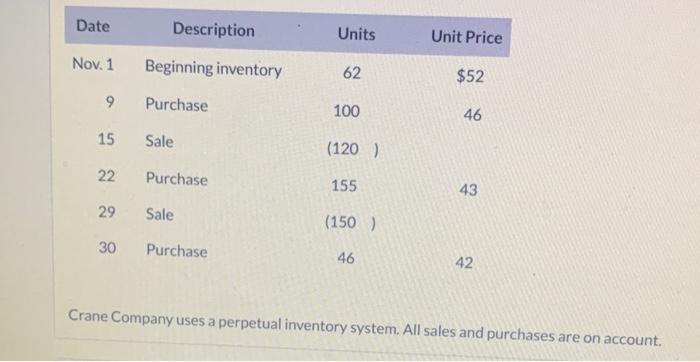

Question: Date Description Units Unit Price Nov. 1 Beginning inventory 62 $52 9 Purchase 100 46 15 Sale (120) 22 Purchase 155 43 29 Sale (150)

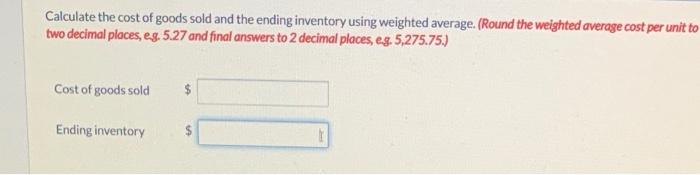

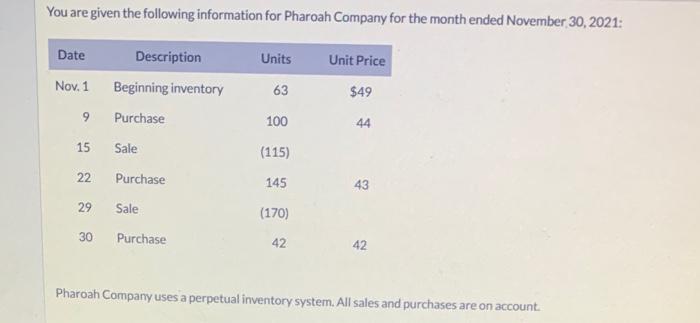

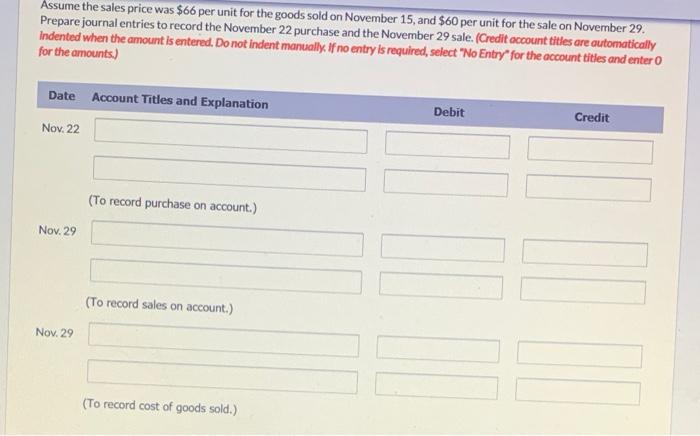

Date Description Units Unit Price Nov. 1 Beginning inventory 62 $52 9 Purchase 100 46 15 Sale (120) 22 Purchase 155 43 29 Sale (150) 30 Purchase 46 42 Crane Company uses a perpetual inventory system. All sales and purchases are on account. Calculate the cost of goods sold and the ending inventory using weighted average. (Round the weighted average cost per unit to two decimal places, eg, 5.27 and final answers to 2 decimal places, eg. 5,275.75.) Cost of goods sold $ Ending inventory You are given the following information for Pharoah Company for the month ended November 30, 2021: Date Units Unit Price Description Beginning inventory Nov. 1 63 $49 9 Purchase 100 44 15 Sale (115) 22 Purchase 145 43 29 Sale (170) 30 Purchase 42 42 Pharoah Company uses a perpetual inventory system. All sales and purchases are on account Assume the sales price was $66 per unit for the goods sold on November 15, and $60 per unit for the sale on November 29. Prepare journal entries to record the November 22 purchase and the November 29 sale. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter 0 for the amounts) Date Account Titles and Explanation Debit Credit Nov. 22 (To record purchase on account.) Nov. 29 (To record sales on account.) Nov. 29 | (To record cost of goods sold.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts