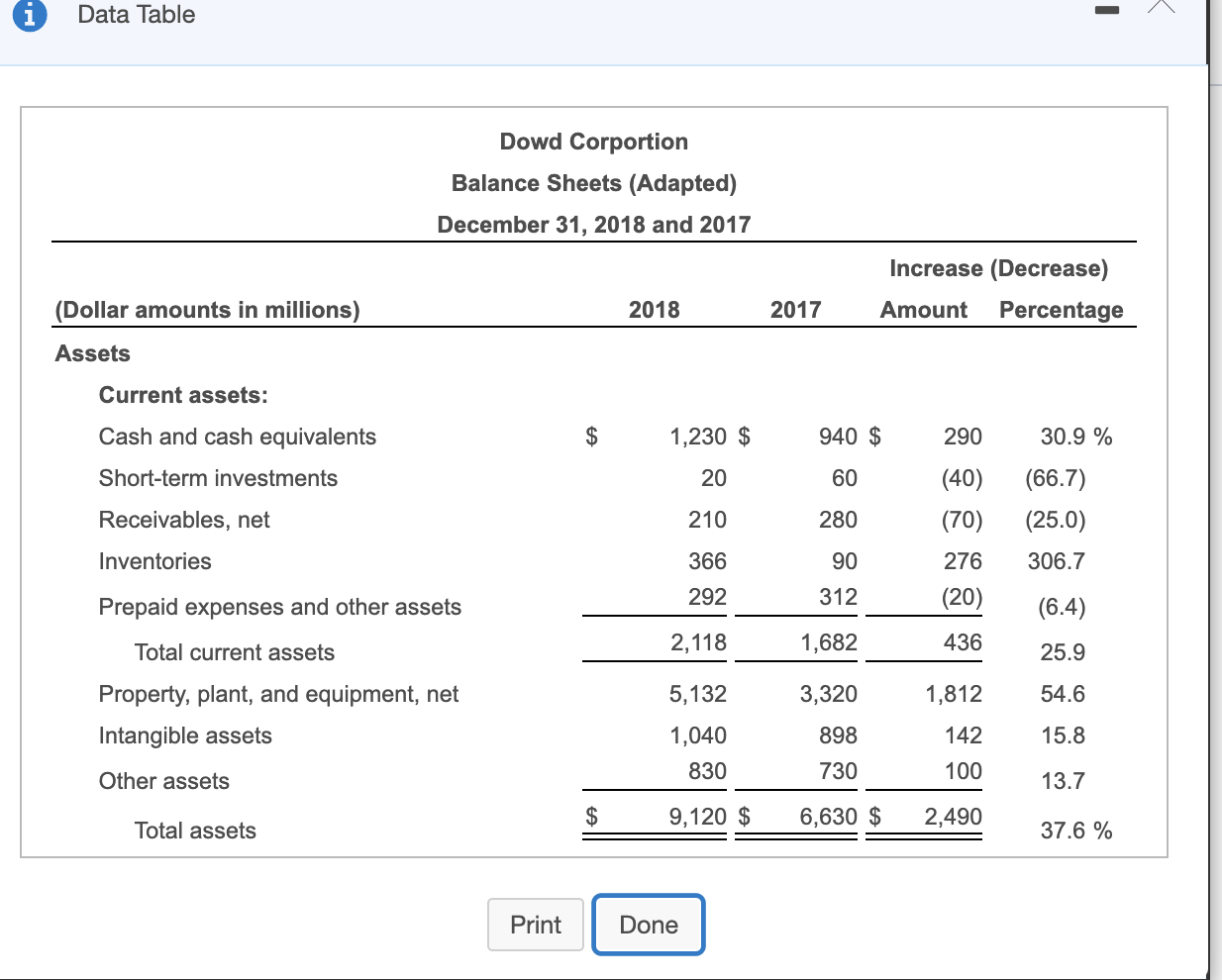

Question: Data Table - Dowd Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Assets Current

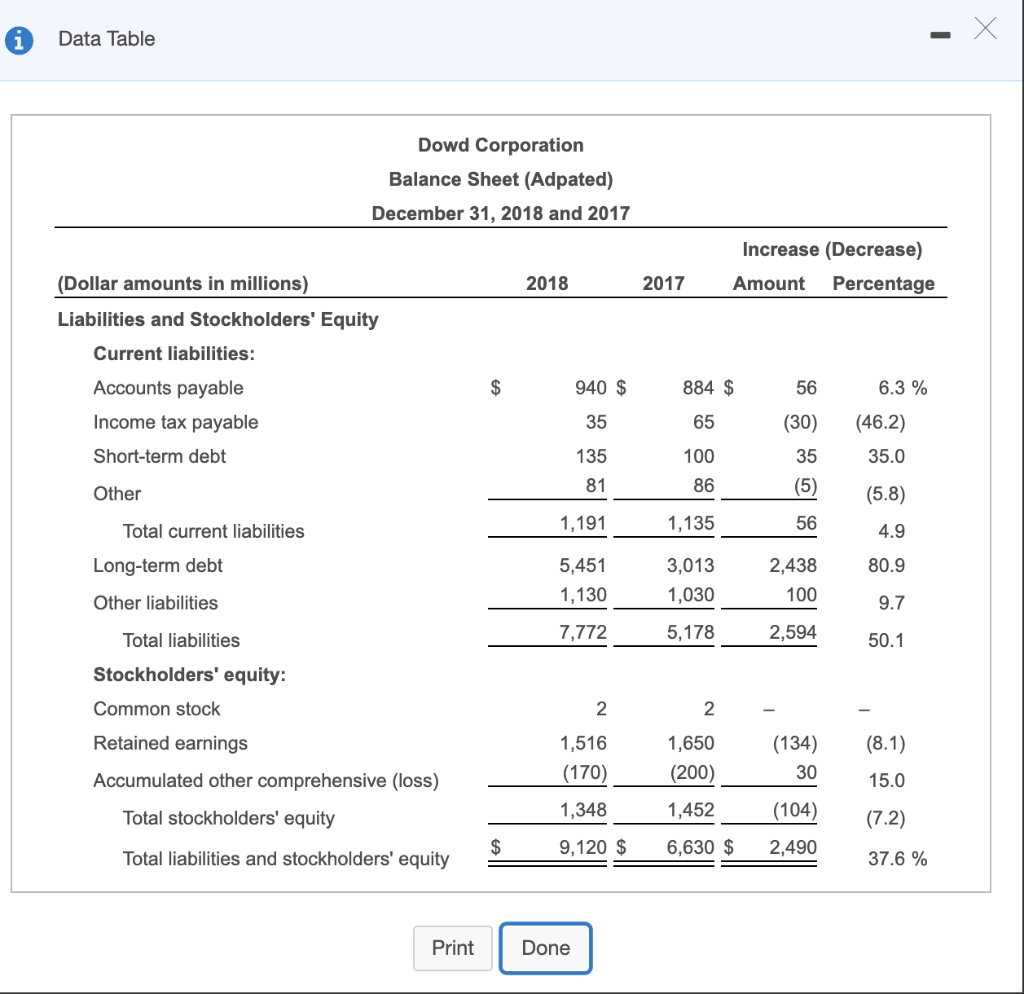

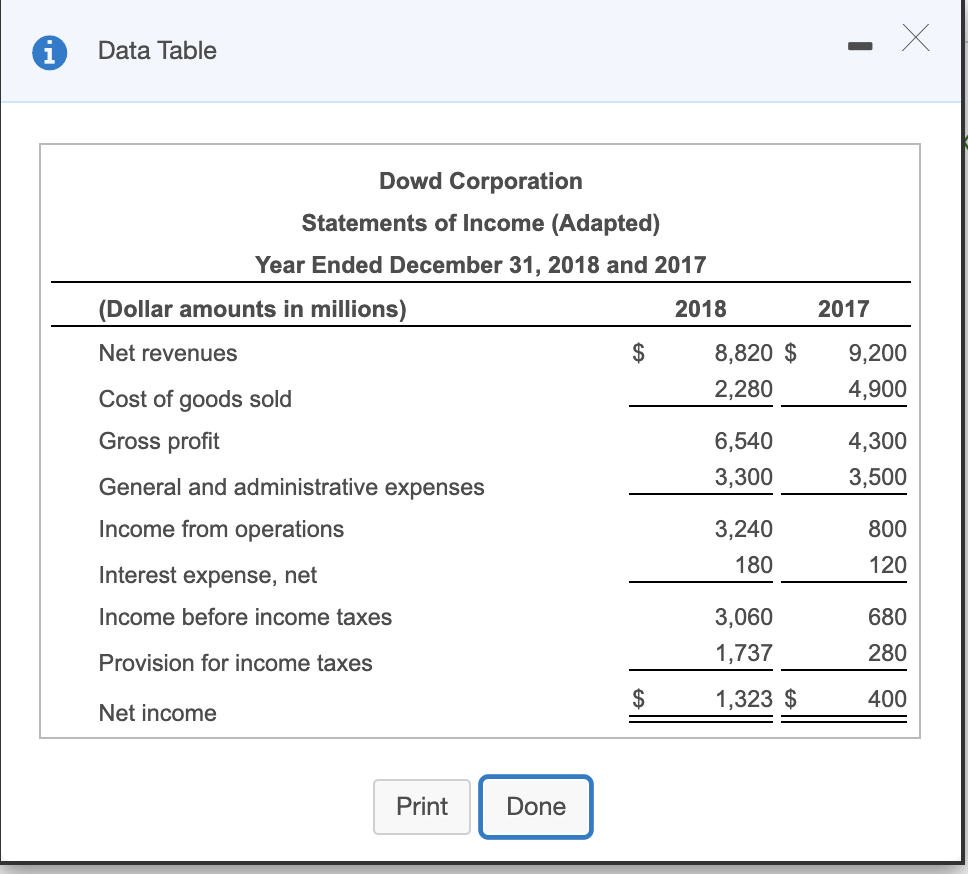

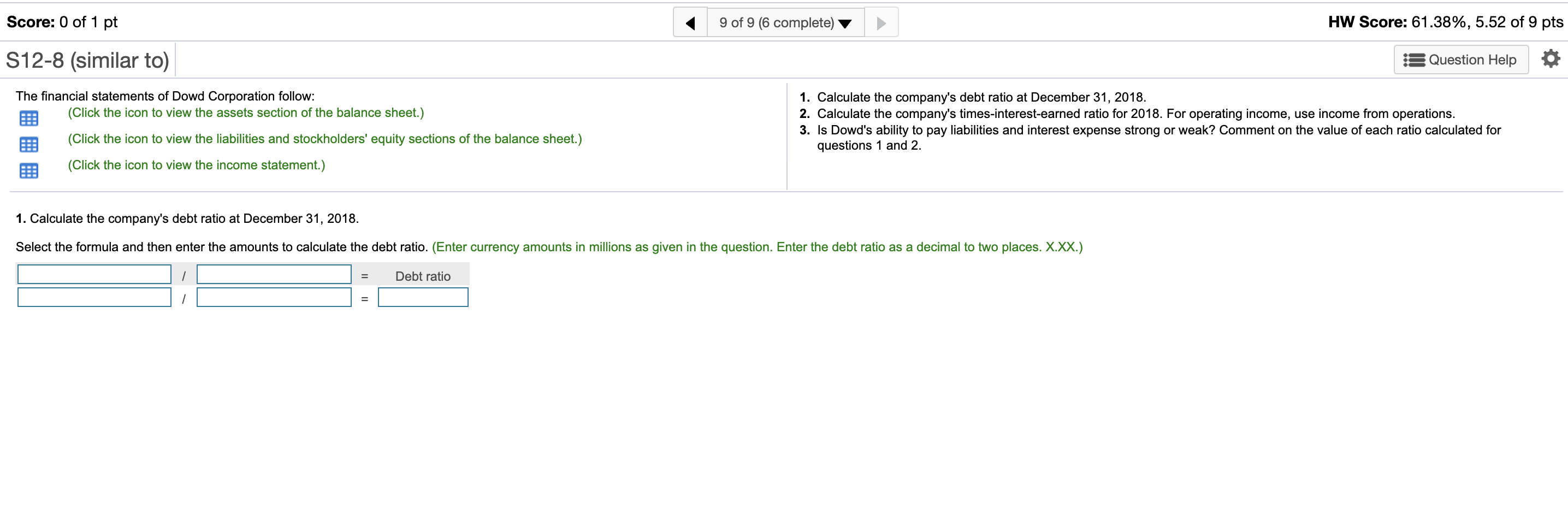

Data Table - Dowd Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Assets Current assets: Cash and cash equivalents Short-term investments Receivables, net Inventories $ 1,230 $ 940 $ 290 30.9 % 20 60 (40) (70) (66.7) (25.0) 210 280 366 90 276 306.7 292 312 Prepaid expenses and other assets (20) (6.4) 2,118 1,682 436 25.9 Total current assets Property, plant, and equipment, net Intangible assets 3,320 1,812 54.6 5,132 1,040 830 898 142 15.8 730 100 Other assets 13.7 $ 9,120 $ 6,630 $ 2,490 Total assets 37.6 % Print Done Data Table Dowd Corporation Balance Sheet (Adpated) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income tax payable Short-term debt $ 940 $ 884 $ 56 6.3% 35 65 (46.2) 35.0 135 81 (30) 35 (5) 100 86 Other (5.8) Total current liabilities 1,191 1,135 56 4.9 Long-term debt 80.9 5,451 1,130 3,013 1,030 2,438 100 Other liabilities 9.7 Total liabilities 7,772 5,178 2,594 50.1 2 2 (8.1) Stockholders' equity: Common stock Retained earnings Accumulated other comprehensive (loss) Total stockholders' equity Total liabilities and stockholders' equity 1,516 (170) 1,650 (200) (134) 30 15.0 1,348 1,452 (104) (7.2) $ 9,120 $ 6,630 $ 2,490 37.6 % Print Done Data Table 2017 9,200 4,900 Dowd Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 Net revenues $ 8,820 $ 2,280 Cost of goods sold Gross profit 6,540 General and administrative expenses 3,300 Income from operations 3,240 180 Interest expense, net Income before income taxes 3,060 1,737 Provision for income taxes $ 1,323 $ Net income 4,300 3,500 800 120 680 280 400 Print Done Score: 0 of 1 pt 9 of 9 (6 complete) HW Score: 61.38%, 5.52 of 9 pts S12-8 (similar to) 3 Question Help The financial statements of Dowd Corporation follow: (Click the icon to view the assets section of the balance sheet.) 1. Calculate the company's debt ratio at December 31, 2018. 2. Calculate the company's times-interest-earned ratio for 2018. For operating income, use income from operations. 3. Is Dowd's ability to pay liabilities and interest expense strong or weak? Comment on the value of each ratio calculated for questions 1 and 2. (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) 1. Calculate the company's debt ratio at December 31, 2018. Select the formula and then enter the amounts to calculate the debt ratio. (Enter currency amounts in millions as given in the question. Enter the debt ratio as a decimal to two places. X.XX.) Debt ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts