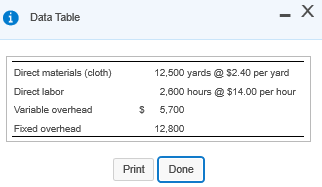

Question: - Data Table X Direct materials (cloth) Direct labor Variable overhead 12,500 yards @ $2.40 per yard 2,600 hours @ $14.00 per hour 5,700 12,800

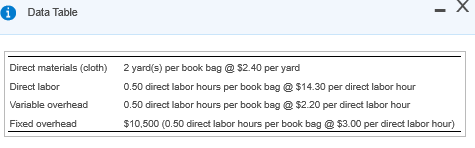

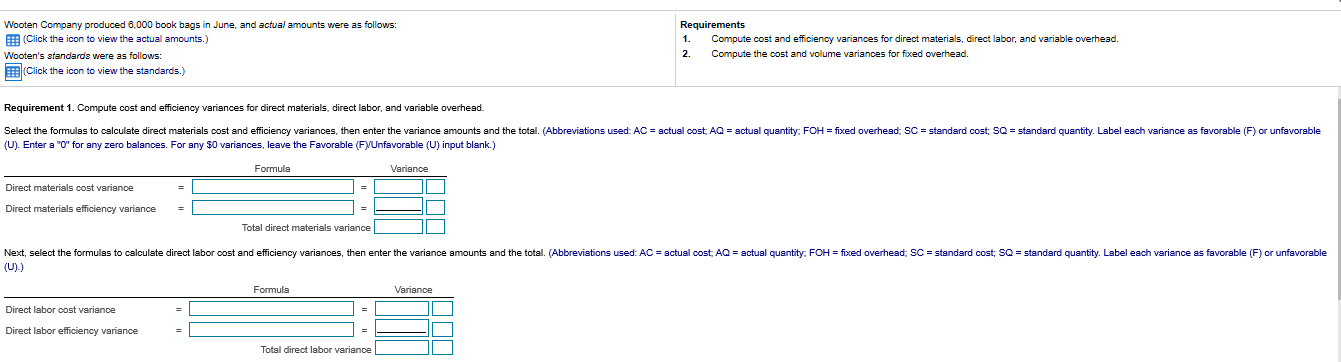

- Data Table X Direct materials (cloth) Direct labor Variable overhead 12,500 yards @ $2.40 per yard 2,600 hours @ $14.00 per hour 5,700 12,800 $ Fixed overhead Print Done 0 Data Table Direct materials (cloth) Direct labor 2 yard(s) per book bag @ $2.40 per yard 0.50 direct labor hours per book bag @ $14.30 per direct labor hour 0.50 direct labor hours per book bag @ $2.20 per direct labor hour $10.500 (0.50 direct labor hours per book bag @ $3.00 per direct labor hour) Variable overhead Fixed overhead Wooten Company produced 6,000 book bags in June, and actual amounts were as follows: (Click the icon to view the actual amounts.) Wooten's standards were as follows: (Click the icon to view the standards.) Requirements 1. Compute cost and efficiency variances for direct materials, direct labor, and variable overhead. 2. Compute the cost and volume variances for fixed overhead. Requirement 1. Compute cost and efficiency variances for direct materials, direct labor, and variable overhead. Select the formulas to calculate direct materials cost and efficiency variances, then enter the variance amounts and the total. (Abbreviations used: AC = actual cost, AQ = actual quantity: FOH = fixed overhead: SC = standard cost: SQ = standard quantity. Label each variance as favorable (F) or unfavorable (U). Enter a "' for any zero balances. For any $0 variances, leave the Favorable (F/Unfavorable (U) input blank.) Formula Variance Direct materials cost variance Direct materials efficiency variance = Total direct materials variance Next, select the formulas to calculate direct labor cost and efficiency variances, then enter the variance amounts and the total. (Abbreviations used: AC = actual cost, AQ = actual quantity: FOH = fixed overhead: SC = standard cost: SQ = standard quantity. Label each variance as favorable (F) or unfavorable (U).) Formula Variance Direct labor cost variance Direct labor efficiency variance 000 Total direct labor variance lotal direct labor variance Finally, select the formulas to calculate the variable overhead cost and efficiency variances, then enter the variance amounts and the total. (Abbreviations used: AC = actual cost: AQ = actual quantity: FOH = fixed overhead: SC = standard cost; SQ = standard quantity: VOH = variable overhead.) Formula Variance VOH cost variance VOH efficiency variance = Total variable overhead variance Requirement 2. Compute the cost and volume variances for fixed overhead. Select the formulas to calculate the fixed overhead cost and volume variances, then enter the variance amounts and the total. (Abbreviations used: AC = actual cost: AQ = actual quantity: FOH = fixed overhead: SC = standard cost: SQ = standard quantity. Label each variance as favorable (F) or unfavorable (U). Enter a "0" for any zero balances. For any $0 variances, leave the Favorable (F/Unfavorable (U) input blank.) Formula Variance FOH cost variance FOH volume variance = Total fixed overhead variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts