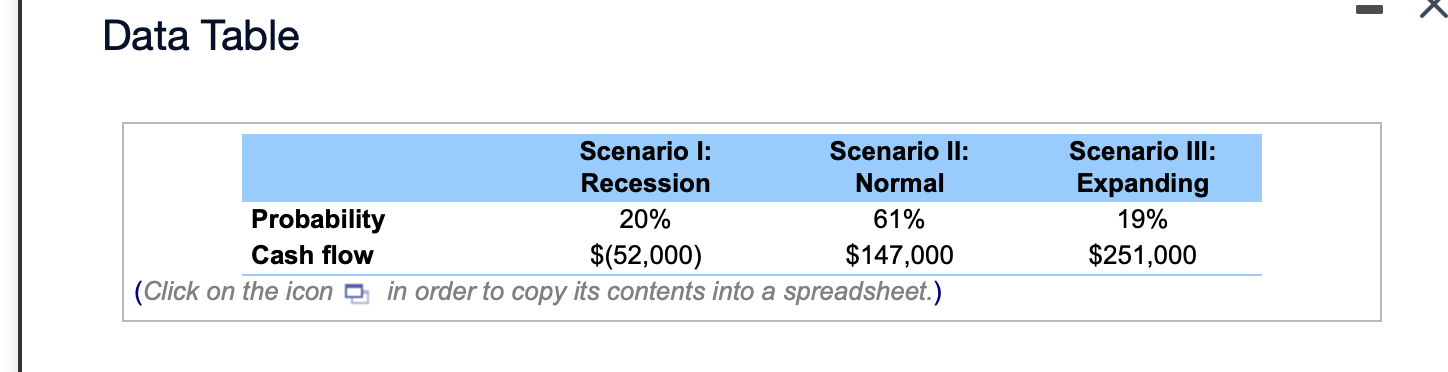

Question: - Data Table Scenario l: Scenario II: Recession Normal Probability 20% 61% Cash flow $(52,000) $147,000 (Click on the icon in order to copy its

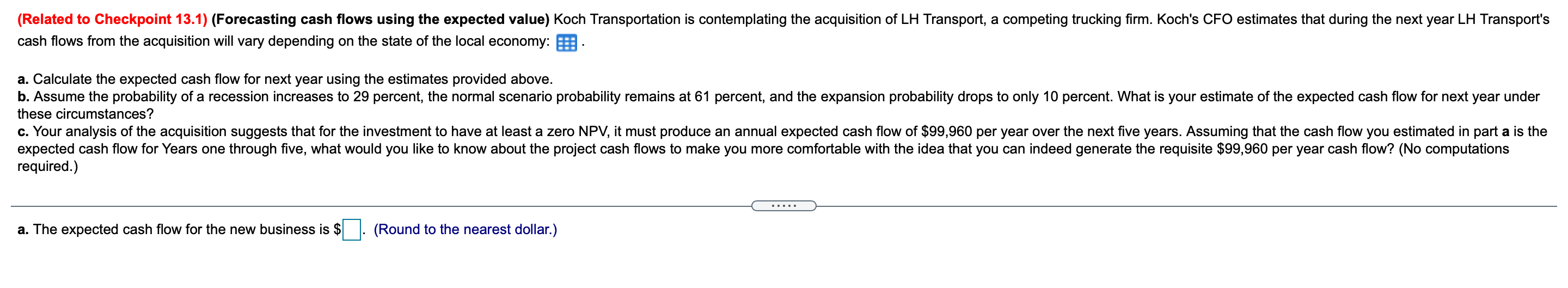

- Data Table Scenario l: Scenario II: Recession Normal Probability 20% 61% Cash flow $(52,000) $147,000 (Click on the icon in order to copy its contents into a spreadsheet.) Scenario III: Expanding 19% $251,000 (Related to Checkpoint 13.1) (Forecasting cash flows using the expected value) Koch Transportation is contemplating the acquisition of LH Transport, a competing trucking firm. Koch's CFO estimates that during the next year LH Transport's cash flows from the acquisition will vary depending on the state of the local economy: a. Calculate the expected cash flow for next year using the estimates provided above. b. Assume the probability of a recession increases to 29 percent, the normal scenario probability remains at 61 percent, and the expansion probability drops to only 10 percent. What is your estimate of the expected cash flow for next year under these circumstances? c. Your analysis of the acquisition suggests that for the investment to have at least a zero NPV, it must produce an annual expected cash flow of $99,960 per year over the next five years. Assuming that the cash flow you estimated in part a is the expected cash flow for Years one through five, what would you like to know about the project cash flows to make you more comfortable with the idea that you can indeed generate the requisite $99,960 per year cash flow? (No computations required.) a. The expected cash flow for the new business is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts