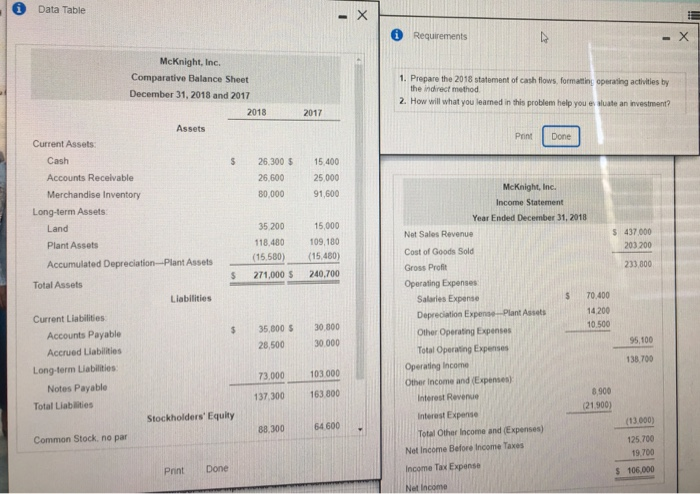

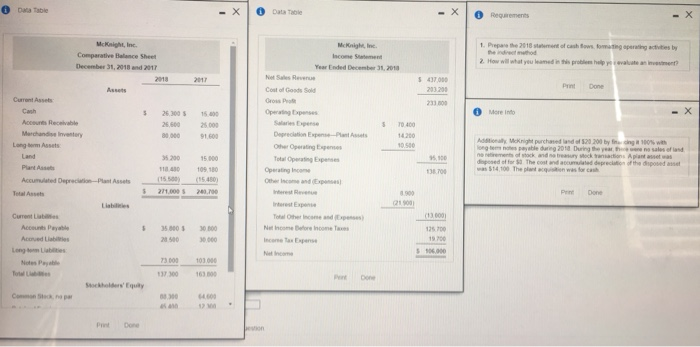

Question: Data Table Requirements - X McKnight, Inc. Comparative Balance Sheet December 31, 2018 and 2017 1. Prepare the 2018 statement of cash flows, formatting operating

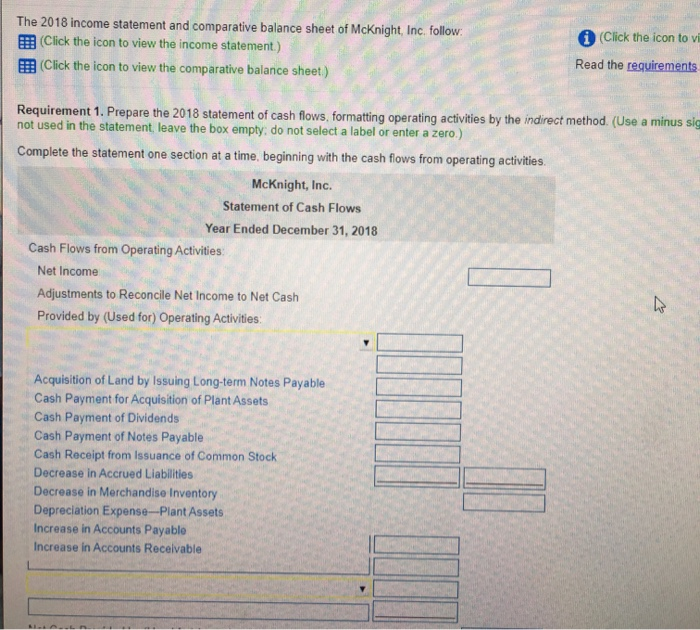

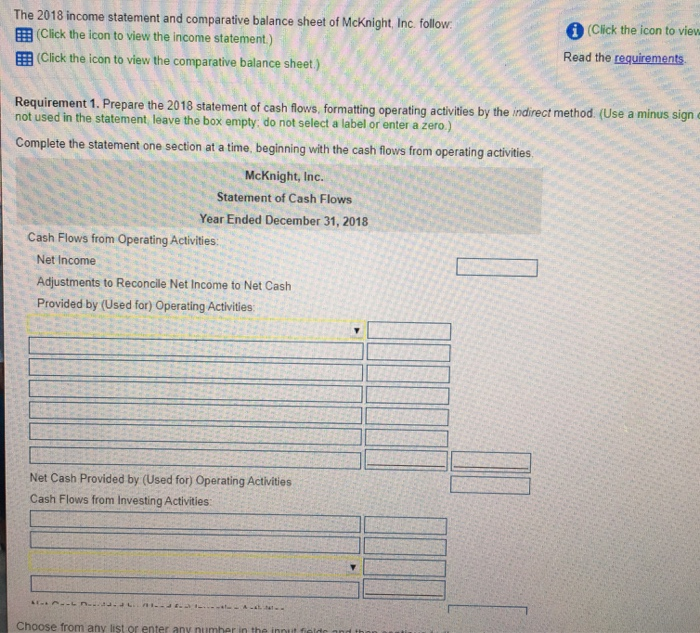

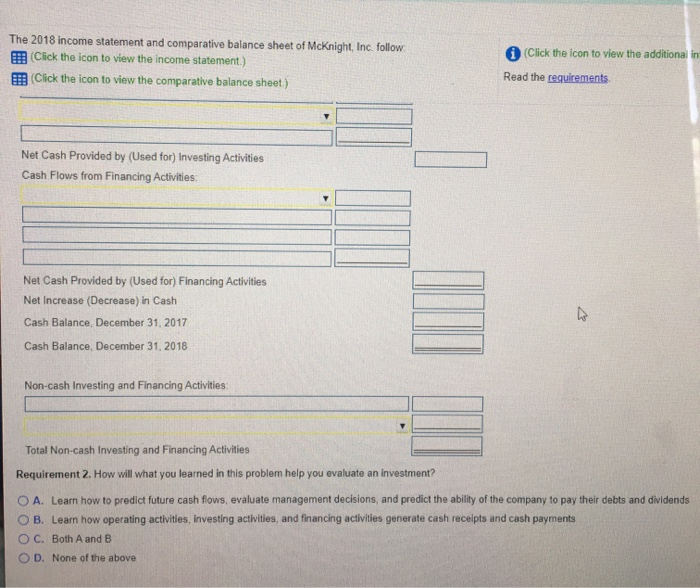

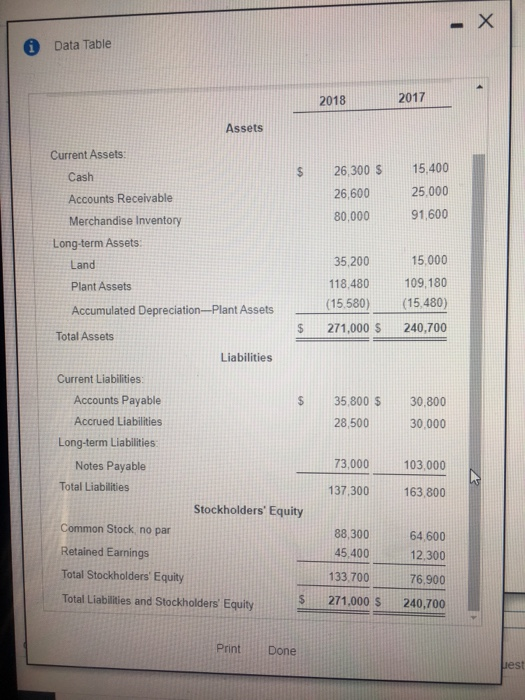

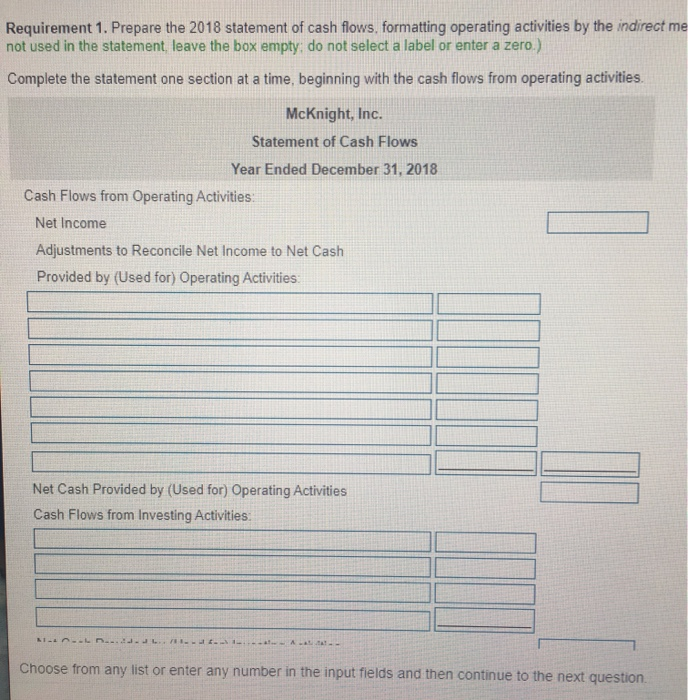

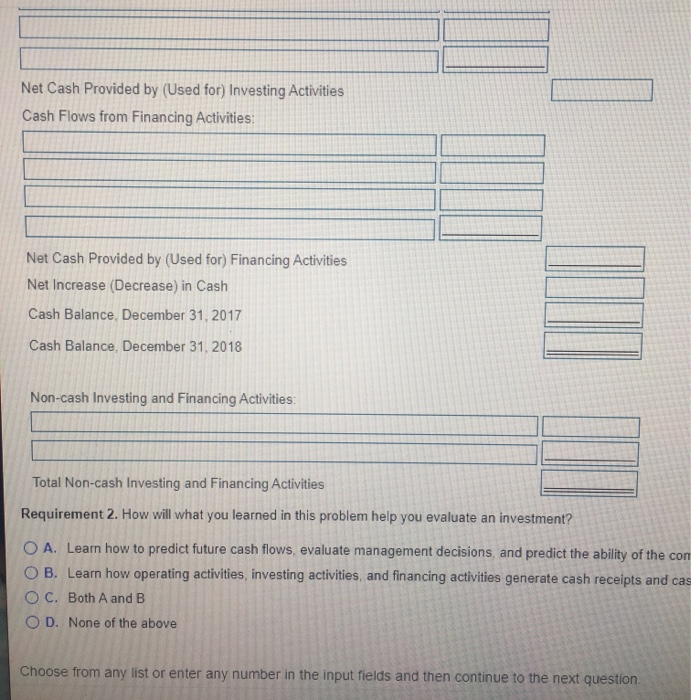

Data Table Requirements - X McKnight, Inc. Comparative Balance Sheet December 31, 2018 and 2017 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method 2. How will what you leared in this problem help you e aluate an investment? 2018 2017 Point Done $ Assets Current Assets Cash Accounts Receivable Merchandise Inventory Long-term Assets Land Plant Assets Accumulated Depreciation-Plant Assets 26,300 $ 26,600 80.000 15.400 25.000 91,600 35 200 118.480 (15.500) 271,000 $ 15,000 109,180 (15.480) 240,700 $ Total Assets Liabilities $ 35,000 $ 28,500 30.800 30.000 Current Liabilities Accounts Payable Accrued Liabilities Long-term Liabilities Notes Payable Total Liabilities McKnight, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue $ 437000 Cost of Goods Sold 203 200 Gross Profit 233 800 Operating Expenses Salaries Expense $ 70.400 Depreciation Expense. Plant Assets 14200 Other Operating Expenses 10.500 Total Operating Expenses 95,100 Operating Income 138.700 Other Income and (Expenses Interest Revenue 8.900 (21 900) Interest Expense (13.000) Total Other Income and (Expenses) 125.700 Net Income Before Income Taxes 19.700 Income Tax Expense $ 106,000 Net Income 73.000 103000 137.300 163 800 Stockholders' Equity 88.300 64600 Common Stock, no par Print Done The 2018 income statement and comparative balance sheet of McKnight, Inc. follow: (Click the icon to view the income statement) (Click the icon to view the comparative balance sheet) (Click the icon to vi Read the requirements Requirement 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. (Use a minus sig not used in the statement, leave the box empty, do not select a label or enter a zero.) Complete the statement one section at a time, beginning with the cash flows from operating activities. McKnight, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Acquisition of Land by Issuing Long-term Notes Payable Cash Payment for Acquisition of Plant Assets Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Decrease in Accrued Liabilities Decrease in Merchandise Inventory Depreciation Expense-Plant Assets Increase in Accounts Payable Increase in Accounts Receivable The 2018 income statement and comparative balance sheet of McKnight, Inc. follow. Click the icon to view the income statement.) Click the icon to view the comparative balance sheet) (Click the icon to view Read the requirements Requirement 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. (Use a minus sign not used in the statement leave the box empty: do not select a label or enter a zero.) Complete the statement one section at a time, beginning with the cash flows from operating activities McKnight, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: ------ Choose from any list or enter any number in the innuit field The 2018 income statement and comparative balance sheet of McKnight, Inc. follow Click the icon to view the income statement.) Click the icon to view the comparative balance sheet) (Click the icon to view the additional in Read the requirements Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Requirement 2. How will what you learned in this problem help you evaluate an investment? O A. Learn how to predict future cash flows, evaluate management decisions, and predict the ability of the company to pay their debts and dividends O B. Learn how operating activities, investing activities, and financing activities generate cash receipts and cash payments O C. Both A and B OD. None of the above wa Table Requirements - X McKnight, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 1. Prepare the 2018 met of shooting operating activity the indirect method 2. How what you leaned in this problem McKnight in Income Statement Year Ended December 31, 2018 Net Sales Revenge Cost of Goods Sold 2017 S47000 203 200 Print Done 231000 5 More inte 26.300 5 26.600 30 000 5 Current Assets Cash Accounts Receivable Merchandisinventory Long Assets Land Plant Accumulated Depreciation-Passes Total Assets Depreciation Expenses Other Operatings Total Operating perses 70 400 14200 10.500 35100 15.000 109180 tily Might purchased and of 20200 by firing 100% with ngente during 2018 During the year we no sales and neck and streasury wedis Apunts was posed of the cost and med depreciation of the was $14.100 The plan was forca 11840 115 13700 271.000 900 (13000 Total income and Not income for home 5 35 000 Current Account Payable Acord Labs Long to Labs 125.00 1970 73000 103 To 137300 163.000 Don Done - X Data Table 2018 2017 Assets 26,300 $ 26,600 80,000 15,400 25,000 91,600 35,200 118.480 (15,580) 15,000 109,180 (15,480) 271,000 $ 240,700 Current Assets Cash $ Accounts Receivable Merchandise Inventory Long-term Assets Land Plant Assets Accumulated Depreciation ---Plant Assets $ Total Assets Liabilities Current Liabilities: Accounts Payable $ Accrued Liabilities Long-term Liabilities Notes Payable Total Liabilities Stockholders' Equity Common Stock no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ 35,800 $ 30.800 30.000 28,500 73,000 103,000 137.300 163,800 88,300 45.400 64.600 12.300 133.700 76,900 240,700 271,000 S Print Done Jest Requirement 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect me not used in the statement, leave the box empty: do not select a label or enter a zero) Complete the statement one section at a time, beginning with the cash flows from operating activities. McKnight, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: ...... --- Choose from any list or enter any number in the input fields and then continue to the next question Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2017 Cash Balance, December 31, 2018 M Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Requirement 2. How will what you learned in this problem help you evaluate an investment? O A. Learn how to predict future cash flows, evaluate management decisions, and predict the ability of the con OB. Learn how operating activities, investing activities, and financing activities generate cash receipts and cas O C. Both A and B OD. None of the above Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts