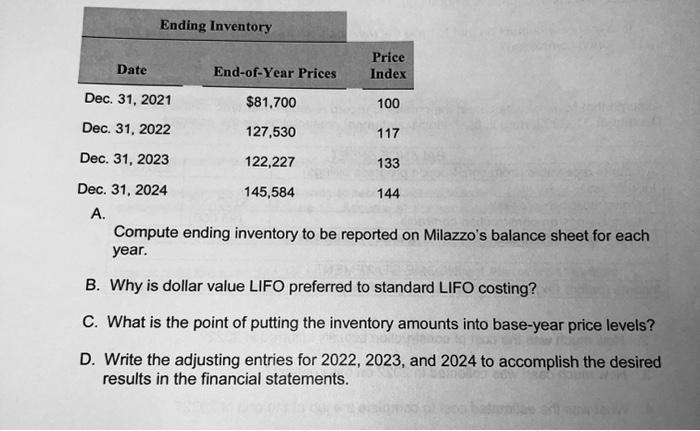

Question: Date Ending Inventory Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 A. End-of-Year Prices $81,700 127,530 122,227 145,584 Price Index

Date Ending Inventory Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 A. End-of-Year Prices $81,700 127,530 122,227 145,584 Price Index 100 117 133 144 Compute ending inventory to be reported on Milazzo's balance sheet for each year. B. Why is dollar value LIFO preferred to standard LIFO costing? C. What is the point of putting the inventory amounts into base-year price levels? D. Write the adjusting entries for 2022, 2023, and 2024 to accomplish the desired results in the financial statements.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

A To compute the ending inventory to be reported on Milazzos balance sheet for each year we need to use the DollarValue LIFO method December 31 2021 Ending Inventory at Base Year Price 81700 given Pri... View full answer

Get step-by-step solutions from verified subject matter experts