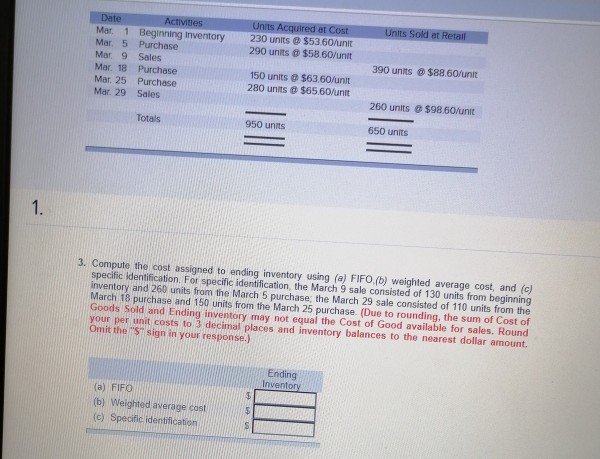

Question: Date Activities Mar 1 Beginning inventory Mar 5 Purchase Mar. 9 Sales Mar 18 Purchase Mar. 25 Purchase Mar. 29 Sales Units Acquired at Cost

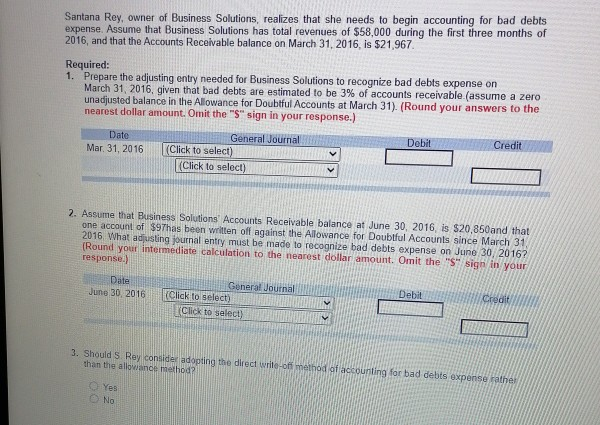

Date Activities Mar 1 Beginning inventory Mar 5 Purchase Mar. 9 Sales Mar 18 Purchase Mar. 25 Purchase Mar. 29 Sales Units Acquired at Cost 230 units $53.60/unit 290 units $58 60/unit Units Sold at Retail 390 units $88.60/unit 150 units @ $63 60/unit 280 units $65.60/unit 260 units $98.60/unit Totals 950 units 650 units 1. 3. Compute the cost assigned to ending inventory using (a) FIFO (b) weighted average cost, and (c) specific Identification. For specific identification, the March 9 sale consisted of 130 units from beginning inventory and 260 units from the March 5 purchase, the March 29 sale consisted of 110 units from the March 18 purchase and 150 units from the March 25 purchase. (Due to rounding, the sum of Cost of Goods Sold and Ending inventory may not equal the Cost of Good available for sales. Round your per unit costs to 3 decimal places and inventory balances to the nearest dollar amount. Omit the "S sign in your response.) Ending Inventory (a) FIFO (b) Weighted average cost (c) Speciflc identification Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $58,000 during the first three months of 2016, and that the Accounts Receivable balance on March 31, 2016, is $21,967 Required: 1. Prepare the adjusting entry needed for Business Solutions to recognize bad debts expense on March 31, 2016, given that bad debts are estimated to be 3% of accounts receivable (assume a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31). (Round your answers to the nearest dollar amount. Omit the "S" sign in your response.) Date General Journal Debit Credit Mar 31, 2016 (Click to select (Click to select) 2. Assume that Business Solutions Accounts Receivable balance at June 30, 2016, is $20,850and that one account of $9Thas been written off against the Allowance for Doubtful Accounts since March 31 2016 What adjusting journal entry must be made to recognize bad debts expense on June 30, 2016? (Round your intermediate calculation to the nearest dollar amount. Omit the "S" sign in your response Date June 30, 2016 General Journal Click to selecti Click to select) Debit Credit 3. Should S Rey consideradopting the direct write-of method of accounting for bad debts expense rather than the allowance method? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts