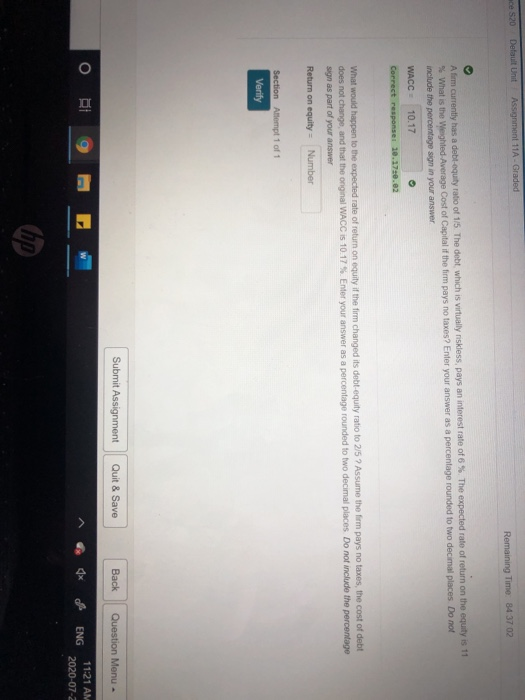

Question: Datault Unit Assignment 11A-Graded Remaining Time: 84 37 02 A firm currently has a debt-equity ratio of 115. The debt which is virtually riskless pays

Datault Unit Assignment 11A-Graded Remaining Time: 84 37 02 A firm currently has a debt-equity ratio of 115. The debt which is virtually riskless pays an interest rate of 6%. The expected rate of return on the equity is 11 % What is the weighted Average Cost of Capital if the firm pays no taxes? Enter your answer as a percentage rounded to two decimal places Do not include the percentage sign in your answer WACC 10.17 Correct responses 10.17 0.02 What would happen to the expected rate of return on equity if the firm changed its debt-equity ratio to 2/5 ? Assume the firm pays no taxes, the cost of debt does not change, and that the onginal WACC is 10.17%. Enter your answer as a percentage rounded to two decimal places. Do not include the percentage sign as part of your answer Return on equity Number Section Attempt 1 of 1 Verify Submit Assignment Quit & Save Back Question Menu ORD C ENG 11:21 AM 2020-07-2 hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts