Question: Date: ame: The second section worth 70 points. (The section is open book and notes) Photochronograph Corporation (PC), a large and fast growing publicly traded

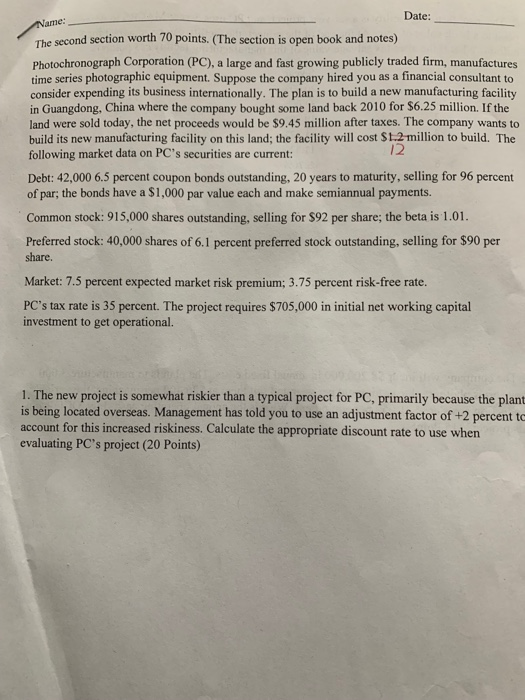

Date: ame: The second section worth 70 points. (The section is open book and notes) Photochronograph Corporation (PC), a large and fast growing publicly traded firm, manufactures time series photographic equipment. Suppose the company hired you as a financial consultant to consider expending its business internationally. The plan is to build a new manufacturing facility in Guangdong, China where the company bought some land back 2010 for $6.25 million. If the land were sold today, the net proceeds would be $9.45 million after taxes. The company wants to build its new manufacturing facility on this land; the facility will cost $1.2 million to build. The following market data on PC's securities are current: 12 Debt: 42,000 6.5 percent coupon bonds outstanding, 20 years to maturity, selling for 96 percent of par; the bonds have a $1,000 par value each and make semiannual payments Common stock: 915,000 shares outstanding, selling for $92 per share; the beta is 1.01. Preferred stock: 40,000 shares of 6.1 percent preferred stock outstanding, selling for $90 per share. Market: 7.5 percent expected market risk premium; 3.75 percent risk-free rate. PC's tax rate is 35 percent. The project requires $705,000 in initial net working capital investment to get operational. 1. The new project is somewhat riskier than a typical project for PC, primarily because the plant is being located overseas. Management has told you to use an adjustment factor of +2 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating PC's project (20 Points) BA 404 4. What is the NPV of this project? What is the project's IRR? (5 points/question) 5. You feel that both sales and fixed costs are accurate to +l-5 percent. What are the NPVs and IRRs of this project for both the best and the worst-case scenarios? (20 Points) Date: ame: The second section worth 70 points. (The section is open book and notes) Photochronograph Corporation (PC), a large and fast growing publicly traded firm, manufactures time series photographic equipment. Suppose the company hired you as a financial consultant to consider expending its business internationally. The plan is to build a new manufacturing facility in Guangdong, China where the company bought some land back 2010 for $6.25 million. If the land were sold today, the net proceeds would be $9.45 million after taxes. The company wants to build its new manufacturing facility on this land; the facility will cost $1.2 million to build. The following market data on PC's securities are current: 12 Debt: 42,000 6.5 percent coupon bonds outstanding, 20 years to maturity, selling for 96 percent of par; the bonds have a $1,000 par value each and make semiannual payments Common stock: 915,000 shares outstanding, selling for $92 per share; the beta is 1.01. Preferred stock: 40,000 shares of 6.1 percent preferred stock outstanding, selling for $90 per share. Market: 7.5 percent expected market risk premium; 3.75 percent risk-free rate. PC's tax rate is 35 percent. The project requires $705,000 in initial net working capital investment to get operational. 1. The new project is somewhat riskier than a typical project for PC, primarily because the plant is being located overseas. Management has told you to use an adjustment factor of +2 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating PC's project (20 Points) BA 404 4. What is the NPV of this project? What is the project's IRR? (5 points/question) 5. You feel that both sales and fixed costs are accurate to +l-5 percent. What are the NPVs and IRRs of this project for both the best and the worst-case scenarios? (20 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts