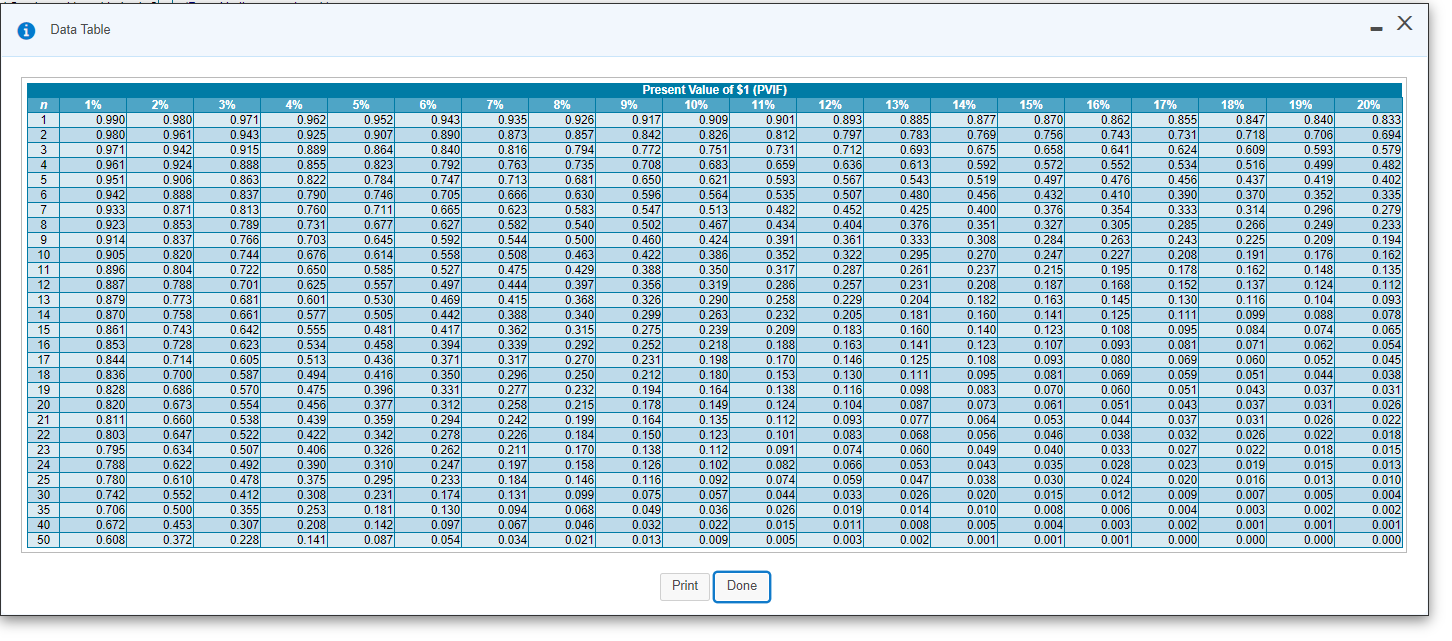

Question: Data Table - X 2% 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 13% 0.885 0.7831 0.693 0.613 0.543 0.480 0.425 17% 0.855 0.7311 0.624

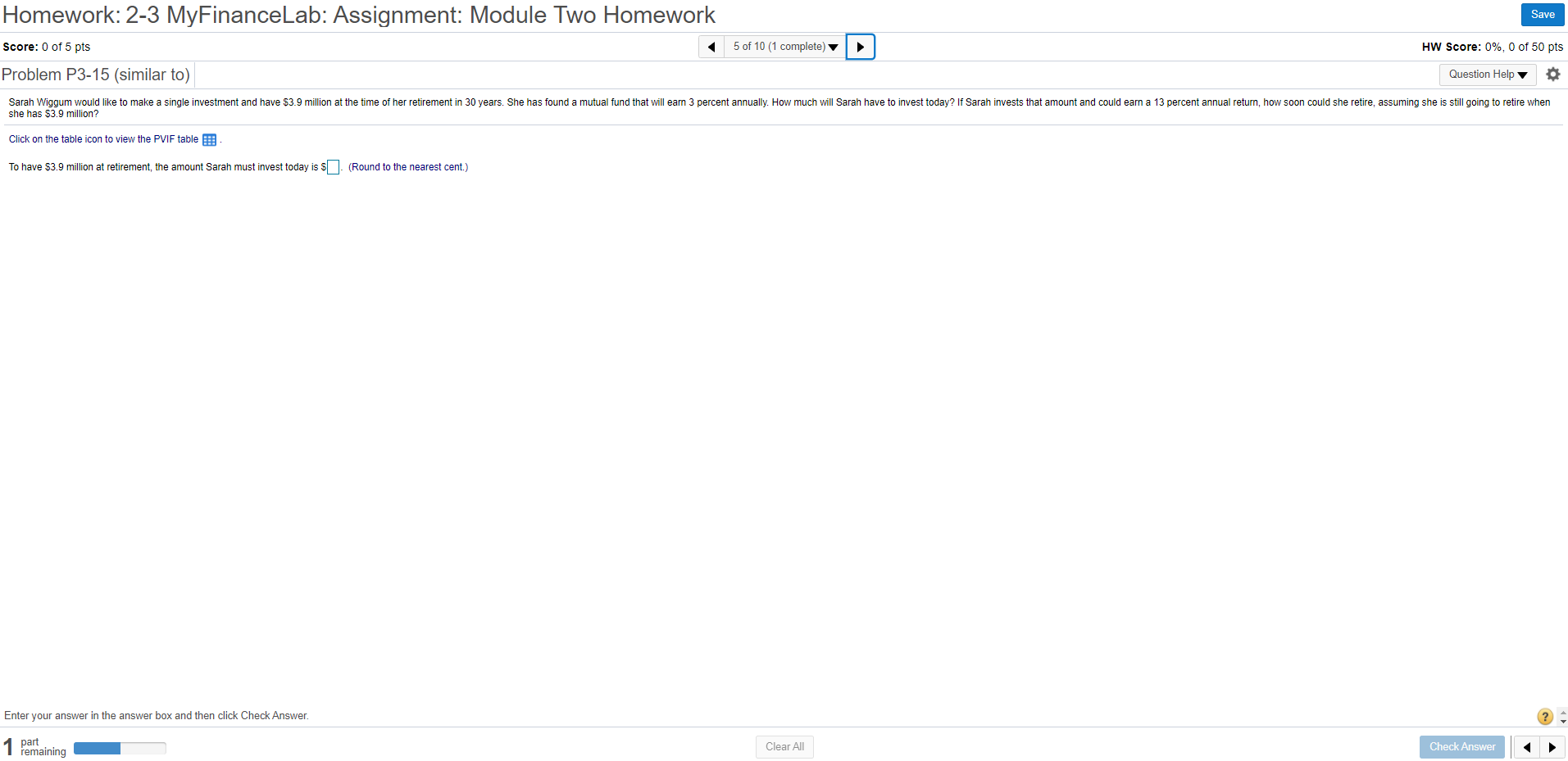

Data Table - X 2% 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 13% 0.885 0.7831 0.693 0.613 0.543 0.480 0.425 17% 0.855 0.7311 0.624 0.534 0.456 0.390 0.333 0.582 0.434 0.376 0.285 0.424 n 1 2 3 4 5 6 7 8 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 50 1% 0.990 0.980 0.971 0.961) 0.951) 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.8201 0.8111 0.803 0.795 0.788 0.7801 0.742 0.706 0.672 0.608 0.9801 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.660 0.647 0.634 0.622 0.610 0.552 0.500 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.538 0.522 0.507 0.492 0.478 0.412 0.355 0.307 0.228) 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475) 0.456 0.439 0.422 0.406 0.390 0.375 0.308 0.253 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.359 0.342 0.3261 0.310 0.295 0.231 0.181 0.142 0.087 6% 0.943 0.890 0.8401 0.7921 0.747 0.705 0.665 0.627 0.592 0.558) 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.294 0.278 0.262 0.247 0.233 0.174 0.130 0.097 0.054 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339) 0.317 0.296 0.277 0.258 0.242 0.226 0.211 0.197 0.184 0.131 0.094 0.067 0.034) 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500) 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.199 0.184 0.170 0.158 0.146 0.099 0.068 0.046 0.021 Present Value of $1 (PVIF) 9% 10% 11% 0.9171 0.909 0.901 0.842 0.826 0.812 0.772 0.7511 0.7311 0.708 0.683 0.659 0.650 0.621 0.593 0.596 0.564 0.535 0.547 0.513 0.482 0.502 0.467 0.460 0.391 0.422 0.386 0.352 0.388 0.350 0.3171 0.356 0.319) 0.286 0.326 0.290 0.258 0.299 0.263 0.232 0.275 0.239 0.209) 0.252 0.218 0.188 0.231 0.198 0.170 0.212 0.180 0.153 0.194 0.164 0.138 0.178 0.149 0.124 0.164 0.135 0.112 0.150 0.123 0.101 0.138 0.112 0.091 0.126 0.1021 0.082 0.116 0.092 0.074 0.075 0.057 0.044 0.049 0.036 0.026 0.032 0.022 0.015 0.013 0.009 0.005 12% 0.8937 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.093 0.08 0.074 0.066 0.059 0.033 0.019 0.011 0.003 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098) 0.087 0.077 0.068 0.060 0.053 0.047 0.026 0.0141 0.008 0.0021 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.0731 0.064 0.056 0.049 0.043) 0.038 0.020 0.010 0.005 0.001 15% 0.870 0.756 0.658| 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.053 0.046 0.040 0.035) 0.030 0.015 0.008 0.004 0.001 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.044 0.038 0.033 0.028 0.024 0.012 0.006 0.003 0.001 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0.037 0.032 0.027 0.023 0.020 0.009 0.004 0.002 0.0001 18% 0.847 0.718 0.609 0.516 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0.037 0.0311 0.026 0.022 0.019) 0.016 0.007 0.003 0.001 0.000 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.005 0.002 0.001 0.000 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279) 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.022 0.018 0.015 0.013 0.010 0.004 0.002 0.001 0.000 Print Done Homework: 2-3 MyFinanceLab: Assignment: Module Two Homework Save Score: 0 of 5 pts 5 of 10 (1 complete) HW Score: 0%, 0 of 50 pts Question Help Problem P3-15 (similar to) Sarah Wiggum would like to make a single investment and have $3.9 million at the time of her retirement in 30 years. She has found a mutual fund that will earn 3 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could earn a 13 percent annual return, how soon could she retire, assuming she is still going to retire when she has $3.9 million? Click on the table icon to view the PVIF table B To have $3.9 million at retirement, the amount Sarah must invest today is $. (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. part remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts