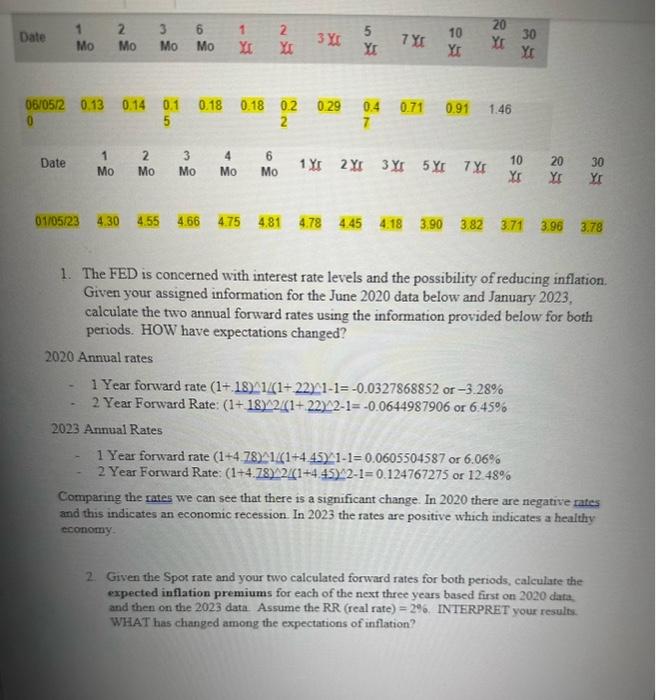

Question: Date 1 Mo 2 Mo 3 Mo 6 Mo 1 YE 3 3x 20 30 YI 06/05/2 0.13 0.14 0 0.1 5 0.18 0.18 02

Date

1

Mo

2

Mo

3

Mo

6

Mo

1

YE

3 3x

20

30

YI

06/05/2 0.13

0.14

0

0.1

5

0.18 0.18

02

2

0.29

0.4

0.71

0.91

7

1.46

Date

1

Mo

2

Mo

3

Mo

4

Mo

6

Mo

1Yr

2Yr 3Yr 5Yr 7Yr

10

Yr

20

Y

30

01/05/23

4.30

4.55

4.66

4.75

4.81

4.78

4.45

4.18

3.90

3.82

3.71

3.96

3.78

1. The FED is concerned with interest rate levels and the possibility of reducing inflation Given your assigned information for the June 2020 data below and January 2023, calculate the two annual forward rates using the information provided below for both periods. HOW have expectations changed?

2020 Annual rates

- Year forward rate (1+ 18)11/1+22)41-1=-0.0327868852 or -3.28%

- Year Forward Rate: (1+18)124(1+ 22)12-1=-0.0644987906 or 6.45%

2023 Annual Rates

- Year forward rate (1+4.78)^1/1+4.45)11-1=0.0605504587 or 6.06%

- Year Forward Rate: (1+4.78)124(1+4.45)12-1=0.124767275 or 12.48%

Comparing the rates we can see that there is a significant change. In 2020 there are negative rates and this indicates an economic recession. In 2023 the rates are positive which indicates a healthy economy.

2. Given the Spot rate and your two calculated forward rates for both periods, calculate the expected inflation premiums for each of the next three years based first on 2020 data, and then on the 2023 data. Assume the RR (real rate) = 2%. INTERPRET your results. WHAT has changed among the expectations of inflation?

2. Given the Spot rate and your two calculated forward rates for both periods, calculate the expected inflation premiums for each of the next three years based first on 2020 data. and then on the 2023 data. Assume the RR (real rate) =2%. INTERPRET your results. WHAT has changed among the expectations of inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts