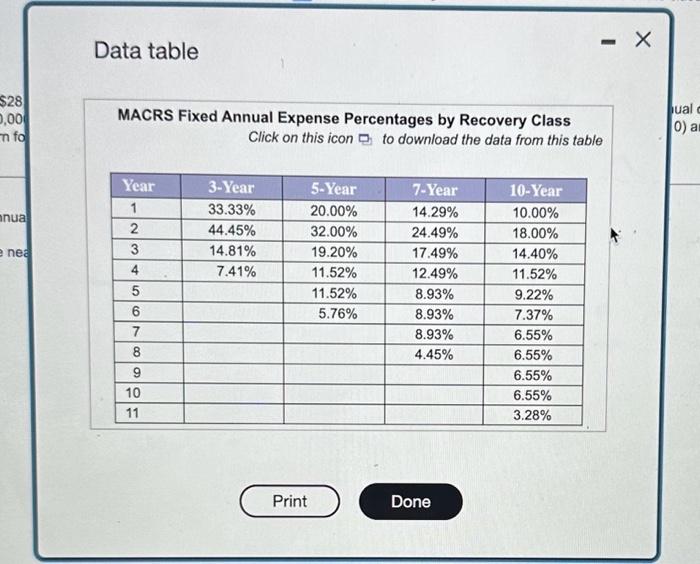

Question: Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon Project cash flow and NPV. The managers of Classic Aulos incorporated

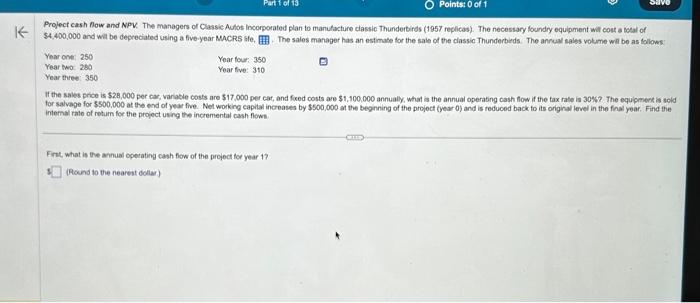

Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon Project cash flow and NPV. The managers of Classic Aulos incorporated plan to manutacture classic Thundertinds (1957 replicas). The necessary foundry equipment wit cont a beal of \$4,400,000 and wal be depreciated using a five-year MhCRS sle, . The sales marager has an estimate for the sale of the classic Thunderbieds. The anrual sales votume wil be as follows: Year one 250 Year lic.260 Year twee: 350 Year four: 350 Year five: 310 If the sales price is $2,000 per car, varlable costs are $17,000 per cat, and fxed costs ave $1,100,000 annualy, what is the annual operating cash flow if the tax rate is 30%?. The equipment is solf for salvage for $500,000 at the end of year five. Nel workng capital increases by $500,000 at the beginning of the projoct (year 0 ) and is reduced back to its originel level in the final year. Find the internal rate of return for the project using the incremental cash flow: Frit, what is the avnual opecating cash fow of the project for year 1 ? (Ricend to the nearest dolw)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts