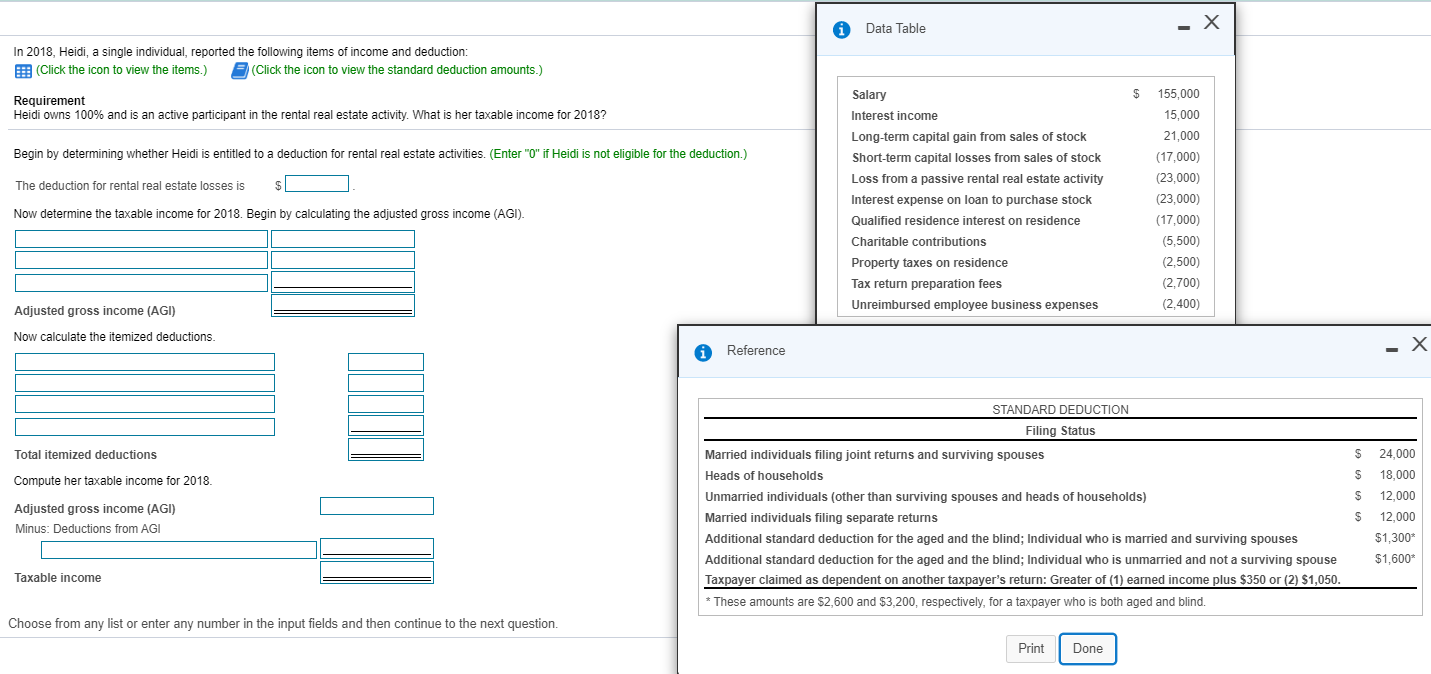

Question: Data Table In 2018, Heidi, a single individual, reported the following items of income and deduction: E (Click the icon to view the items.) (Click

Data Table In 2018, Heidi, a single individual, reported the following items of income and deduction: E (Click the icon to view the items.) (Click the icon to view the standard deduction amounts.) $ Requirement Heidi owns 100% and is an active participant in the rental real estate activity. What is her taxable income for 2018? Begin by determining whether Heidi is entitled to a deduction for rental real estate activities. (Enter "0" if Heidi is not eligible for the deduction.) The deduction for rental real estate losses is $ Salary Interest income Long-term capital gain from sales of stock Short-term capital losses from sales of stock Loss from a passive rental real estate activity Interest expense on loan to purchase stock Qualified residence interest on residence Charitable contributions Property taxes on residence Tax return preparation fees Unreimbursed employee business expenses 155,000 15,000 21,000 (17,000) (23,000) (23,000) (17,000) (5,500) (2,500) (2,700) (2,400) Now determine the taxable income for 2018. Begin by calculating the adjusted gross income (AGI). Adjusted gross income (AGI) Now calculate the itemized deductions. A X - Reference STANDARD DEDUCTION Filing Status Total itemized deductions Compute her taxable income for 2018. $ $ $ $ Adjusted gross income (AGI) Minus: Deductions from AGI Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,050. * These amounts are $2,600 and $3,200, respectively, for a taxpayer who is both aged and blind. 24,000 18,000 12,000 12,000 $1,300 $1,600* Taxable income Choose from any list or enter any number in the input fields and then continue to the next question. Print Done Data Table In 2018, Heidi, a single individual, reported the following items of income and deduction: E (Click the icon to view the items.) (Click the icon to view the standard deduction amounts.) $ Requirement Heidi owns 100% and is an active participant in the rental real estate activity. What is her taxable income for 2018? Begin by determining whether Heidi is entitled to a deduction for rental real estate activities. (Enter "0" if Heidi is not eligible for the deduction.) The deduction for rental real estate losses is $ Salary Interest income Long-term capital gain from sales of stock Short-term capital losses from sales of stock Loss from a passive rental real estate activity Interest expense on loan to purchase stock Qualified residence interest on residence Charitable contributions Property taxes on residence Tax return preparation fees Unreimbursed employee business expenses 155,000 15,000 21,000 (17,000) (23,000) (23,000) (17,000) (5,500) (2,500) (2,700) (2,400) Now determine the taxable income for 2018. Begin by calculating the adjusted gross income (AGI). Adjusted gross income (AGI) Now calculate the itemized deductions. A X - Reference STANDARD DEDUCTION Filing Status Total itemized deductions Compute her taxable income for 2018. $ $ $ $ Adjusted gross income (AGI) Minus: Deductions from AGI Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,050. * These amounts are $2,600 and $3,200, respectively, for a taxpayer who is both aged and blind. 24,000 18,000 12,000 12,000 $1,300 $1,600* Taxable income Choose from any list or enter any number in the input fields and then continue to the next question. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts