Question: Data table Data table During 2020, actual number of units produced and sold was 4,800 , at an average selling price of $710. Actual cost

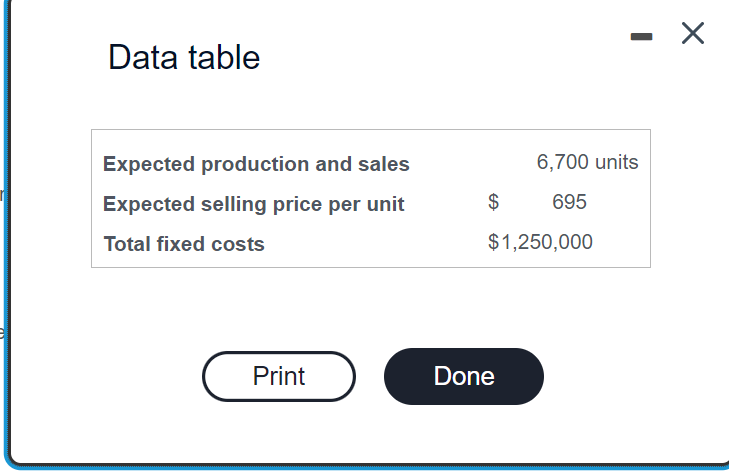

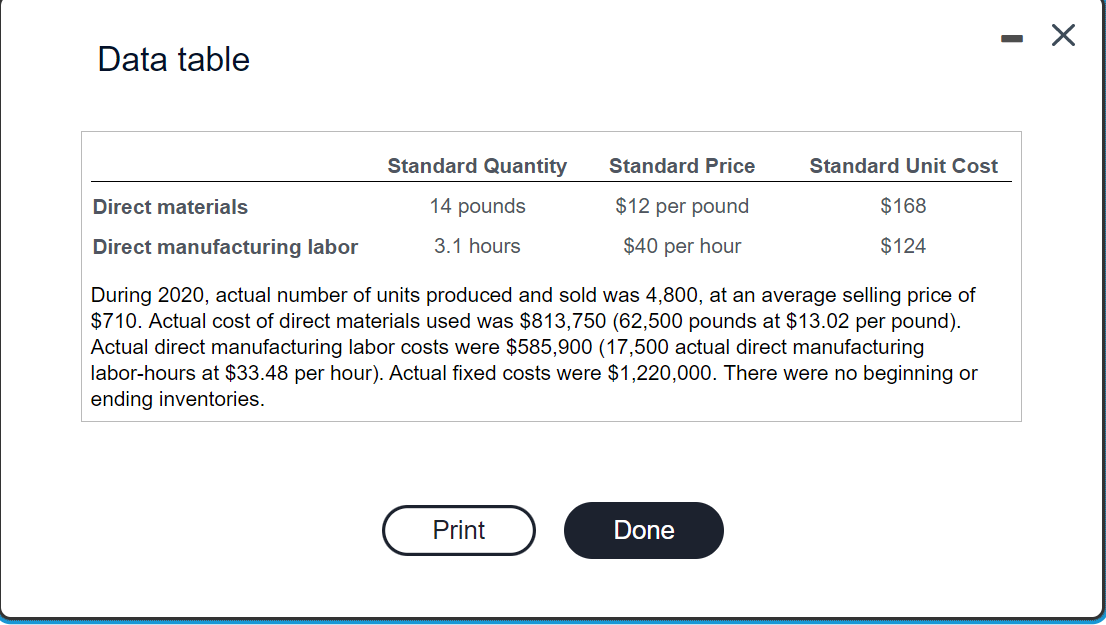

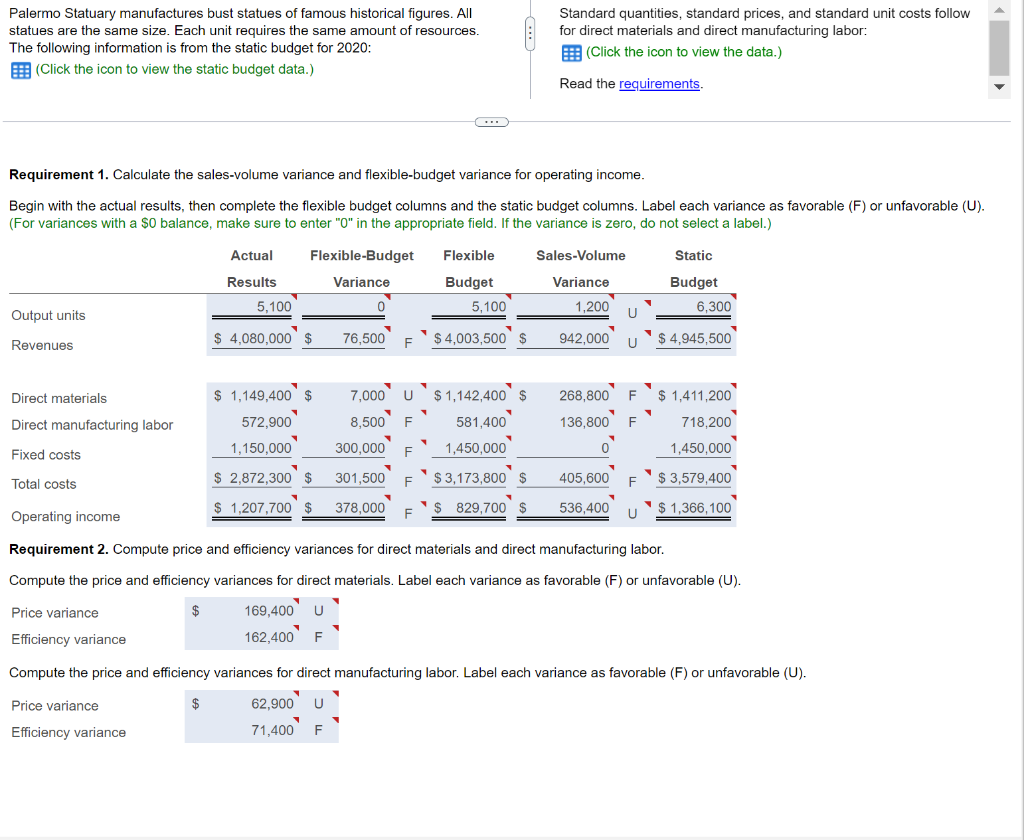

Data table Data table During 2020, actual number of units produced and sold was 4,800 , at an average selling price of $710. Actual cost of direct materials used was $813,750 (62,500 pounds at $13.02 per pound). Actual direct manufacturing labor costs were $585,900(17,500 actual direct manufacturing labor-hours at $33.48 per hour). Actual fixed costs were $1,220,000. There were no beginning or ending inventories. Requirement 1. Calculate the sales-volume variance and flexible-budget variance for operating income. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favorable (F) or unfavorable (U). (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Requirement 2. Compute price and efficiency variances for direct materials and direct manufacturing labor. Compute the price and efficiency variances for direct materials. Label each variance as favorable (F) or unfavorable (U). Data table Data table During 2020, actual number of units produced and sold was 4,800 , at an average selling price of $710. Actual cost of direct materials used was $813,750 (62,500 pounds at $13.02 per pound). Actual direct manufacturing labor costs were $585,900(17,500 actual direct manufacturing labor-hours at $33.48 per hour). Actual fixed costs were $1,220,000. There were no beginning or ending inventories. Requirement 1. Calculate the sales-volume variance and flexible-budget variance for operating income. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favorable (F) or unfavorable (U). (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Requirement 2. Compute price and efficiency variances for direct materials and direct manufacturing labor. Compute the price and efficiency variances for direct materials. Label each variance as favorable (F) or unfavorable (U)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts