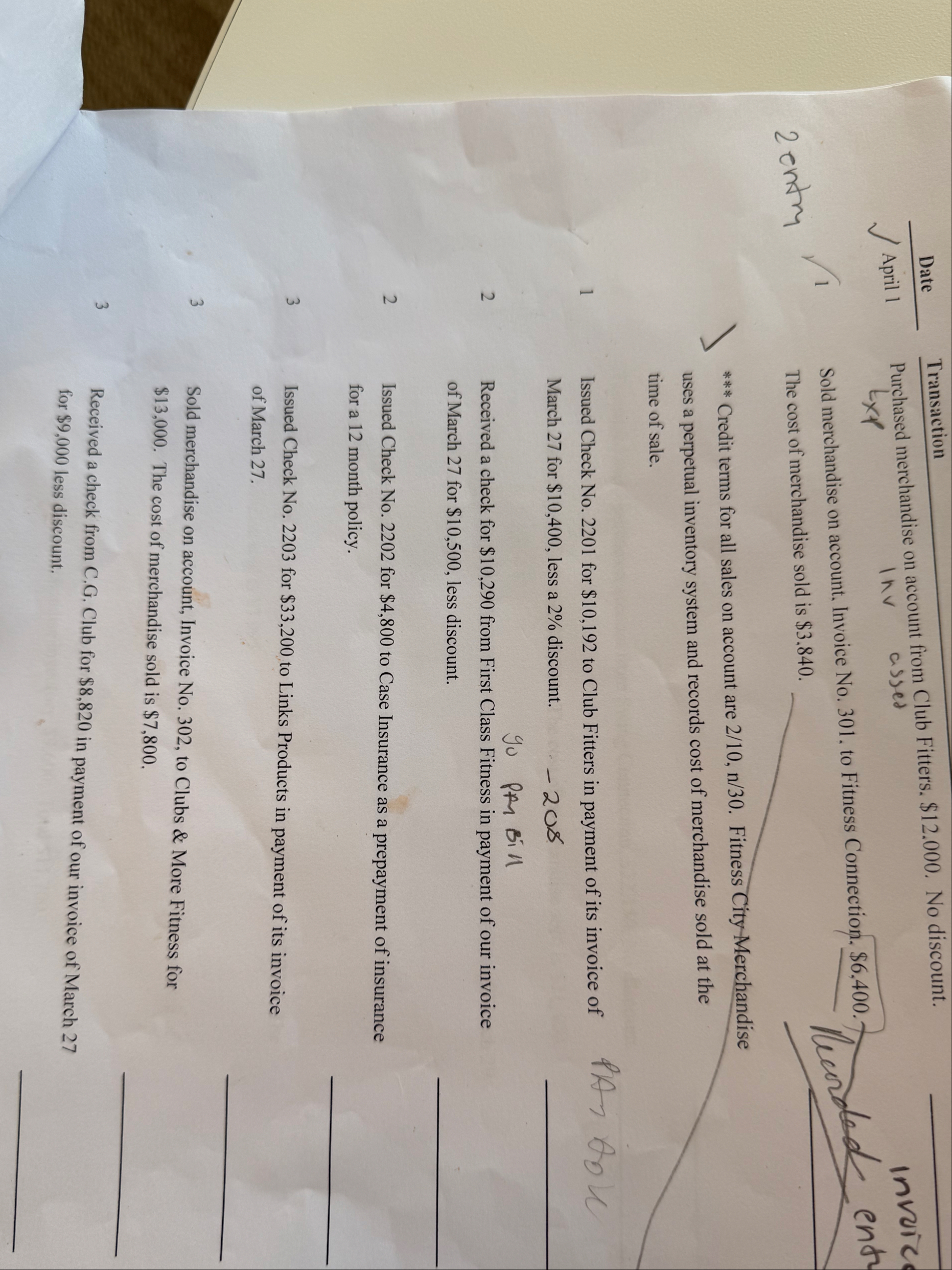

Question: Date April 1 1 2 entry J ? 2 Transaction Purchased merchandise on account from Club Fitters. $ 1 2 . 0 0 0 .

Date

April

entry

J

Transaction

Purchased merchandise on account from Club Fitters. $ No discount. tep Inv assed

Sold merchandise on account. Invoice No to Fitness Connection. $ The cost of merchandise sold is $

Issued Check No for $ to Club Fitters in payment of its invoice of March for $ less a discount.

go presill

Received a check for $ from First Class Fitness in payment of our invoice of March for $ less discount.

Issued Check No for $ to Case Insurance as a prepayment of insurance for a month policy.

Issued Check No for $ to Links Products in payment of its invoice of March

Sold merchandise on account, Invoice No to Clubs & More Fitness for $ The cost of merchandise sold is $

Received a check from CG Club for $ in payment of our invoice of March for $ less discount.

Issued Check No for $ to Royal Fitness in payment of their invoice of March

Received a check for $ from My Fitness Shop in payment of our invoice of March for $ less discount.

Sold merchandise on account, Invoice No to Pure Fitness, $ The cost of merchandise sold is $

Purchased merchandise on account from Swing Connection, $ No discount.

Cash sales for April were $ The cost of merchandise sold is $

Received a check for $ from Pure Fitness in payment of our invoice of March for $ less discount.

Purchased merchandise on account from Fitness Equipment Products, $ terms

Sold merchandise on account, Invoice No to My Fitness Shop, $ The cost of merchandise sold is $

Received a check for $ from King Fitness Club in payment of our invoice of March for $ less discount.

Purchased the following on account from Links Products: display charge to Store Supplies $; merchandise inventory, $; Total $

Issued Credit Memorandum No to My Fitness Shop for merchandise returned on Invoice No of April $ The cost of merchandise sold is $

Issued Check No for $ to Michael Davis for customer entertainment charge to Miscellaneous Selling Expense

Sold merchandise on account, Invoice No to Fitness House, Inc., $ The cost of merchandise sold is $

Received Credit Memorandum No from Fitness Equipment Products for merchandise returned, $

Received a check for $ from Eastwood Supply for return of store supplies that were originally purchased for cash.

Received a check for $ from Fitness Connection in payment of Invoice No for $ less discount.

Received a check for $ from Clubs & More in payment of Invoice No for $ less discount.

Issued Check No for $ to Payroll for biweekly salaries: sales salaries $; office salaries $

Cash sales for April were $ The cost of merchandise sold is $

Received a check for $ from Pure Fitness in payment of Invoice No for $ less discount.

Purchased the following items on account from Club Fitters: merchandise inventory $; miscellaneous selling expenses display cases $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock