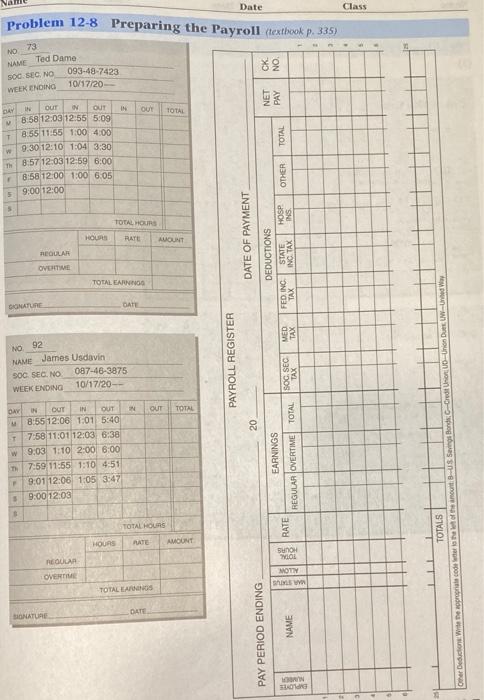

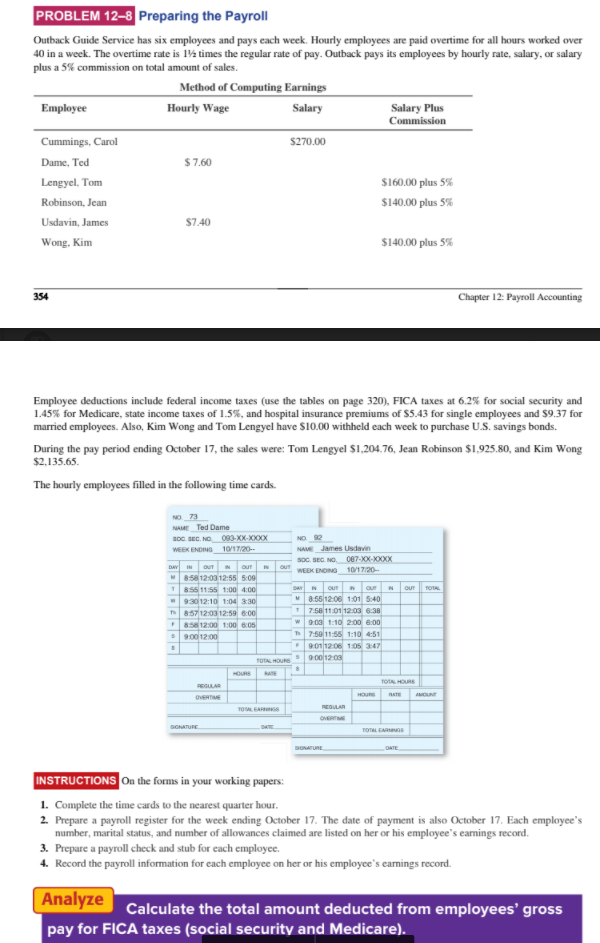

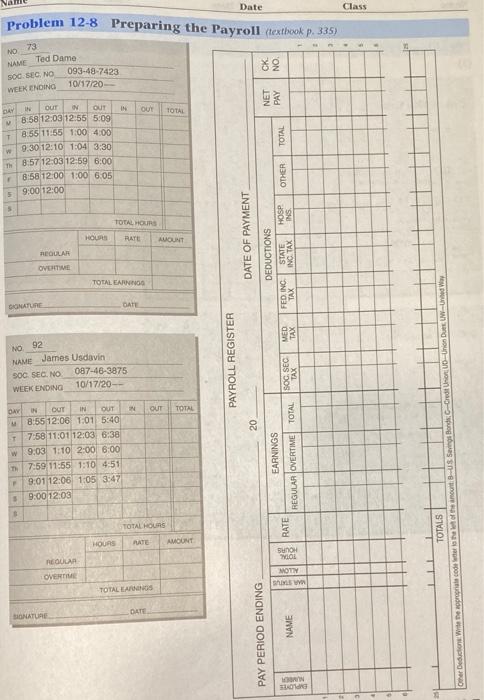

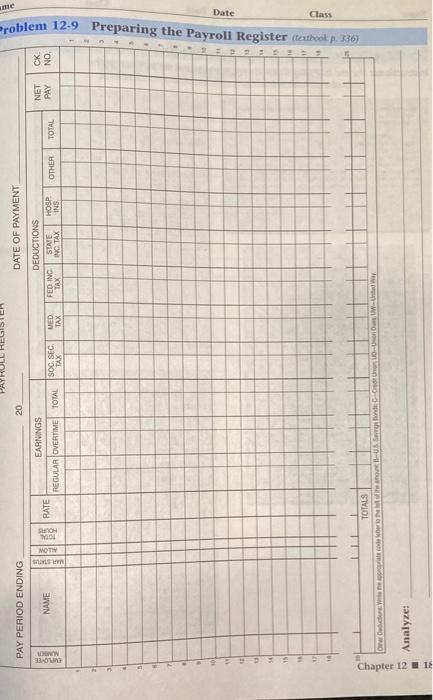

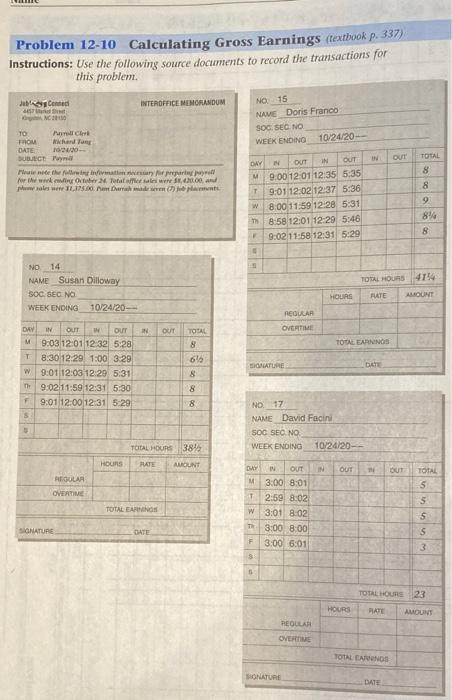

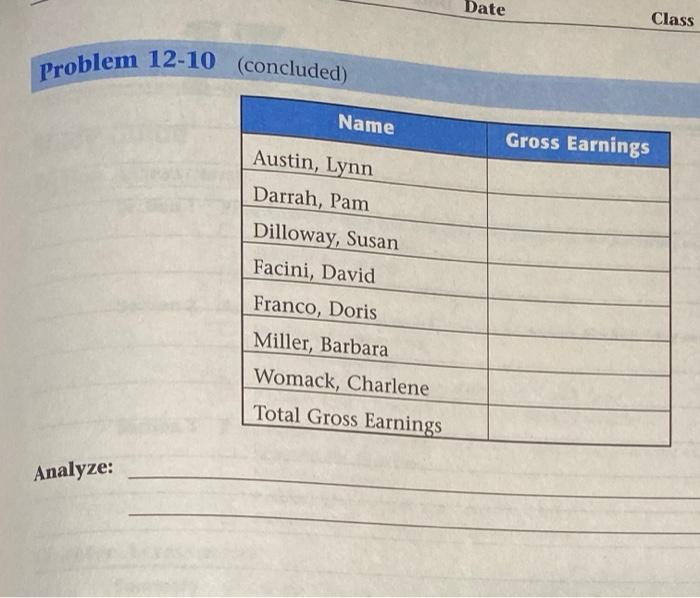

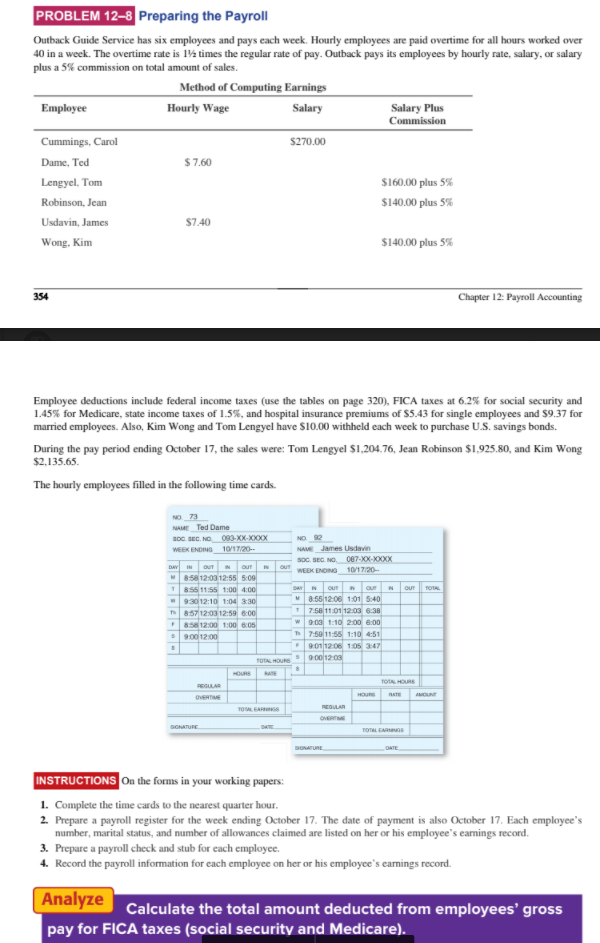

Question: Date Class Problem 12-8 Preparing the Payroll (textbook p. 335) NO 73 NAME Ted Dame SOC. SEC. NO WEEK ENDING CK NO 093-48-7423 10/17/20 NET

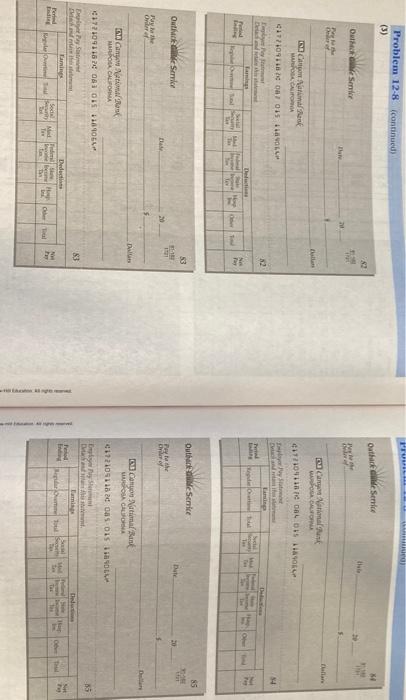

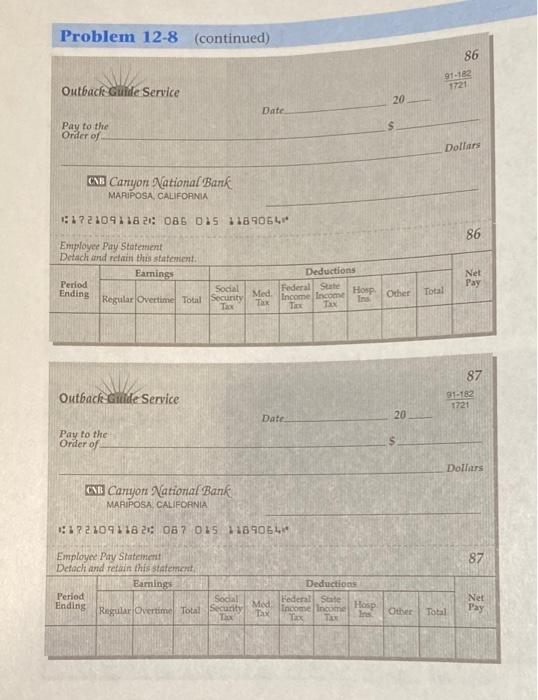

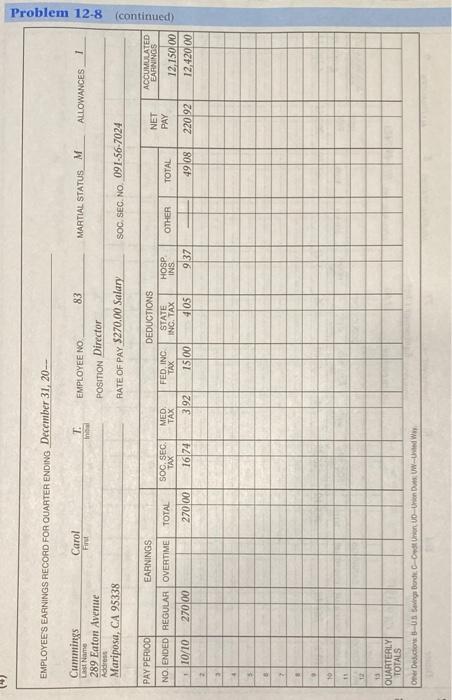

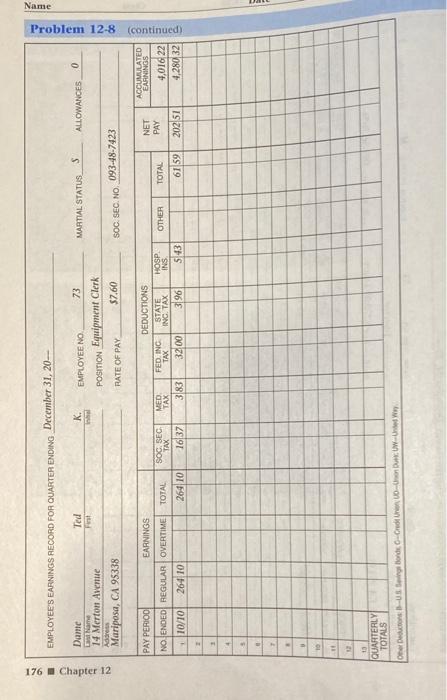

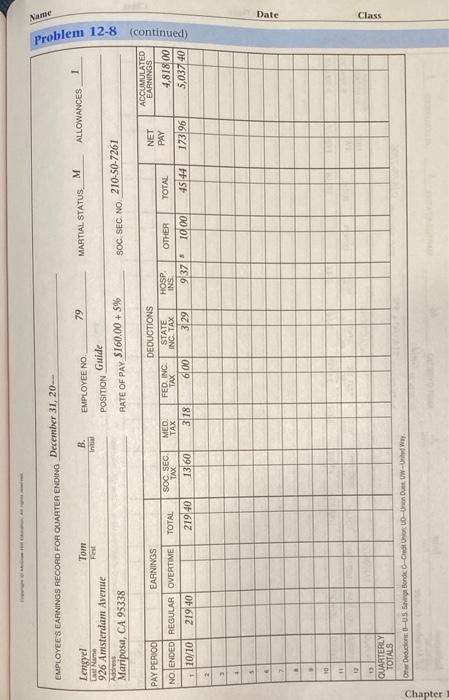

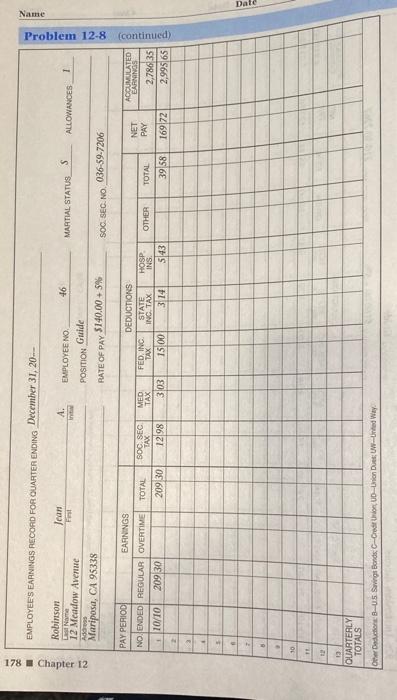

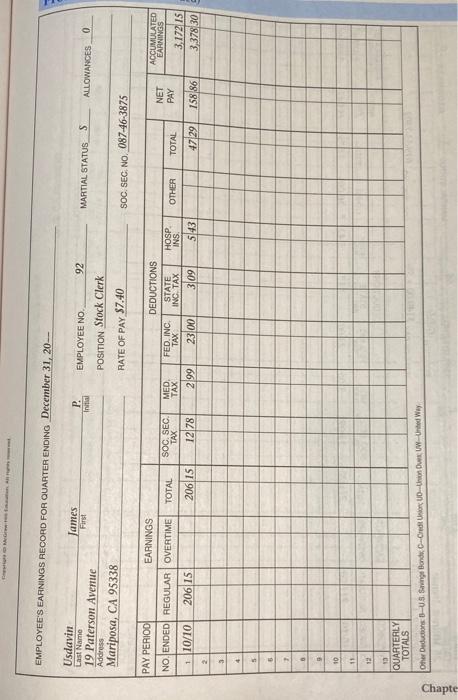

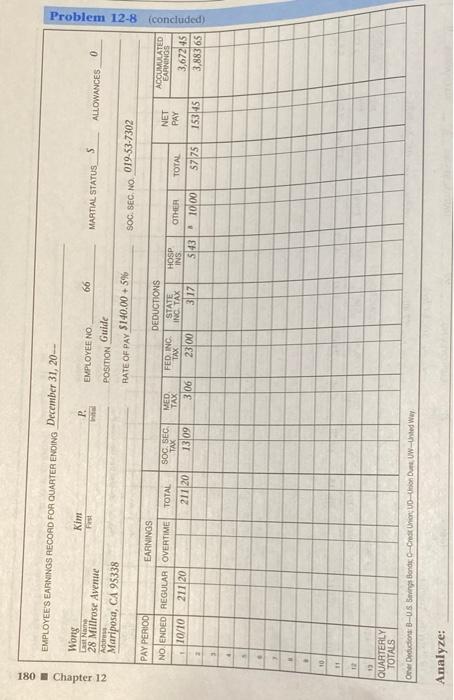

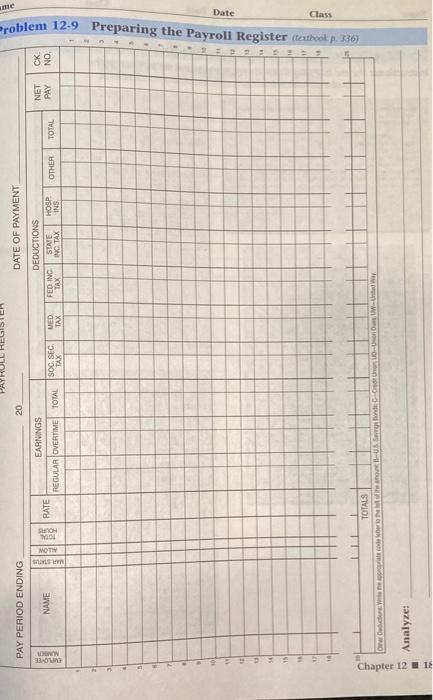

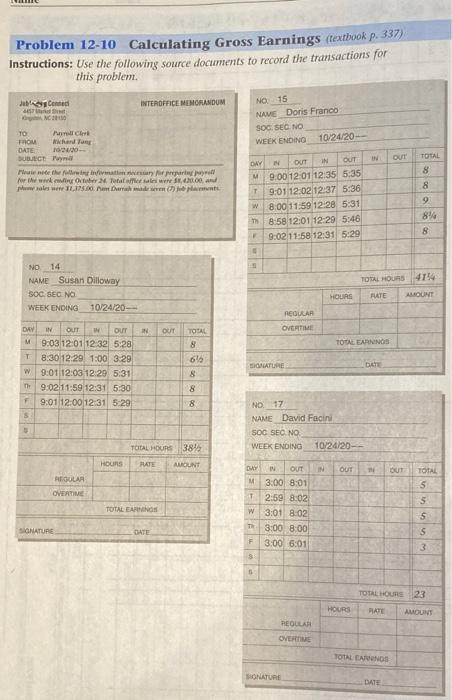

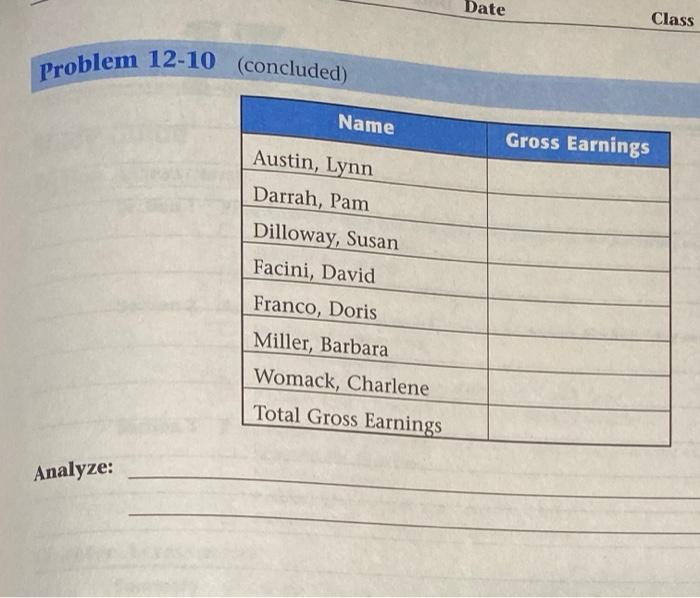

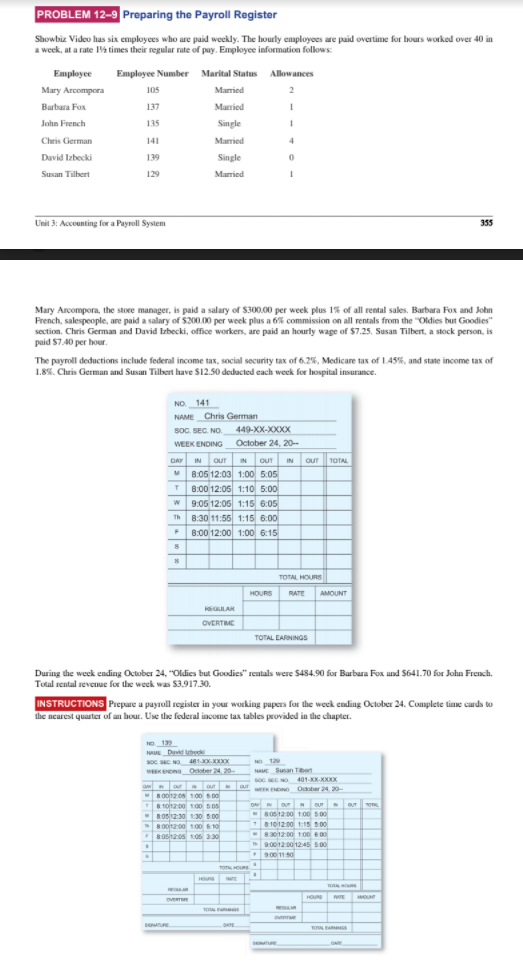

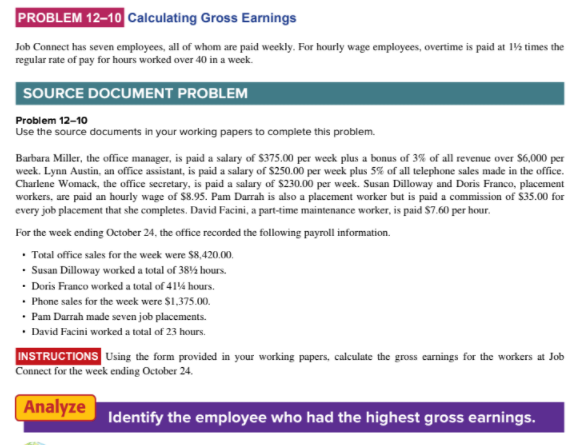

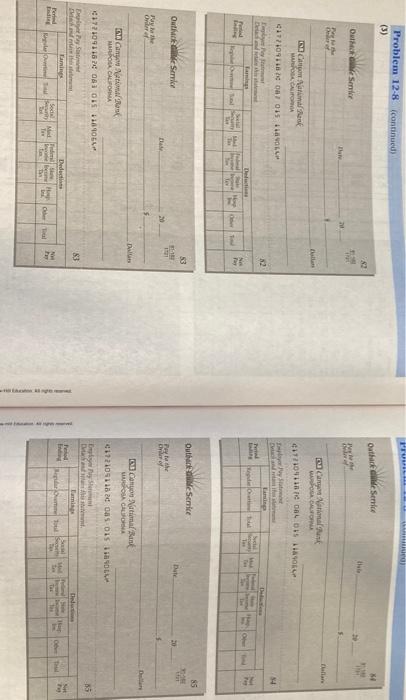

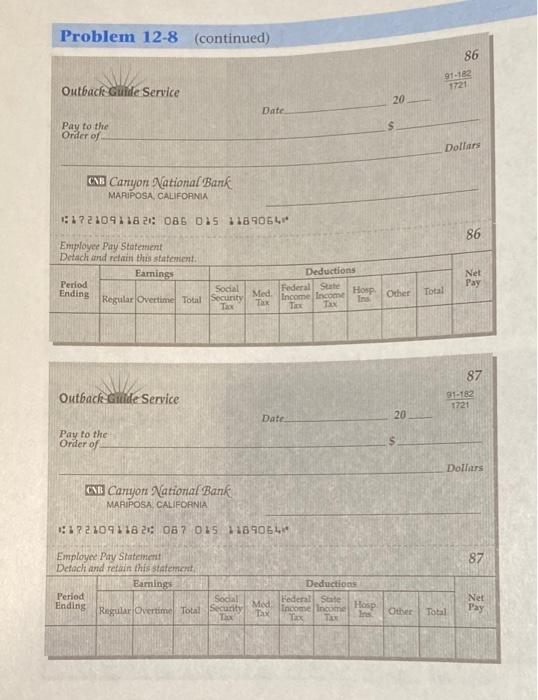

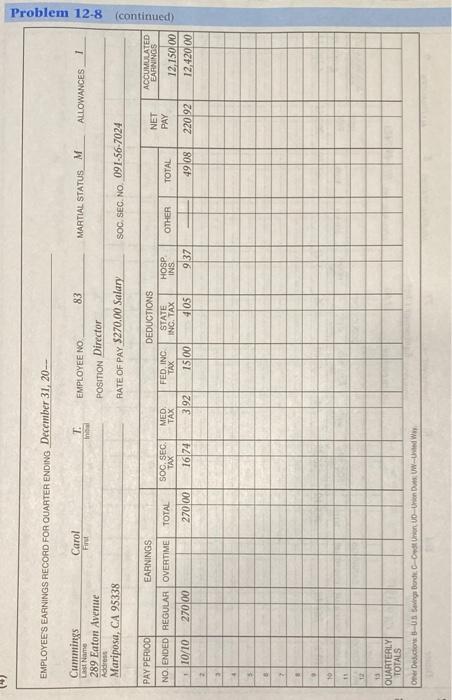

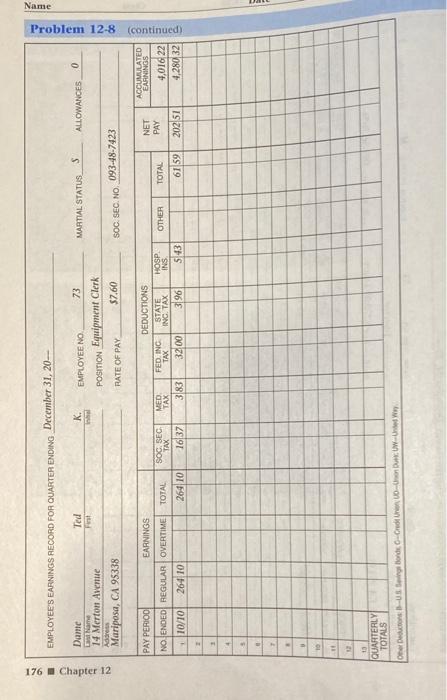

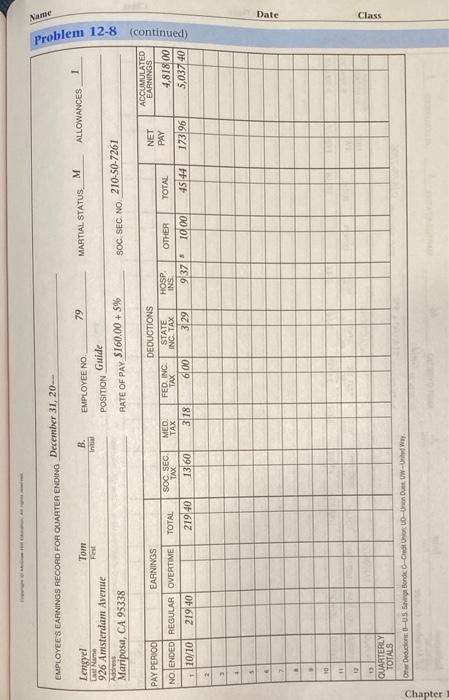

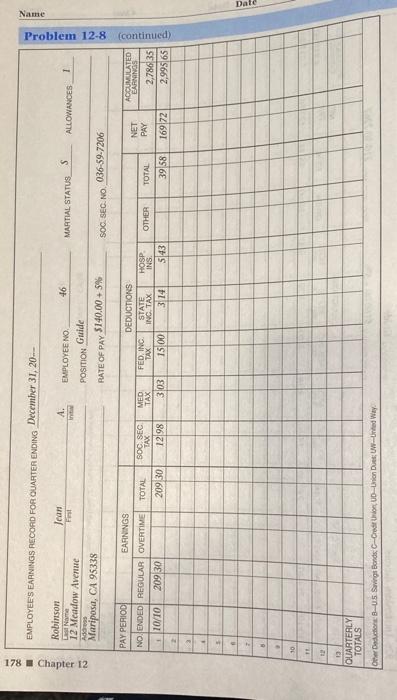

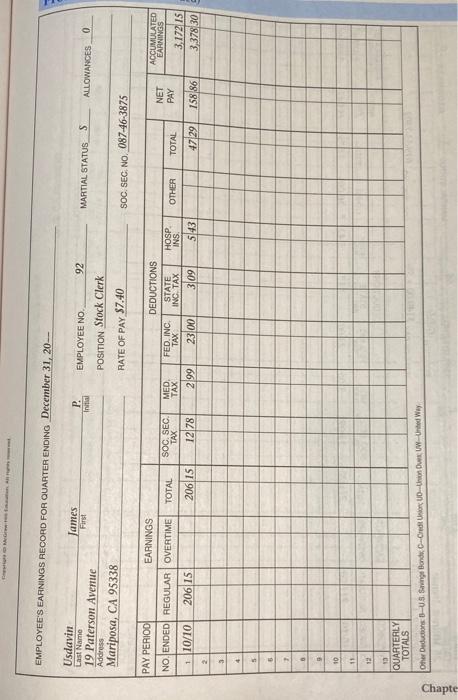

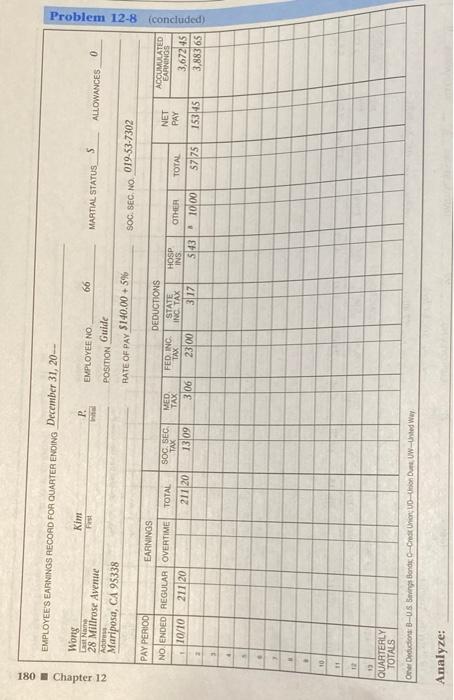

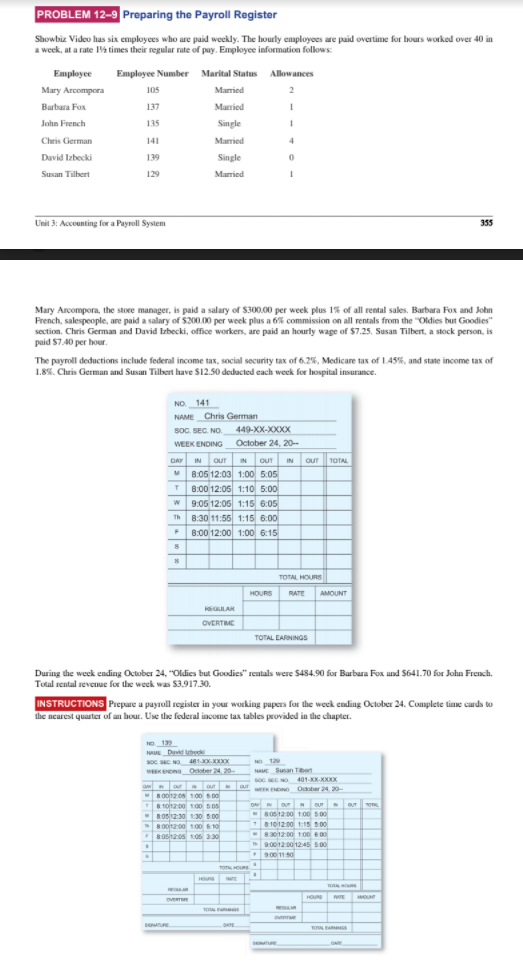

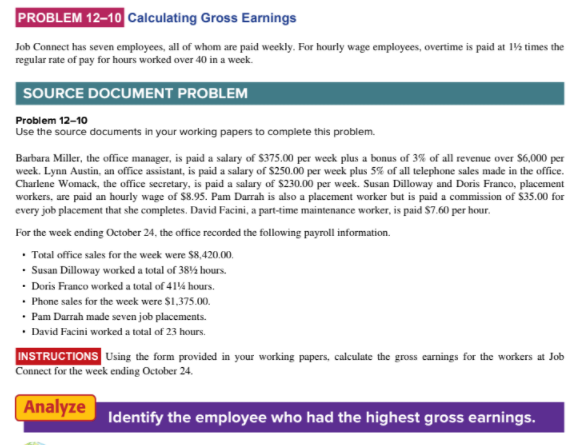

Date Class Problem 12-8 Preparing the Payroll (textbook p. 335) NO 73 NAME Ted Dame SOC. SEC. NO WEEK ENDING CK NO 093-48-7423 10/17/20 NET PAY OUT TOTAL TOTAL DUT OUT 8:58 12:03 12:55 5:09 18:55 11:55 1:00 4:00 w 9:30 12:10 1:04 3:30 8.5712:03 12:59 6:00 8:58 12:00 1:00 6.05 9:00 12:00 OTHER TOTAL HOURS RATE AUOUNT HOUS DATE OF PAYMENT REGULAR OVERTIME HOSP DEDUCTIONS STATE INC TAX FED, INC TAX TOTAL EARNING DIGNATURE DATE TAX No 92 NAE James Usdavin SOC SEC.NO 087-48-3875 WEEK ENDING 10/17/20 PAYROLL REGISTER SOC. SEC TAX OUT TOTAL bar OUT IN OUT 8:55 12:06 1:01 5:40 7:58 11:01 12:03 6:38 w 9.03 1:10 2:00 6:00 7:59 11:55 1:10 4:51 9:01 12:06 1:05 3:47 9:00 12:03 20 motus Savings Bonds: C-Credit Union: D-Union De EARNINGS REGULAR OVERTIME TOTAL TOTAL HOURS TOTALS HOURS PATE AMOUNT BRATE REGULAR OVERTE MOTY SU TOTAL LAOS BIONATURE DATE PAY PERIOD ENDING NAME Other Deduction with the world code ON SONG Problem 12-8 continued) (3) Outbace Serie ht Hi De Service Than 0 Comek CALIFORNIA 01771091107015 VOL a Canyon National Park OG DAF 17710984 DISKA yet 14 2 La Svil De LIMINE Tas Pay Outback Service 53 BE Outive Service Date 20 ta Peyto the Cho ye Orie Di DAG CN Canon MARO CALIFORMA Canyon National in ROSA CASA 1721091 085 015 1721091182 081 085 0 ley DS MWING 83 Lumia Tarnings Deduct po Per ding Social TE Med Te DO Problem 12-8 (continued) 86 97-182 1721 Outback Guide Service 20 Date Pay to the S Order of Dollars CNB Cartyor National Bank MARIPOSA CALIFORNIA 317210918 20: 086 015 1189054 86 Employee Pay Statement Detach and retain this statement Earnings Period Ending Regular Overtime Total Nel Pay Sadal Security Tax Med Tax Deductions Federal State Income Income Hosp TE TIX Total Other 87 Outback-Guide Service 1721 Date 20 Pay to the Order of Dollars CNB Canyon National Bank MARIPOSA CALIFORNIA 1:17210911820 087 015118 9054 87 Employee Pay Slateret Detach and retain this statement Earning Period Ending Regular Overtime Total Deductions Federal Site Income income Hosp Tax Tax Ins Soda Security Mind TIN Tax Net Other Total Total EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20- Carol First 11 Ini MARTIAL STATUS M ALLOWANCES 1 Cummings Last Name 289 Eaton Avenue Address Mariposa, CA 95338 EMPLOYEE NO 83 POSITION Director RATE OF PAY $270.00 Salary Problem 12-8 (continued) SOC. SEC. NO. 091-56-7024 PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME ACCUMULATED EARNINGS NET PAY TOTAL SOC. SEC. TAX 16 74 DEDUCTIONS FED.INC STATE TAX ING. TAX 15.00 4105 OTHER MED TAX 392 HOSP INS 937 TOTAL 49.08 10/10 270.00 12.150.00 12,420 00 27000 220 92 10 11 1 13 QUARTERLY TOTALS On Deduction - Saving Bord Onion 00- Cins: W- UW Name EMPLOYEE'S EARNINGS RECORD FOR QUARTER ENDING December 31, 20- 176 Chapter 12 Ted K. MARTIAL STATUS S ALLOWANCES 0 Dame Name 14 Merton Avenue Adres Mariposa, CA 95338 EMPLOYEE NO 73 POSITION Equipment Clerk $7.60 PATE OF PAY SOC. SEC. NO. 093-48-7423 Problem 12-8 (continued) ACCUMULATED EARNINGS NET PAY PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 26410 SOC. SEC TAX DEDUCTIONS FED, INC STATE TAX INC. TAX 32 00 396 TOTAL 264 10 OTHER TOTAL MED TAX 383 HOSP INS 5143 4,016 22 4,280 32 1637 61 59 20251 I 1 10 13 QUARTERLY TOTALS Deco -Crowe de EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20 Tom 79 M MARTIAL STATUS ALLOWANCES B. Initial EMPLOYEE NO Lengyel Last Nam 926 Amsterdam Avenue ADOS Mariposa, CA 95338 POSITION Gulde RATE OF PAY $160.00 + 5% SOC. SEC. NO. 210-50-7261 Problem 12-8 (continued) NET PAY PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 219,40 HOSP INS DEDUCTIONS FED INC STATE TAX INC TAX 600 329 SOC SEC TAX 13.60 MED TAX 318 TOTAL 219 40 OTHER ACCUMULATED EARNINGS 4,818 00 5,03740 937 TOTAL 45 44 1000 17396 Date 10 11 12 Class 3 QUARTERLY TOTALS O Deduction Bonde - UD- Usuw-Way Chapter EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20-- Name 178 Chapter 12 Jean Ft A. In MARTIAL STATUS S ALLOWANCES 1 Robinson Nam 12 Meadow Avenue MOS Mariposa, CA 95338 EMPLOYEE NO 46 POSITION Guide RATE OF PAY $140.00 + 5% SOC. SEC. NO. 036-59-7206 Problem 12-8 continued) PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 209 30 MED SOC. SEC TAX 1298 TOTAL 209 30 OTHER DEDUCTIONS FED, INC STATE TAX INC. TAX 15.00 314 TAX 3103 HOSP INS 543 NET TOTAL PAY 39 58 169 72 ACCUMULATED EARANAS 2,78635 2,99565 10/10 2 > . 8 10 TE 13 QUARTERLY TOTALS Other Deduction B-05 Sage Bonds C-Credit Union UD-U Dew-United Way EMPLOYEE'S EARNINGS RECORD FOR QUARTER ENDING December 31, 20-- James First P. Initial MARTIAL STATUSS Usdavin Last Name 19 Paterson Avenue Address Mariposa, CA 95338 ALLOWANCES 0 EMPLOYEE NO 92 POSITION Stock Clerk RATE OF PAY $7.40 SOC. SEG. NO. 087-46-3875 PAY PERIOD EARNINGS NO, ENDED REGULAR OVERTIME TOTAL MED TAX SOC. SEC. TAX 1278 DEDUCTIONS FED. INC STATE TAX INC TAX 23.00 HOSP NET PAY INS. OTHER TOTAL ACCUMULATED EARNINGS 3,17215 3,378 30 1. 10/10 20615 206 15 299 309 543 4729 158 86 2 3 4 5 9 10 12 13 QUARTERLY TOTALS Oh Deduction -US. Savings Bond C-Credit Unior UDOUW. Und Wey Chapte EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20- 180 Chapter 12 Kim P. 66 S Wong Nam 28 Millrose Avenue Mariposa, CA 95338 MARTIAL STATUS EMPLOYEE NO POSITION Guide ALLOWANCES Ad 0 RATE OF PAY $140.00 + 5% SOC. SEC. NO 019-53-7302 Problem 12-8 (concluded) PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 211 20 TOTAL 211 20 SOC. SEC TAX 1309 MED TAX 306 DEDUCTIONS FED, INC STATE TAX INCI TAX 2300 317 HOSP INS OTHER 5143 1000 NET TOTAL PAY 57 75 153,45 ACCUMULATED EARNINGS 3,672 45 3,88365 1 10 11 12 QUARTERLY TOTALS One Deduction: B-US Singsonde --Credit Union UD-DU-Unted Way Analyze: AY PAY PERIOD ENDING 20 SALS MOTIV DATE OF PAYMENT DEDUCTIONS FED INC STATE HOSP TAX INC TAX INS OTHER EARNINGS PATE REGULAR OVERTIME NAME NET PAY . NO TOTAL SOC. SEC TAX TOTAL TAX Problem 129 Preparing the Payroll Register toutbook p.330) NO Date 15 1 Class TOTALS LUSSOU ODW Chapter 121 Analyze: Problem 12-10 Calculating Gross Earnings (textbook p. 337) Instructions: Use the following source documents to record the transactions for this problem. Jake Comed 4 INTEROFFICE MEMORANDUM NO 15 NAME Doris Franco SOC SEC.NO WEEK ENDNO 10/24/20 OUT TO TO PC Tone DATE 109 SUBJECT und Mou nee the private par for the week in October 26 Totalitate 20.00 www.Draw() IN 8 8 DAY N OUT OUT M 9.00 12.01 12:35 5:35 T 9:01 12:02 12:37 5:36 w 8.00 11:59 12:28 5:31 Th 8:58 12:01 12:29 5:46 9:02 11:58 12:31 5:29 9 8% 8 TOTAL HOURS NO 14 NAME Susan Dilloway SOC. SEC NO WEEK ENDING 10/24/20 - HOURS FATE AMOUNT REDRAR OUT OVERTIME TOTAL EARUNOS DAY IN OUT OUT 9:03 12:01 12:32 5:28 8:30 12:29 1:00 3.29 W 9:01 12:03 12:29 5:31 9:02 11:59 12:31 5:30 F 9:01 12:00 12:31 5:29 3-5 TOTAL 8 61 8 8 8 SIGNATURE DATE . NO. 17 NAME David Facini SOC SEC NO WEEK ENDING 10/24/20 - TOTAL HOURS 38 RATE AMOUNT HOURS IN IN OUT OUT REGULAR M OVERTIME HT TOTAL 5 3 5 OUT 3:00) 8:01 2:59 8:02 3:01 8.02 3:00 8:00 3:00 6:01 TOTAL BANOS w SIGNATURE DATE 5 F 3 3 TOTAL HOURS 23 HOURS PLATE AMOUNT REOLLAR OVERTIME TOTAL ANONS SONATURE DATE Date Class Problem 12-10 (concluded) Name Gross Earnings Austin, Lynn Darrah, Pam Dilloway, Susan Facini, David Franco, Doris Miller, Barbara Womack, Charlene Total Gross Earnings Analyze: PROBLEM 128 Preparing the Payroll Outback Guide Service has six employees and pays each week. Hourly employees are paid overtime for all hours worked over 40 in a week. The overtime rate is 11 times the regular rate of pay. Outback pays its employees by hourly rate, salary, or salary plus a 5% commission on total amount of sales. Method of Computing Earnings Employee Hourly Wage Salary Salary Plus Commission Cummings, Carol $270.00 Dame, Ted $ 7.60 Lengyel, Tom $160.00 plus 5% Robinson, Jean $140.00 plus 5% Usdavin, James Wong, Kim $140.00 plus 5% $7.40 354 Chapter 12: Payroll Accounting Employee deductions include federal income taxes (use the tables on page 320), FICA taxes at 6.2% for social security and 1.45% for Medicare, state income taxes of 1.5%, and hospital insurance premiums of $5.43 for single employees and $9.37 for married employees. Also, Kim Wong and Tom Lengyel have $10.00 withheld cach week to purchase U.S. savings bonds. During the pay period ending October 17, the sales were: Tom Lengyel $1,204.76, Jean Robinson $1,925.80, and Kim Wong $2,135.65 The hourly employees filled in the following time cards. NO 73 NE Ted Dame BOC SECNO 03-XX-XXXX WEEKENDNO 10/17/20 NAVE James Usdevin SOC. SECO087-XX-XXXX WEEKENING 10/17/20 OUT N OUT TOTAL DAV GUT OUT 8.58 12:03 12:55 5:09 18:55 11:55 1:004:00 930 12:10 1:04 3:30 8:57 12:03 12:59 6.00 8.58 12:00 1:00 6:05 9.00 12:00 T w OUT 8:55 12:06 1:01 5:40 7:58 11:01 12:03 6:38 9.00 1:10 2:00 6:00 7:50 11:55 1:10 4:51 9:01 12:06 1:05 3:47 9:00 12:00 TOTAL HOURS HOURS TOTAL HOURS REGULAR OVERTIM TE TOMER ROLAR SIGNATURE TOTALCAR SONATURE DATE INSTRUCTIONS On the forms in your working papers: 1. Complete the time cards to the nearest quarter hour. 2. Prepare a payroll register for the week ending October 17. The date of payment is also October 17. Each employee's number, marital status, and number of allowances claimed are listed on her or his employee's earnings record. 3. Prepare a payroll check and stub for each employee. 4. Record the payroll information for each employee on her or his employee's earnings record. Analyze Calculate the total amount deducted from employees' gross pay for FICA taxes (social security and Medicare). PROBLEM 12-9 Preparing the Payroll Register Showbiz Video has six employees who are paid weekly. The hourly employees are paid overtime for hours worked over 40 in a week, at a rate 19 times their regular nute of pay. Employee information follows: 1 Employee Mary Arcopera Barbara Fox John French Chris German David lubecki Employee Number Marital Status Allowances 105 Married 137 Married 135 Single 141 Married 4 139 Single 129 Married 1 1 Susan Tilbert Unit 3: Accounting for a Payroll System 3a 355 Mary Arcompora, the store manager, is paid a salary of $300.00 per week plus 1% of all rental sales, Barbara Fox and John French, salespeople, are paid a salary of $200.00 per week plus a 6% commission on all rentals from the "Oldies but Goodies section. Chris German and David Irbecki, office workers are paid an hourly wage of $7.25. Susan Tilbert, a stock person.is paid 57.40 per hour The payroll deductions include federal income tax, social security tax of 6.2%, Medicare tax of 1.45%, and state income tax of 1.8%. Chris German and Susan Tilbert have $12.50 deducted each week for hospital insurance NO.141 NAME Chris German SOC. SEC. NO. 449-XX-XXXX WEEK ENDING October 24, 20-- DAY IN OUT IN OUT IN OUT TOTAL 8:05 12:03 1:00 5:05 T 8:00 12:06 1:10 5:00 W 9:05 12:06 1:15 6:05 Th 8:30 11:56 1:15 6.00 F 8:00 12:00 1:00 6:15 TOTAL HOURS HOURS RATE AMOUNT LILAR OVERTM TOTAL EARNINGS During the week ending October 24. "Oldies but Goodies" rentals were 5484.90 for Barbara Fox and 5641.70 for John French Total rental revenue for the week was $3.917.30 INSTRUCTIONS Prepare a payroll register in your working papers for the week ending October 24. Complete time cards to the nearest quarter of an hour. Use the federal income tax tables provided in the chapter NED SOCCO 4512X.XXXX WEEKEND October 24 20 HAVE Susan Tibor OG SO401 XXXXX our wex Ober 24 - 800 12:00 100 500 8 10 12:00 1.00 505 8:05 12:30 130 5.00 80512.00 100 500 800 12:00 100 10 18:10 12:00 13:00 8:05 12:05 105 3.30 -8.2012 00 00 00 12:00 12:00 12:45 500 - 9:00 11:50 TOTAL TOLERINGS PROBLEM 12-10 Calculating Gross Earnings Job Connect has seven employees, all of whom are paid weekly. For hourly wage employees, overtime is paid at 15 times the regular rate of pay for hours worked over 40 in a week. SOURCE DOCUMENT PROBLEM Problem 12-10 Use the source documents in your working papers to complete this problem. Barbara Miller, the office manager, is paid a salary of $375.00 per week plus a bonus of 3% of all revenue over $6,000 per week. Lynn Austin, an office assistant, is paid a salary of $250.00 per week plus 5% of all telephone sales made in the office. Charlene Womack, the office secretary, is paid a salary of $230.00 per week. Susan Dilloway and Doris Franco, placement workers, are paid an hourly wage of $8.95. Pam Darrah is also a placement worker but is paid a commission of $35.00 for every job placement that she completes. David Facini, a part-time maintenance worker, is paid $7.60 per hour. For the week ending October 24, the office recorded the following payroll information. Total office sales for the week were $8,420.00 . Susan Dilloway worked a total of 38% hours. Doris Franco worked a total of 414 hours. Phone sales for the week were $1,375.00 Pam Darrah made seven job placements. . David Facini worked a total of 23 hours. INSTRUCTIONS Using the form provided in your working papers, calculate the gross earnings for the workers at Job Connect for the week ending October 24. Analyze Identify the employee who had the highest gross earnings. Date Class Problem 12-8 Preparing the Payroll (textbook p. 335) NO 73 NAME Ted Dame SOC. SEC. NO WEEK ENDING CK NO 093-48-7423 10/17/20 NET PAY OUT TOTAL TOTAL DUT OUT 8:58 12:03 12:55 5:09 18:55 11:55 1:00 4:00 w 9:30 12:10 1:04 3:30 8.5712:03 12:59 6:00 8:58 12:00 1:00 6.05 9:00 12:00 OTHER TOTAL HOURS RATE AUOUNT HOUS DATE OF PAYMENT REGULAR OVERTIME HOSP DEDUCTIONS STATE INC TAX FED, INC TAX TOTAL EARNING DIGNATURE DATE TAX No 92 NAE James Usdavin SOC SEC.NO 087-48-3875 WEEK ENDING 10/17/20 PAYROLL REGISTER SOC. SEC TAX OUT TOTAL bar OUT IN OUT 8:55 12:06 1:01 5:40 7:58 11:01 12:03 6:38 w 9.03 1:10 2:00 6:00 7:59 11:55 1:10 4:51 9:01 12:06 1:05 3:47 9:00 12:03 20 motus Savings Bonds: C-Credit Union: D-Union De EARNINGS REGULAR OVERTIME TOTAL TOTAL HOURS TOTALS HOURS PATE AMOUNT BRATE REGULAR OVERTE MOTY SU TOTAL LAOS BIONATURE DATE PAY PERIOD ENDING NAME Other Deduction with the world code ON SONG Problem 12-8 continued) (3) Outbace Serie ht Hi De Service Than 0 Comek CALIFORNIA 01771091107015 VOL a Canyon National Park OG DAF 17710984 DISKA yet 14 2 La Svil De LIMINE Tas Pay Outback Service 53 BE Outive Service Date 20 ta Peyto the Cho ye Orie Di DAG CN Canon MARO CALIFORMA Canyon National in ROSA CASA 1721091 085 015 1721091182 081 085 0 ley DS MWING 83 Lumia Tarnings Deduct po Per ding Social TE Med Te DO Problem 12-8 (continued) 86 97-182 1721 Outback Guide Service 20 Date Pay to the S Order of Dollars CNB Cartyor National Bank MARIPOSA CALIFORNIA 317210918 20: 086 015 1189054 86 Employee Pay Statement Detach and retain this statement Earnings Period Ending Regular Overtime Total Nel Pay Sadal Security Tax Med Tax Deductions Federal State Income Income Hosp TE TIX Total Other 87 Outback-Guide Service 1721 Date 20 Pay to the Order of Dollars CNB Canyon National Bank MARIPOSA CALIFORNIA 1:17210911820 087 015118 9054 87 Employee Pay Slateret Detach and retain this statement Earning Period Ending Regular Overtime Total Deductions Federal Site Income income Hosp Tax Tax Ins Soda Security Mind TIN Tax Net Other Total Total EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20- Carol First 11 Ini MARTIAL STATUS M ALLOWANCES 1 Cummings Last Name 289 Eaton Avenue Address Mariposa, CA 95338 EMPLOYEE NO 83 POSITION Director RATE OF PAY $270.00 Salary Problem 12-8 (continued) SOC. SEC. NO. 091-56-7024 PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME ACCUMULATED EARNINGS NET PAY TOTAL SOC. SEC. TAX 16 74 DEDUCTIONS FED.INC STATE TAX ING. TAX 15.00 4105 OTHER MED TAX 392 HOSP INS 937 TOTAL 49.08 10/10 270.00 12.150.00 12,420 00 27000 220 92 10 11 1 13 QUARTERLY TOTALS On Deduction - Saving Bord Onion 00- Cins: W- UW Name EMPLOYEE'S EARNINGS RECORD FOR QUARTER ENDING December 31, 20- 176 Chapter 12 Ted K. MARTIAL STATUS S ALLOWANCES 0 Dame Name 14 Merton Avenue Adres Mariposa, CA 95338 EMPLOYEE NO 73 POSITION Equipment Clerk $7.60 PATE OF PAY SOC. SEC. NO. 093-48-7423 Problem 12-8 (continued) ACCUMULATED EARNINGS NET PAY PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 26410 SOC. SEC TAX DEDUCTIONS FED, INC STATE TAX INC. TAX 32 00 396 TOTAL 264 10 OTHER TOTAL MED TAX 383 HOSP INS 5143 4,016 22 4,280 32 1637 61 59 20251 I 1 10 13 QUARTERLY TOTALS Deco -Crowe de EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20 Tom 79 M MARTIAL STATUS ALLOWANCES B. Initial EMPLOYEE NO Lengyel Last Nam 926 Amsterdam Avenue ADOS Mariposa, CA 95338 POSITION Gulde RATE OF PAY $160.00 + 5% SOC. SEC. NO. 210-50-7261 Problem 12-8 (continued) NET PAY PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 219,40 HOSP INS DEDUCTIONS FED INC STATE TAX INC TAX 600 329 SOC SEC TAX 13.60 MED TAX 318 TOTAL 219 40 OTHER ACCUMULATED EARNINGS 4,818 00 5,03740 937 TOTAL 45 44 1000 17396 Date 10 11 12 Class 3 QUARTERLY TOTALS O Deduction Bonde - UD- Usuw-Way Chapter EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20-- Name 178 Chapter 12 Jean Ft A. In MARTIAL STATUS S ALLOWANCES 1 Robinson Nam 12 Meadow Avenue MOS Mariposa, CA 95338 EMPLOYEE NO 46 POSITION Guide RATE OF PAY $140.00 + 5% SOC. SEC. NO. 036-59-7206 Problem 12-8 continued) PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 209 30 MED SOC. SEC TAX 1298 TOTAL 209 30 OTHER DEDUCTIONS FED, INC STATE TAX INC. TAX 15.00 314 TAX 3103 HOSP INS 543 NET TOTAL PAY 39 58 169 72 ACCUMULATED EARANAS 2,78635 2,99565 10/10 2 > . 8 10 TE 13 QUARTERLY TOTALS Other Deduction B-05 Sage Bonds C-Credit Union UD-U Dew-United Way EMPLOYEE'S EARNINGS RECORD FOR QUARTER ENDING December 31, 20-- James First P. Initial MARTIAL STATUSS Usdavin Last Name 19 Paterson Avenue Address Mariposa, CA 95338 ALLOWANCES 0 EMPLOYEE NO 92 POSITION Stock Clerk RATE OF PAY $7.40 SOC. SEG. NO. 087-46-3875 PAY PERIOD EARNINGS NO, ENDED REGULAR OVERTIME TOTAL MED TAX SOC. SEC. TAX 1278 DEDUCTIONS FED. INC STATE TAX INC TAX 23.00 HOSP NET PAY INS. OTHER TOTAL ACCUMULATED EARNINGS 3,17215 3,378 30 1. 10/10 20615 206 15 299 309 543 4729 158 86 2 3 4 5 9 10 12 13 QUARTERLY TOTALS Oh Deduction -US. Savings Bond C-Credit Unior UDOUW. Und Wey Chapte EMPLOYEES EARNINGS RECORD FOR QUARTER ENDING December 31, 20- 180 Chapter 12 Kim P. 66 S Wong Nam 28 Millrose Avenue Mariposa, CA 95338 MARTIAL STATUS EMPLOYEE NO POSITION Guide ALLOWANCES Ad 0 RATE OF PAY $140.00 + 5% SOC. SEC. NO 019-53-7302 Problem 12-8 (concluded) PAY PERIOD EARNINGS NO. ENDED REGULAR OVERTIME 10/10 211 20 TOTAL 211 20 SOC. SEC TAX 1309 MED TAX 306 DEDUCTIONS FED, INC STATE TAX INCI TAX 2300 317 HOSP INS OTHER 5143 1000 NET TOTAL PAY 57 75 153,45 ACCUMULATED EARNINGS 3,672 45 3,88365 1 10 11 12 QUARTERLY TOTALS One Deduction: B-US Singsonde --Credit Union UD-DU-Unted Way Analyze: AY PAY PERIOD ENDING 20 SALS MOTIV DATE OF PAYMENT DEDUCTIONS FED INC STATE HOSP TAX INC TAX INS OTHER EARNINGS PATE REGULAR OVERTIME NAME NET PAY . NO TOTAL SOC. SEC TAX TOTAL TAX Problem 129 Preparing the Payroll Register toutbook p.330) NO Date 15 1 Class TOTALS LUSSOU ODW Chapter 121 Analyze: Problem 12-10 Calculating Gross Earnings (textbook p. 337) Instructions: Use the following source documents to record the transactions for this problem. Jake Comed 4 INTEROFFICE MEMORANDUM NO 15 NAME Doris Franco SOC SEC.NO WEEK ENDNO 10/24/20 OUT TO TO PC Tone DATE 109 SUBJECT und Mou nee the private par for the week in October 26 Totalitate 20.00 www.Draw() IN 8 8 DAY N OUT OUT M 9.00 12.01 12:35 5:35 T 9:01 12:02 12:37 5:36 w 8.00 11:59 12:28 5:31 Th 8:58 12:01 12:29 5:46 9:02 11:58 12:31 5:29 9 8% 8 TOTAL HOURS NO 14 NAME Susan Dilloway SOC. SEC NO WEEK ENDING 10/24/20 - HOURS FATE AMOUNT REDRAR OUT OVERTIME TOTAL EARUNOS DAY IN OUT OUT 9:03 12:01 12:32 5:28 8:30 12:29 1:00 3.29 W 9:01 12:03 12:29 5:31 9:02 11:59 12:31 5:30 F 9:01 12:00 12:31 5:29 3-5 TOTAL 8 61 8 8 8 SIGNATURE DATE . NO. 17 NAME David Facini SOC SEC NO WEEK ENDING 10/24/20 - TOTAL HOURS 38 RATE AMOUNT HOURS IN IN OUT OUT REGULAR M OVERTIME HT TOTAL 5 3 5 OUT 3:00) 8:01 2:59 8:02 3:01 8.02 3:00 8:00 3:00 6:01 TOTAL BANOS w SIGNATURE DATE 5 F 3 3 TOTAL HOURS 23 HOURS PLATE AMOUNT REOLLAR OVERTIME TOTAL ANONS SONATURE DATE Date Class Problem 12-10 (concluded) Name Gross Earnings Austin, Lynn Darrah, Pam Dilloway, Susan Facini, David Franco, Doris Miller, Barbara Womack, Charlene Total Gross Earnings Analyze: PROBLEM 128 Preparing the Payroll Outback Guide Service has six employees and pays each week. Hourly employees are paid overtime for all hours worked over 40 in a week. The overtime rate is 11 times the regular rate of pay. Outback pays its employees by hourly rate, salary, or salary plus a 5% commission on total amount of sales. Method of Computing Earnings Employee Hourly Wage Salary Salary Plus Commission Cummings, Carol $270.00 Dame, Ted $ 7.60 Lengyel, Tom $160.00 plus 5% Robinson, Jean $140.00 plus 5% Usdavin, James Wong, Kim $140.00 plus 5% $7.40 354 Chapter 12: Payroll Accounting Employee deductions include federal income taxes (use the tables on page 320), FICA taxes at 6.2% for social security and 1.45% for Medicare, state income taxes of 1.5%, and hospital insurance premiums of $5.43 for single employees and $9.37 for married employees. Also, Kim Wong and Tom Lengyel have $10.00 withheld cach week to purchase U.S. savings bonds. During the pay period ending October 17, the sales were: Tom Lengyel $1,204.76, Jean Robinson $1,925.80, and Kim Wong $2,135.65 The hourly employees filled in the following time cards. NO 73 NE Ted Dame BOC SECNO 03-XX-XXXX WEEKENDNO 10/17/20 NAVE James Usdevin SOC. SECO087-XX-XXXX WEEKENING 10/17/20 OUT N OUT TOTAL DAV GUT OUT 8.58 12:03 12:55 5:09 18:55 11:55 1:004:00 930 12:10 1:04 3:30 8:57 12:03 12:59 6.00 8.58 12:00 1:00 6:05 9.00 12:00 T w OUT 8:55 12:06 1:01 5:40 7:58 11:01 12:03 6:38 9.00 1:10 2:00 6:00 7:50 11:55 1:10 4:51 9:01 12:06 1:05 3:47 9:00 12:00 TOTAL HOURS HOURS TOTAL HOURS REGULAR OVERTIM TE TOMER ROLAR SIGNATURE TOTALCAR SONATURE DATE INSTRUCTIONS On the forms in your working papers: 1. Complete the time cards to the nearest quarter hour. 2. Prepare a payroll register for the week ending October 17. The date of payment is also October 17. Each employee's number, marital status, and number of allowances claimed are listed on her or his employee's earnings record. 3. Prepare a payroll check and stub for each employee. 4. Record the payroll information for each employee on her or his employee's earnings record. Analyze Calculate the total amount deducted from employees' gross pay for FICA taxes (social security and Medicare). PROBLEM 12-9 Preparing the Payroll Register Showbiz Video has six employees who are paid weekly. The hourly employees are paid overtime for hours worked over 40 in a week, at a rate 19 times their regular nute of pay. Employee information follows: 1 Employee Mary Arcopera Barbara Fox John French Chris German David lubecki Employee Number Marital Status Allowances 105 Married 137 Married 135 Single 141 Married 4 139 Single 129 Married 1 1 Susan Tilbert Unit 3: Accounting for a Payroll System 3a 355 Mary Arcompora, the store manager, is paid a salary of $300.00 per week plus 1% of all rental sales, Barbara Fox and John French, salespeople, are paid a salary of $200.00 per week plus a 6% commission on all rentals from the "Oldies but Goodies section. Chris German and David Irbecki, office workers are paid an hourly wage of $7.25. Susan Tilbert, a stock person.is paid 57.40 per hour The payroll deductions include federal income tax, social security tax of 6.2%, Medicare tax of 1.45%, and state income tax of 1.8%. Chris German and Susan Tilbert have $12.50 deducted each week for hospital insurance NO.141 NAME Chris German SOC. SEC. NO. 449-XX-XXXX WEEK ENDING October 24, 20-- DAY IN OUT IN OUT IN OUT TOTAL 8:05 12:03 1:00 5:05 T 8:00 12:06 1:10 5:00 W 9:05 12:06 1:15 6:05 Th 8:30 11:56 1:15 6.00 F 8:00 12:00 1:00 6:15 TOTAL HOURS HOURS RATE AMOUNT LILAR OVERTM TOTAL EARNINGS During the week ending October 24. "Oldies but Goodies" rentals were 5484.90 for Barbara Fox and 5641.70 for John French Total rental revenue for the week was $3.917.30 INSTRUCTIONS Prepare a payroll register in your working papers for the week ending October 24. Complete time cards to the nearest quarter of an hour. Use the federal income tax tables provided in the chapter NED SOCCO 4512X.XXXX WEEKEND October 24 20 HAVE Susan Tibor OG SO401 XXXXX our wex Ober 24 - 800 12:00 100 500 8 10 12:00 1.00 505 8:05 12:30 130 5.00 80512.00 100 500 800 12:00 100 10 18:10 12:00 13:00 8:05 12:05 105 3.30 -8.2012 00 00 00 12:00 12:00 12:45 500 - 9:00 11:50 TOTAL TOLERINGS PROBLEM 12-10 Calculating Gross Earnings Job Connect has seven employees, all of whom are paid weekly. For hourly wage employees, overtime is paid at 15 times the regular rate of pay for hours worked over 40 in a week. SOURCE DOCUMENT PROBLEM Problem 12-10 Use the source documents in your working papers to complete this problem. Barbara Miller, the office manager, is paid a salary of $375.00 per week plus a bonus of 3% of all revenue over $6,000 per week. Lynn Austin, an office assistant, is paid a salary of $250.00 per week plus 5% of all telephone sales made in the office. Charlene Womack, the office secretary, is paid a salary of $230.00 per week. Susan Dilloway and Doris Franco, placement workers, are paid an hourly wage of $8.95. Pam Darrah is also a placement worker but is paid a commission of $35.00 for every job placement that she completes. David Facini, a part-time maintenance worker, is paid $7.60 per hour. For the week ending October 24, the office recorded the following payroll information. Total office sales for the week were $8,420.00 . Susan Dilloway worked a total of 38% hours. Doris Franco worked a total of 414 hours. Phone sales for the week were $1,375.00 Pam Darrah made seven job placements. . David Facini worked a total of 23 hours. INSTRUCTIONS Using the form provided in your working papers, calculate the gross earnings for the workers at Job Connect for the week ending October 24. Analyze Identify the employee who had the highest gross earnings