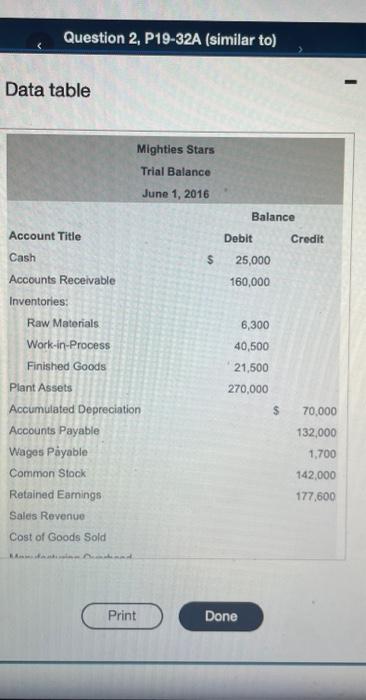

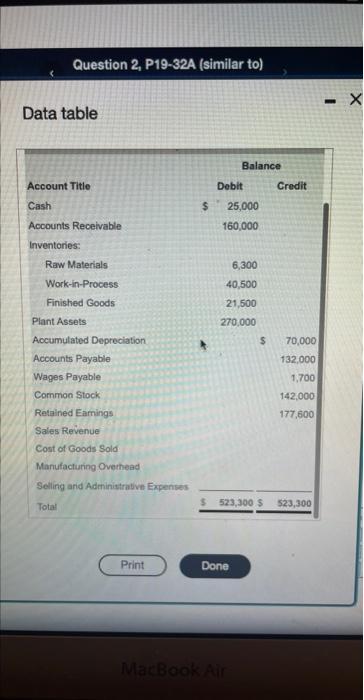

Question: Data table Question 2, P19-32A (similar to) Data table Aceounts Recelvable Raw Materlals Inventory Becounts Receivable Wages Payable 1,700 Bal. 1,700 Bal. Retained Eamings Sales

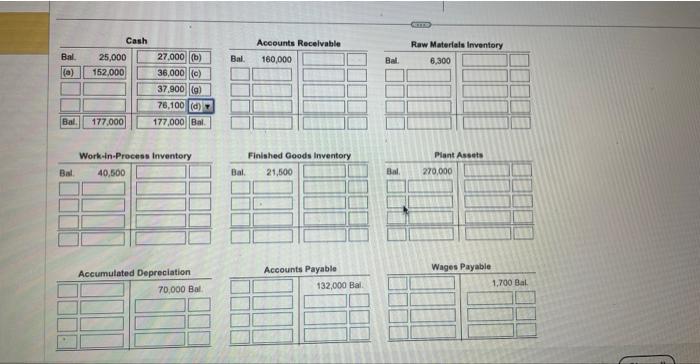

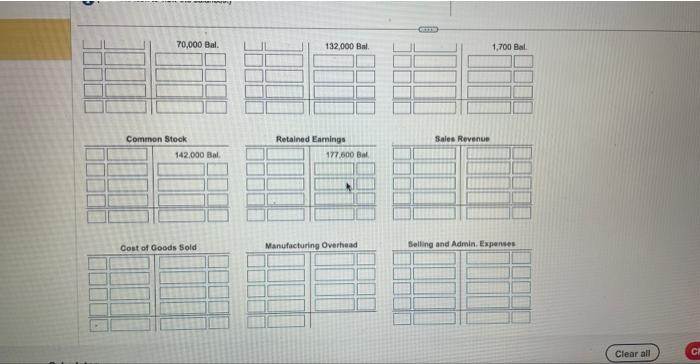

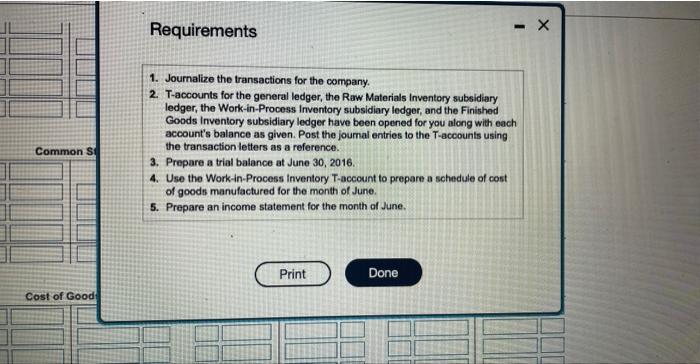

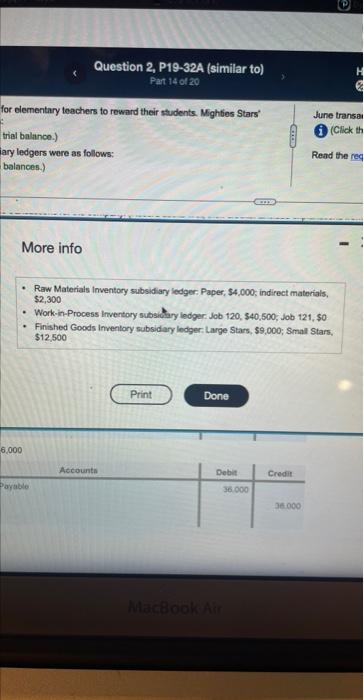

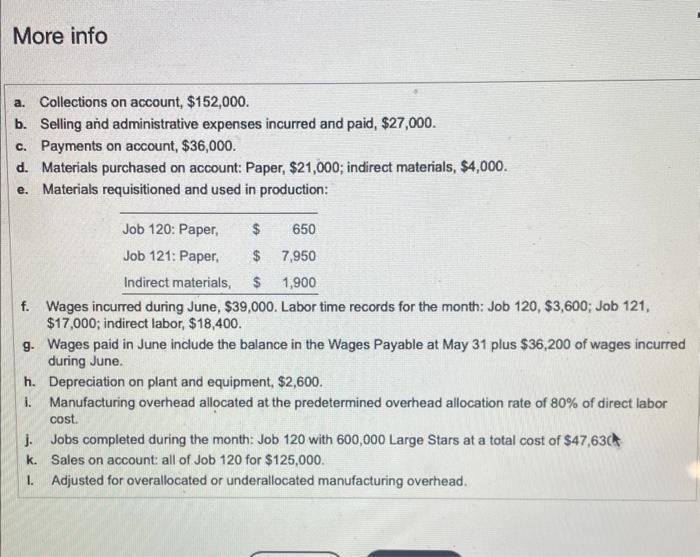

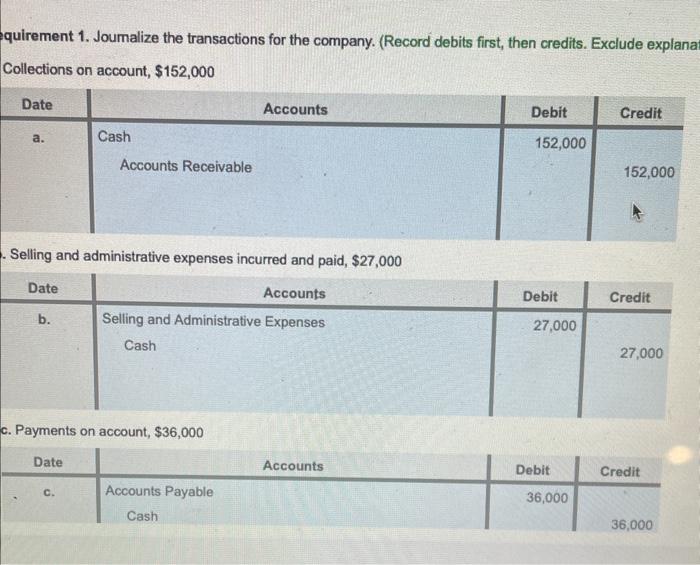

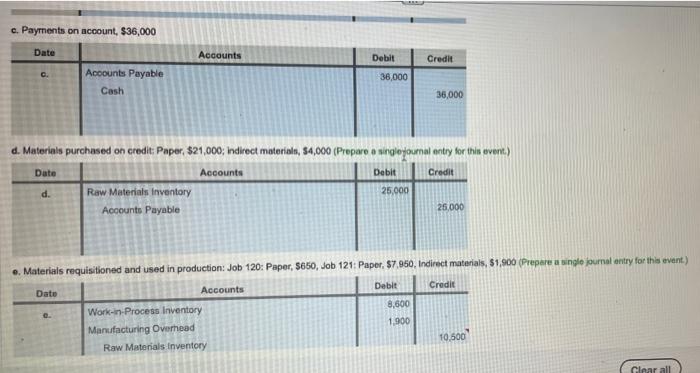

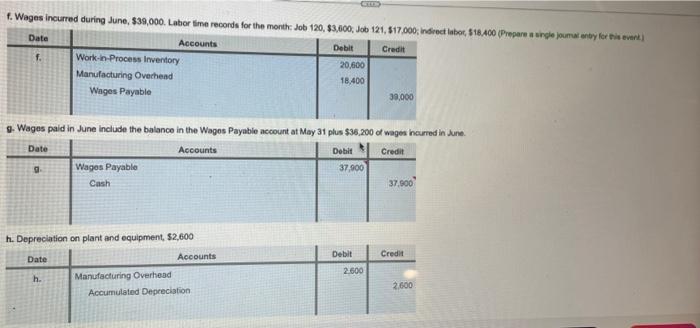

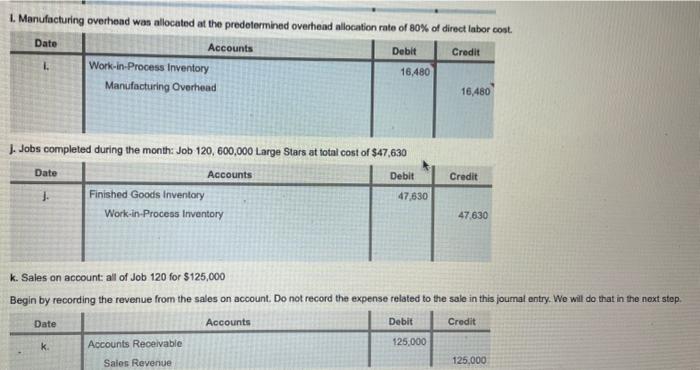

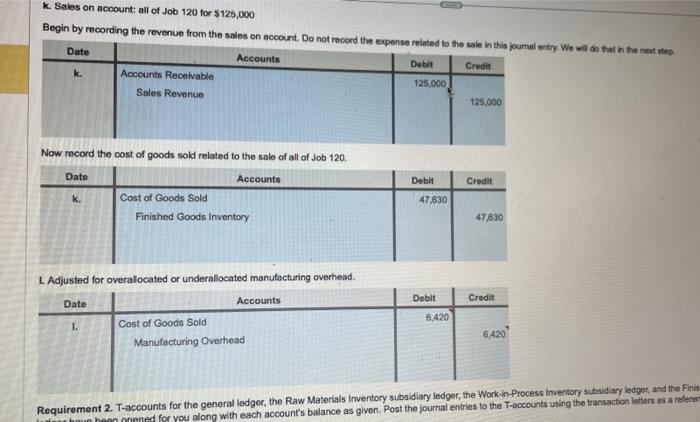

Data table Question 2, P19-32A (similar to) Data table Aceounts Recelvable Raw Materlals Inventory Becounts Receivable Wages Payable 1,700 Bal. 1,700 Bal. Retained Eamings Sales Revenue Selling and Admin. Expenses Clear ali Requirements 1. Journalize the transactions for the company. 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger have been opened for you along with each account's balance as given. Post the joumal entries to the T-accounts using the transaction letters as a reference. 3. Prepare a trial balance at June 30,2016. 4. Use the Work-in-Process inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. 5. Prepare an income statement for the month of June. - Raw Materials inventory subsidiary ledger: Paper, $4,000; indirect materials, $2,300 - Work-in-Process inventary subsibary ledger jab 120, \$40,500; job 121, 50 - Finished Goods inventory subsidary ledger Large Stars, \$9,000; Smal Stars, $12,500 a. Collections on account, $152,000. b. Selling and administrative expenses incurred and paid, $27,000. c. Payments on account, $36,000. d. Materials purchased on account: Paper, $21,000; indirect materials, $4,000. e. Materials requisitioned and used in production: f. Wages incurred during June, $39,000. Labor time records for the month: Job 120,$3,600; Job 121, $17,000; indirect labor, $18,400. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,200 of wages incurred during June. h. Depreciation on plant and equipment, $2,600. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor cost. j. Jobs completed during the month: Job 120 with 600,000 Large Stars at a total cost of $47,63(4) k. Sales on account: all of Job 120 for $125,000. I. Adjusted for overallocated or underallocated manufacturing overhead. quirement 1. Joumalize the transactions for the company. (Record debits first, then credits. Exclude explana Collections on account, $152,000 Selling and administrative expenses incurred and paid, \$27,000 c. Payments on account, $36,000 c. Payrnents on account, $36,000 f. Wages incurred during June, $39,000. Labor fime reconds for the monthe Job 120, $3,600, Job 121. S17.000= indrect labot, 518,400 (Prepare a sireje poumai entyy fer fit event) 9. Wages paid in June include the balance in the Wages Payable account at May 31 plus $36.200 of wages ineurred in dune. h. Depreclation on plant and equipment, \$2,600 1. Manufacturing overhead was allocated at the predetermined overhead allocation rate of 80% of direct labor cost. 1. Jobs completed during the month: Job 120,600,000 Large Stars at totai cost of $47,630 k. Sales on account: all of Job 120 for $125,000 Begin by recording the revenue from the sales on account. Do not record the expense related to the sale in this joumat entry. Wo wil do that in the noxt step. k. Sales on account: all of Job 120 for $125,000 Begin by recording the revenue from the sales on account. Do not record the oxpense reinted to thin wale in ikis youmal entry. Wo wit de that in the neat wtep. Now record the cost of goods sold related to the sale of all of Job 120. 1. Adjusted for overallocated or underallocated manufacturing overhead. Requirement 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory sibsidiary ledger, and the Fin Data table Question 2, P19-32A (similar to) Data table Aceounts Recelvable Raw Materlals Inventory Becounts Receivable Wages Payable 1,700 Bal. 1,700 Bal. Retained Eamings Sales Revenue Selling and Admin. Expenses Clear ali Requirements 1. Journalize the transactions for the company. 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory subsidiary ledger, and the Finished Goods Inventory subsidiary ledger have been opened for you along with each account's balance as given. Post the joumal entries to the T-accounts using the transaction letters as a reference. 3. Prepare a trial balance at June 30,2016. 4. Use the Work-in-Process inventory T-account to prepare a schedule of cost of goods manufactured for the month of June. 5. Prepare an income statement for the month of June. - Raw Materials inventory subsidiary ledger: Paper, $4,000; indirect materials, $2,300 - Work-in-Process inventary subsibary ledger jab 120, \$40,500; job 121, 50 - Finished Goods inventory subsidary ledger Large Stars, \$9,000; Smal Stars, $12,500 a. Collections on account, $152,000. b. Selling and administrative expenses incurred and paid, $27,000. c. Payments on account, $36,000. d. Materials purchased on account: Paper, $21,000; indirect materials, $4,000. e. Materials requisitioned and used in production: f. Wages incurred during June, $39,000. Labor time records for the month: Job 120,$3,600; Job 121, $17,000; indirect labor, $18,400. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,200 of wages incurred during June. h. Depreciation on plant and equipment, $2,600. i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor cost. j. Jobs completed during the month: Job 120 with 600,000 Large Stars at a total cost of $47,63(4) k. Sales on account: all of Job 120 for $125,000. I. Adjusted for overallocated or underallocated manufacturing overhead. quirement 1. Joumalize the transactions for the company. (Record debits first, then credits. Exclude explana Collections on account, $152,000 Selling and administrative expenses incurred and paid, \$27,000 c. Payments on account, $36,000 c. Payrnents on account, $36,000 f. Wages incurred during June, $39,000. Labor fime reconds for the monthe Job 120, $3,600, Job 121. S17.000= indrect labot, 518,400 (Prepare a sireje poumai entyy fer fit event) 9. Wages paid in June include the balance in the Wages Payable account at May 31 plus $36.200 of wages ineurred in dune. h. Depreclation on plant and equipment, \$2,600 1. Manufacturing overhead was allocated at the predetermined overhead allocation rate of 80% of direct labor cost. 1. Jobs completed during the month: Job 120,600,000 Large Stars at totai cost of $47,630 k. Sales on account: all of Job 120 for $125,000 Begin by recording the revenue from the sales on account. Do not record the expense related to the sale in this joumat entry. Wo wil do that in the noxt step. k. Sales on account: all of Job 120 for $125,000 Begin by recording the revenue from the sales on account. Do not record the oxpense reinted to thin wale in ikis youmal entry. Wo wit de that in the neat wtep. Now record the cost of goods sold related to the sale of all of Job 120. 1. Adjusted for overallocated or underallocated manufacturing overhead. Requirement 2. T-accounts for the general ledger, the Raw Materials Inventory subsidiary ledger, the Work-in-Process Inventory sibsidiary ledger, and the Fin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts