the correct formula. Gross profit \% =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts