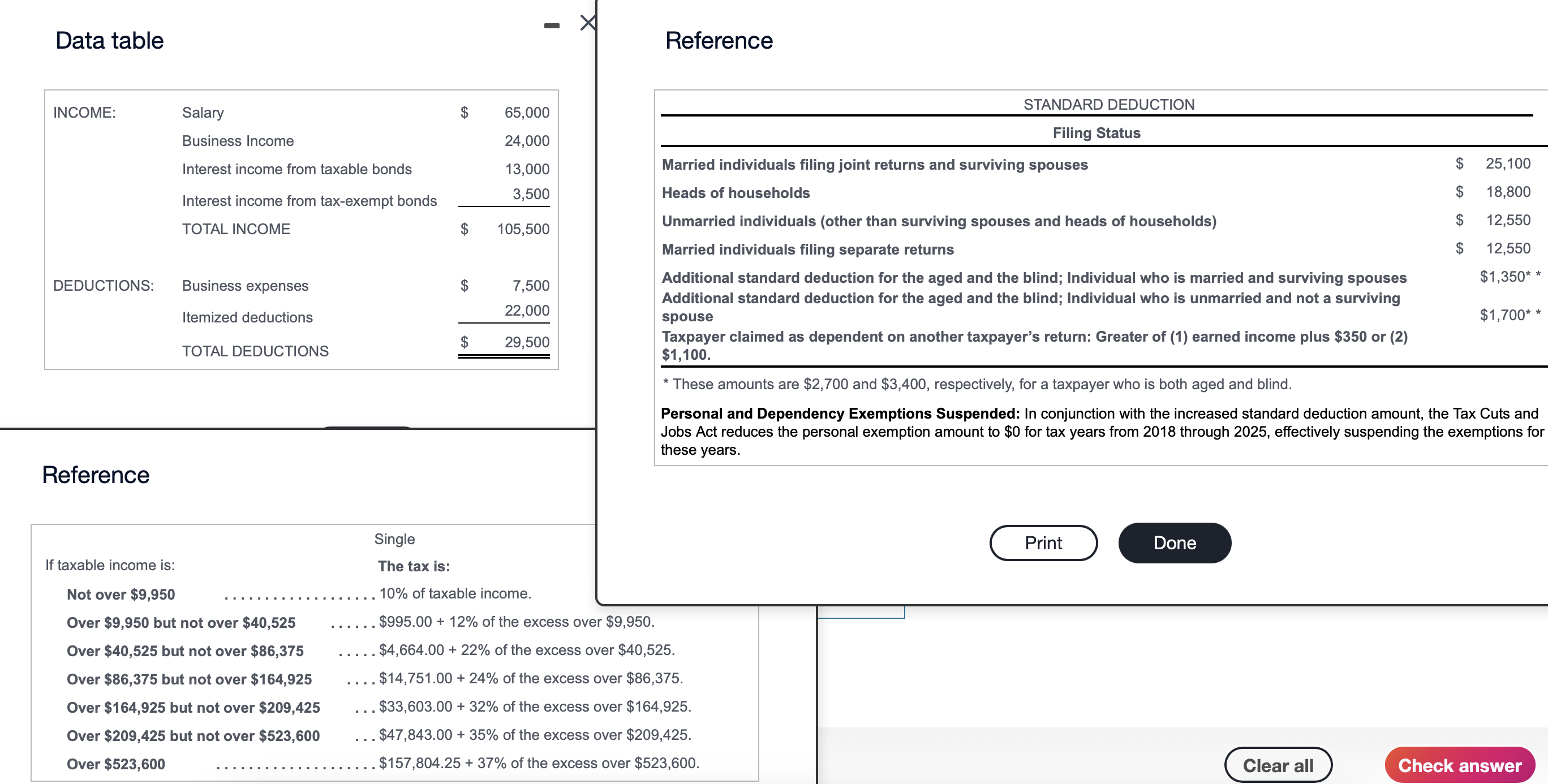

Question: Data table Reference Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses

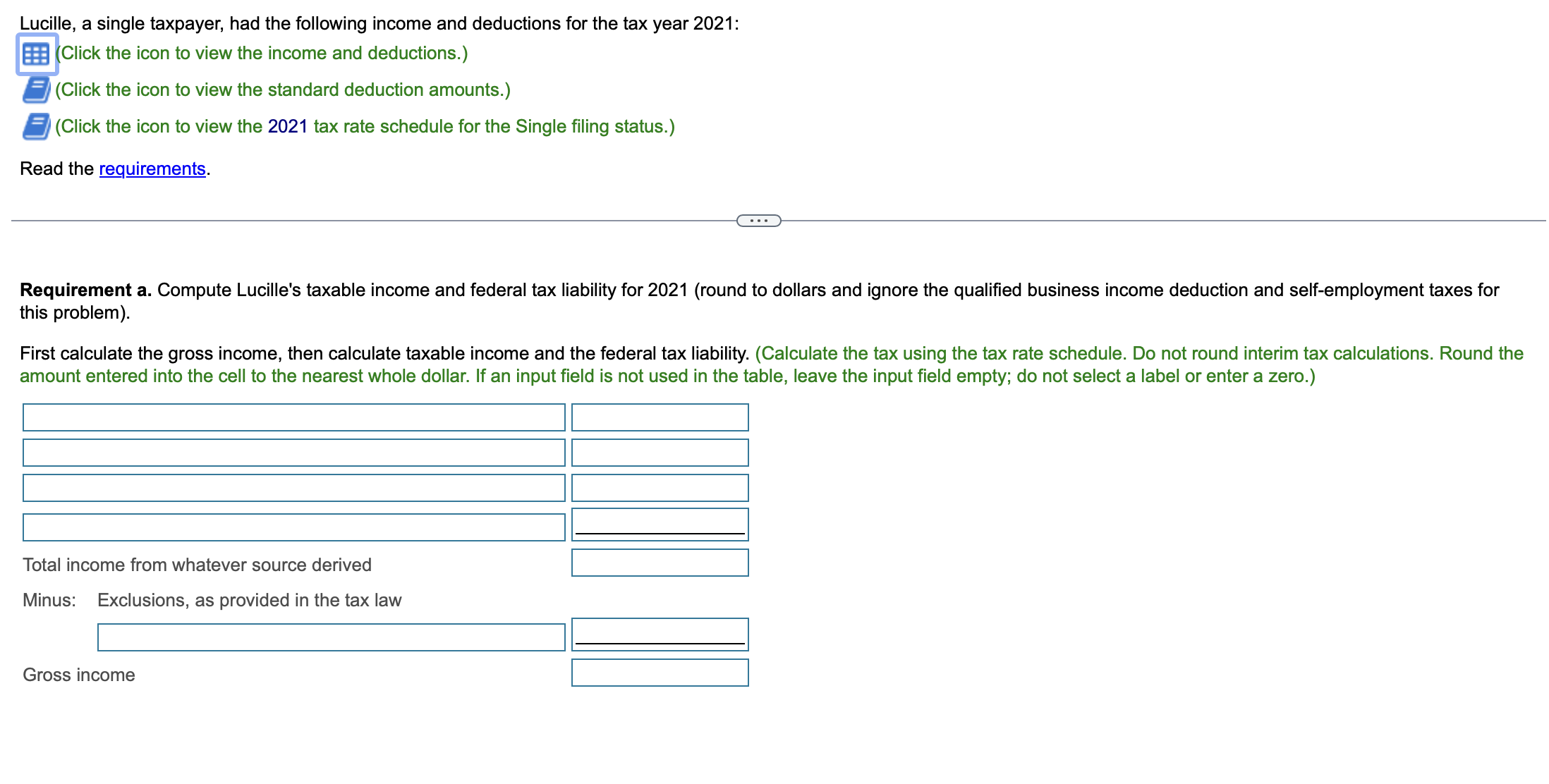

Data table Reference Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,700 and $3,400, respectively, for a taxpayer who is both aged and blind. Personal and Dependency Exemptions Suspended: In conjunction with the increased standard deduction amount, the Tax Cuts and Jobs Act reduces the personal exemption amount to $0 for tax years from 2018 through 2025, effectively suspending the exemptions for these years. Print Done Lucille, a single taxpayer, had the following income and deductions for the tax year 2021: (Click the icon to view the income and deductions.) (Click the icon to view the standard deduction amounts.) (Click the icon to view the 2021 tax rate schedule for the Single filing status.) Read the requirements. Requirement a. Compute Lucille's taxable income and federal tax liability for 2021 (round to dollars and ignore the qualified business income deduction and self-employment taxes for this problem). First calculate the gross income, then calculate taxable income and the federal tax liability. (Calculate the tax using the tax rate schedule. Do not round interim tax calculations. Round the amount entered into the cell to the nearest whole dollar. If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Business expenses Business income Interest income from taxable bonds Interest income from tax-exempt bonds Itemized deductions Salary Standard deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts