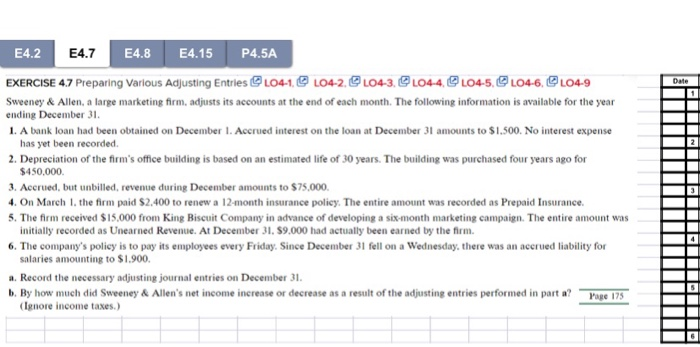

Question: Date E4.2 E4.7 E4.8 E4.15 P4.5A EXERCISE 4.7 Preparing Various Adjusting Entries L04-1, L04-2. L04-3.2044 204-5. L04-6, L04-9 Sweeney & Allen, a large marketing firm,

Date E4.2 E4.7 E4.8 E4.15 P4.5A EXERCISE 4.7 Preparing Various Adjusting Entries L04-1, L04-2. L04-3.2044 204-5. L04-6, L04-9 Sweeney & Allen, a large marketing firm, adjusts its accounts at the end of each month. The following information is available for the year ending December 31 1. A bank loan had been obtained on December 1. Accrued interest on the loan at December 31 amounts to $1.500. No interest expense has yet been recorded. 2. Depreciation of the firm's office building is based on an estimated life of 30 years. The building was purchased four years ago for $450,000 3. Accrued, but unbilled, revenue during December amounts to $75,000 4. On March 1, the firm paid $2.400 to renew a 12-month insurance policy. The entire amount was recorded as Prepaid Insurance. 5. The firm received $15.000 from King Biscuit Company in advance of developing a six-month marketing campaign. The entire amount was initially recorded as Unearned Revenue. At December 31. $9.000 had actually been earned by the firm. 6. The company's policy is to pay its employees every Friday. Since December 31 fell on a Wednesday. there was an accrued liability for salaries amounting to $1.900. a. Record the necessary adjusting journal entries on December 31. b. By how much did Sweeney & Allen's net income increase or decrease as a result of the adjusting entries performed in parta? (Ignore income taxes.) Page 175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts