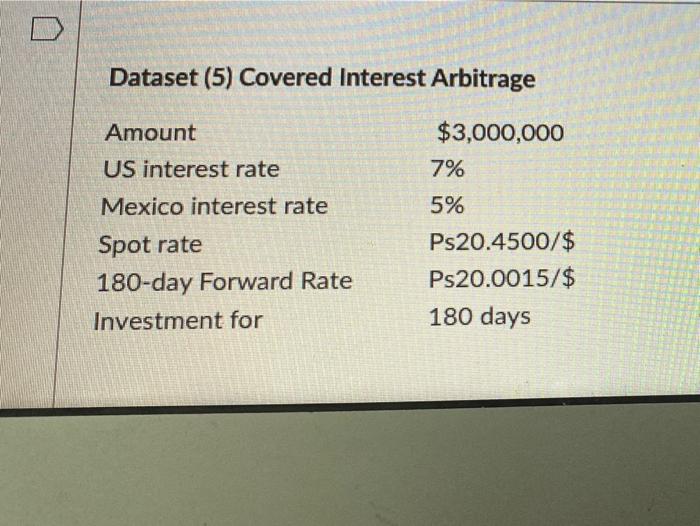

Question: Dataset (5) Covered Interest Arbitrage Amount $3,000,000 7% 5% US interest rate Mexico interest rate Spot rate 180-day Forward Rate Investment for Ps20.4500/$ Ps20.0015/$ 180

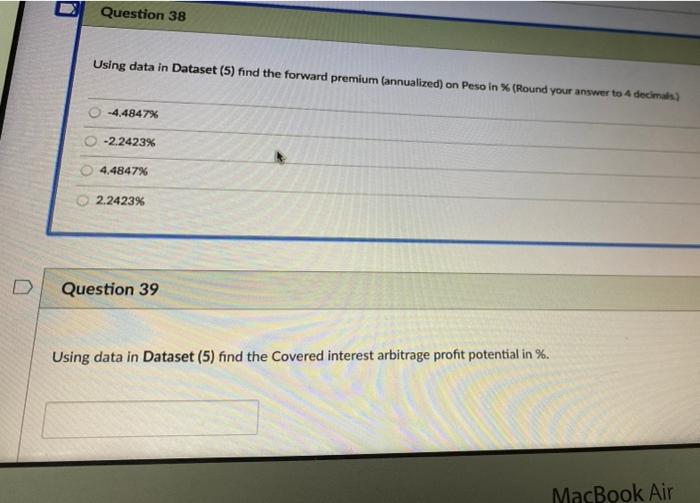

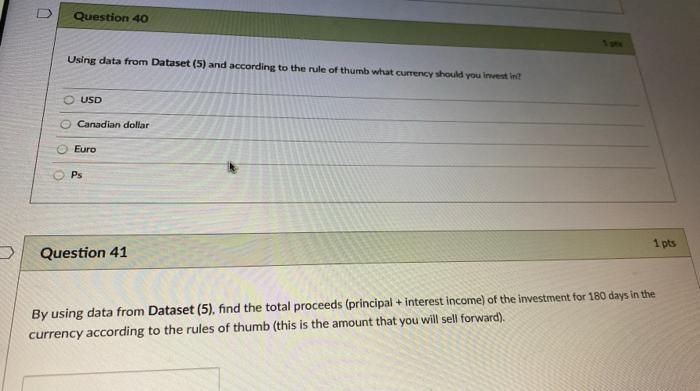

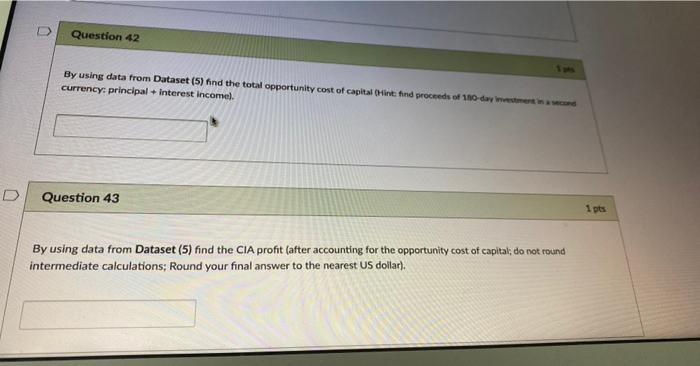

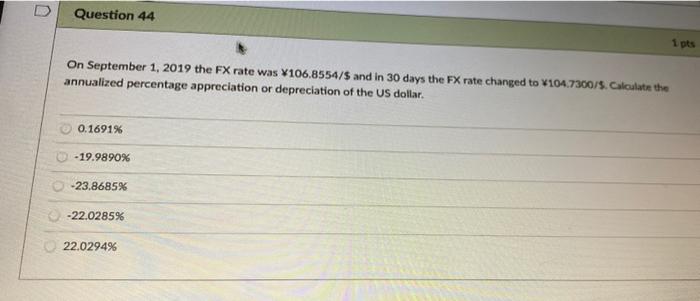

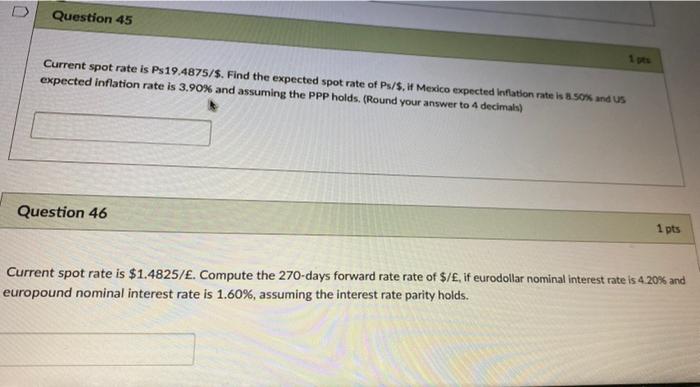

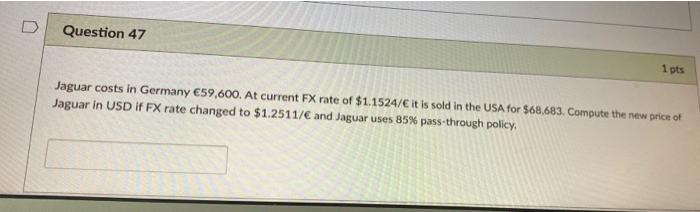

Dataset (5) Covered Interest Arbitrage Amount $3,000,000 7% 5% US interest rate Mexico interest rate Spot rate 180-day Forward Rate Investment for Ps20.4500/$ Ps20.0015/$ 180 days Question 38 Using data in Dataset (5) find the forward premium (annualized) on Peso in % (Round your answer to A decimals -4.4847% -2.2423% 4.4847% 2.2423% Question 39 Using data in Dataset (5) find the Covered interest arbitrage profit potential in %. MacBook Air U Question 40 Using data from Dataset (5) and according to the rule of thumb what currency should you invest in? USD Canadian dollar 0 Euro Ps 1 pts Question 41 By using data from Dataset (5), find the total proceeds (principal + interest income) of the investment for 180 days in the currency according to the rules of thumb (this is the amount that you will sell forward). Question 42 By using data from Dataset (5) find the total opportunity cost of capital in hind proceeds of 180 day in currency: principal + interest Incomel. Question 43 1 pts By using data from Dataset (5) find the CIA profit (after accounting for the opportunity cost of capital, do not round intermediate calculations; Round your final answer to the nearest US dollar). Question 44 1 pts On September 1, 2019 the FX rate was 106.8554/5 and in 30 days the FX rate changed to 104.7300/5. Calculate the annualized percentage appreciation or depreciation of the US dollar. 0.1691% - 19.9890% -23.8685% -22.0285% 22.0294% Question 45 Current spot rate is Ps19.4875/$. Find the expected spot rate of Ps/$. If Mexdco expected Inflation rate is and US expected inflation rate is 3.90% and assuming the PPP holds. (Round your answer to 4 decimals) Question 46 1 pts Current spot rate is $1.4825/. Compute the 270 days forward rate rate of $/, if eurodollar nominal interest rate is 4.20% and europound nominal interest rate is 1.60%, assuming the interest rate parity holds. Question 47 1 pts Jaguar costs in Germany 59,600. At current FX rate of $1.1524/ it is sold in the USA for $68,683. Compute the new price of Jaguar in USD if FX rate changed to $1.2511/ and Jaguar uses 85% pass through policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts