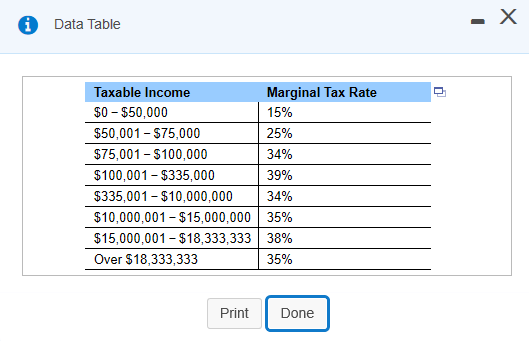

Question: Data Table . Taxable income Marginal Tax Rate $0 - $50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001

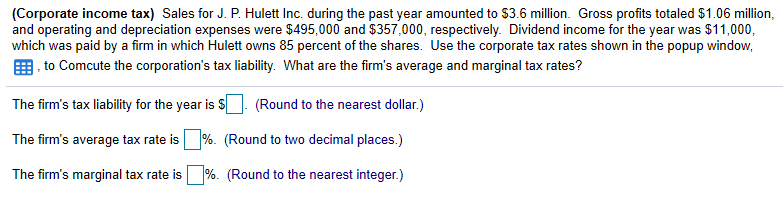

Data Table . Taxable income Marginal Tax Rate $0 - $50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35% Print Done (Corporate income tax) Sales for J. P. Hulett Inc. during the past year amounted to $3.6 million. Gross profits totaled $1.06 million, and operating and depreciation expenses were $495,000 and $357,000, respectively. Dividend income for the year was $11,000, which was paid by a firm in which Hulett owns 85 percent of the shares. Use the corporate tax rates shown in the popup window, , to Comcute the corporation's tax liability. What are the firm's average and marginal tax rates? The firm's tax liability for the year is $ (Round to the nearest dollar.) The firm's average tax rate is l%. (Round to two decimal places.) The firm's marginal tax rate is 1% (Round to the nearest integer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts