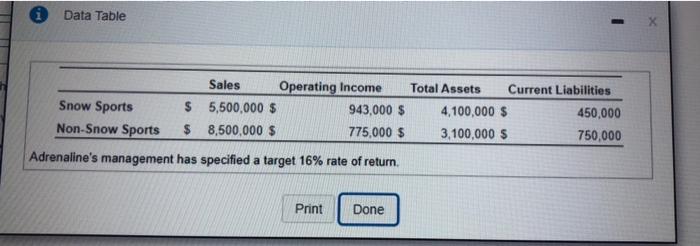

Question: Data Table Sales Operating Income Total Assets Current Liabilities Snow Sports $ 5,500,000 $ 943,000 $ 4,100,000 $ 450,000 Non-Snow Sports $ 8,500,000 $ 775,000

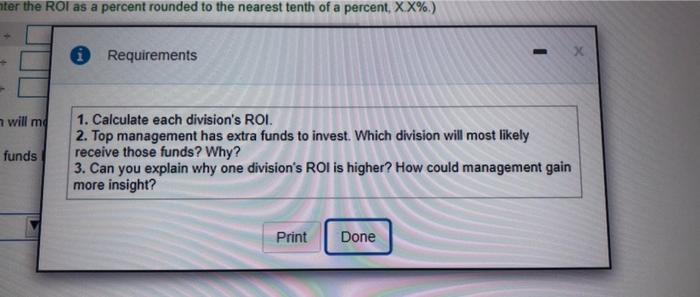

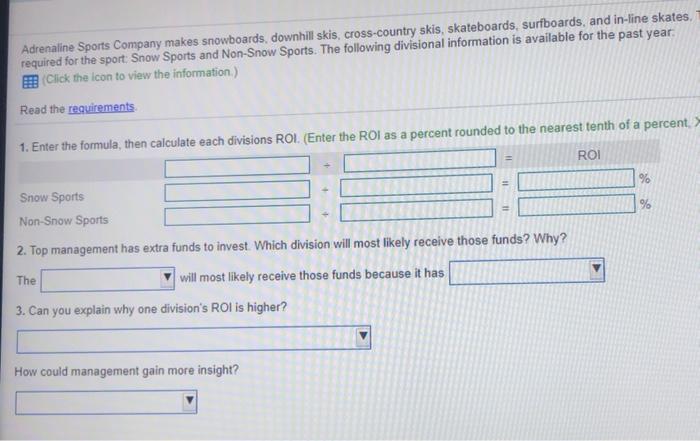

Data Table Sales Operating Income Total Assets Current Liabilities Snow Sports $ 5,500,000 $ 943,000 $ 4,100,000 $ 450,000 Non-Snow Sports $ 8,500,000 $ 775,000 $ 3,100,000 $ 750,000 Adrenaline's management has specified a target 16% rate of return Print Done ter the rol as a percent rounded to the nearest tenth of a percent, XX%.) * Requirements will me funds 1. Calculate each division's ROI. 2. Top management has extra funds to invest. Which division will most likely receive those funds ? Why? 3. Can you explain why one division's ROI is higher? How could management gain more insight? Print Done Adrenaline Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and in-line skates, required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year. Click the icon to view the information.) Read the requirements 1. Enter the formula, then calculate each divisions ROI. (Enter the ROI as a percent rounded to the nearest tenth of a percent ROI 96 % Snow Sports Non-Snow Sports 2. Top management has extra funds to invest. Which division will most likely receive those funds? Why? The will most likely receive those funds because it has 3. Can you explain why one division's ROI is higher? How could management gain more insight? s. The company has found it beneficial to split operations into two divisions based on the climate 2. X.X%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts