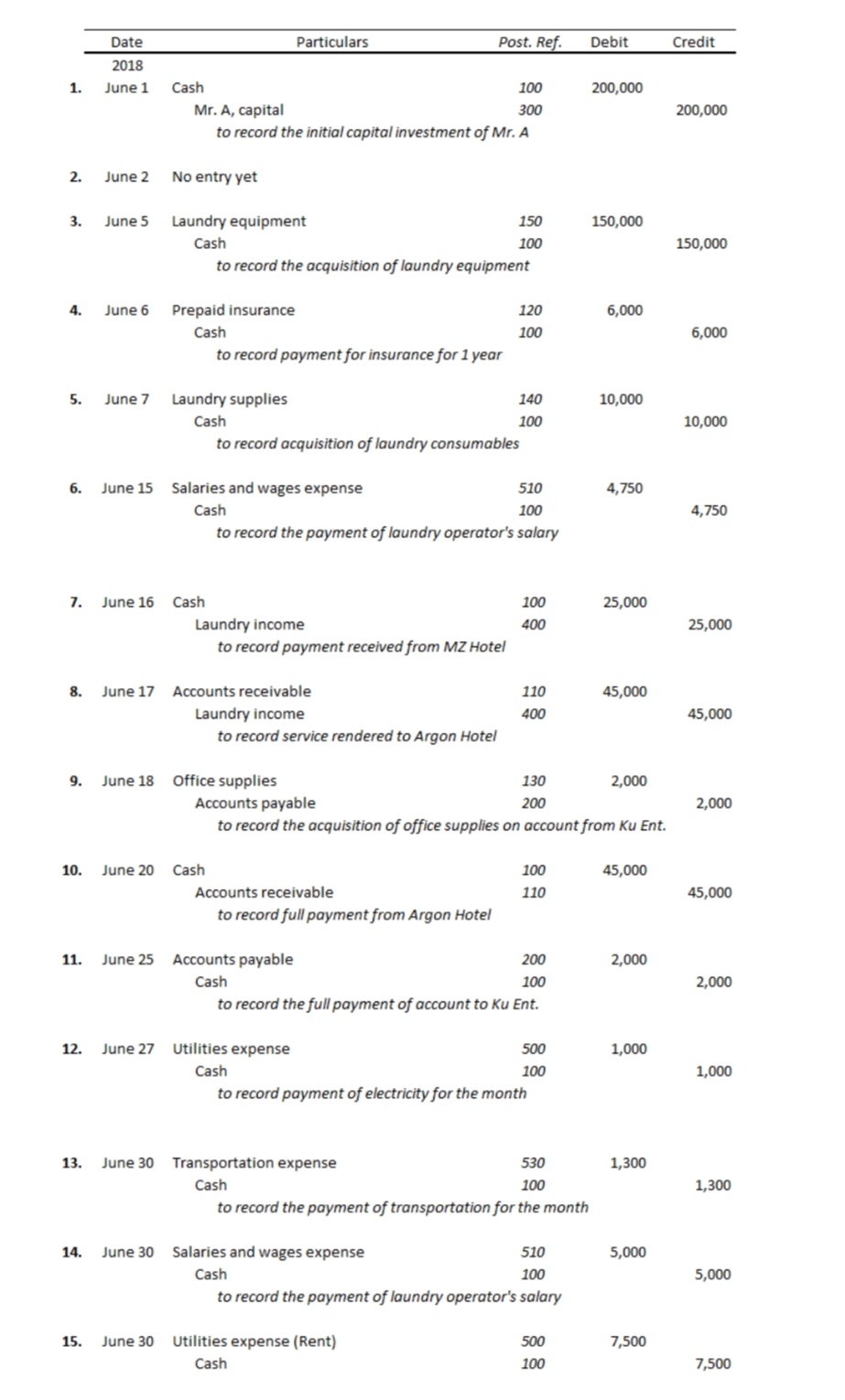

Question: Date Particulars Post. Ref. Debit Credit 2018 1. June 1 Cash 100 200,000 Mr. A, capital 300 200,000 to record the initial capital investment of

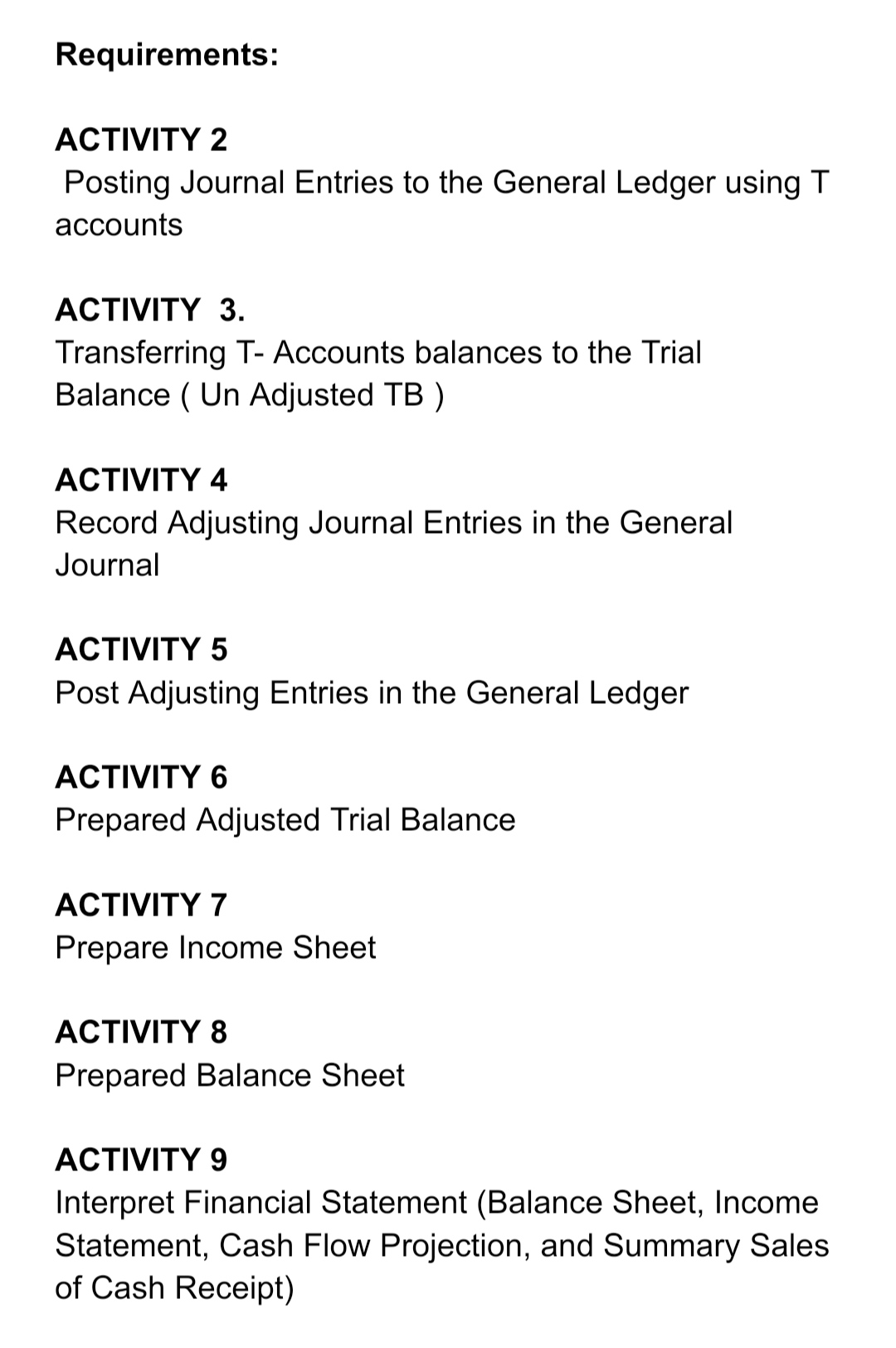

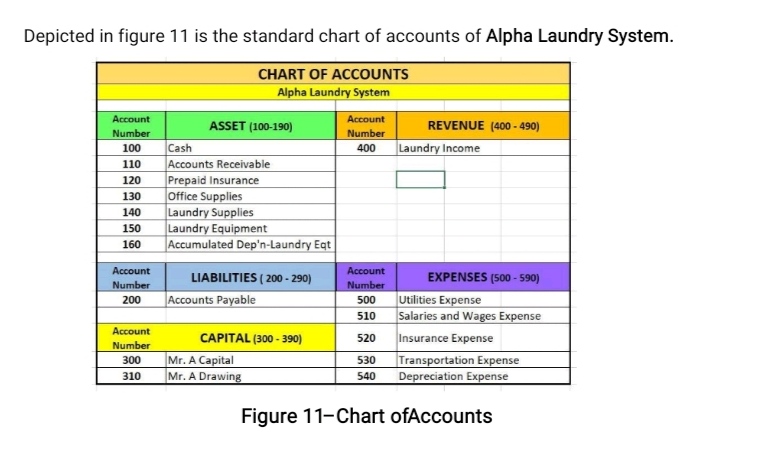

Date Particulars Post. Ref. Debit Credit 2018 1. June 1 Cash 100 200,000 Mr. A, capital 300 200,000 to record the initial capital investment of Mr. A 2. June 2 No entry yet 3. June 5 Laundry equipment 150 150,000 Cash 100 150,000 to record the acquisition of laundry equipment 4. June 6 Prepaid insurance 120 6,000 Cash 100 6,000 to record payment for insurance for 1 year 5. June 7 Laundry supplies 140 10,000 Cash 100 10,000 to record acquisition of laundry consumables 6. June 15 Salaries and wages expense 510 4,750 Cash 100 4,750 to record the payment of laundry operator's salary 7. June 16 Cash 100 25,000 Laundry income 400 25,000 to record payment received from MZ Hotel 8. June 17 Accounts receivable 110 45,000 Laundry income 400 45,000 to record service rendered to Argon Hotel 9. June 18 Office supplies 130 2,000 Accounts payable 200 2,000 to record the acquisition of office supplies on account from Ku Ent. 10. June 20 Cash 100 45,000 Accounts receivable 110 45,000 to record full payment from Argon Hotel 11. June 25 Accounts payable 200 2,000 Cash 100 2,000 to record the full payment of account to Ku Ent. 12. June 27 Utilities expense 500 1,000 Cash 100 1,000 to record payment of electricity for the month 13. June 30 Transportation expense 530 1,300 Cash 100 1,300 to record the payment of transportation for the month 14. June 30 Salaries and wages expense 510 5,000 Cash 100 5,000 to record the payment of laundry operator's salary 15. June 30 Utilities expense (Rent) 500 7,500 Cash 100 7,500Requirements: ACTIVITY 2 Posting Journal Entries to the General Ledger using T accounts ACTIVITY 3. Transferring T- Accounts balances to the Trial Balance ( Un Adjusted TB ) ACTIVITY 4 Record Adjusting Journal Entries in the General Journal ACTIVITY 5 Post Adjusting Entries in the General Ledger ACTIVITY 6 Prepared Adjusted Trial Balance ACTIVITY 7 Prepare Income Sheet ACTIVITY 8 Prepared Balance Sheet ACTIVITY 9 Interpret Financial Statement (Balance Sheet, Income Statement, Cash Flow Projection, and Summary Sales of Cash Receipt) Depicted in figure 11 is the standard chart of accounts of Alpha Laundry System. CHART OF ACCOUNTS Alpha Laundry System Account Account ASSET (100-190) REVENUE (400 - 490) Number Number 100 Cash 400 Laundry Income 110 Accounts Receivable 120 Prepaid Insurance 130 Office Supplies 140 Laundry Supplies 150 Laundry Equipment 160 Accumulated Dep'n-Laundry Egt Account Account LIABILITIES [ 200 - 290) EXPENSES (500 - 590) Number Number 200 Accounts Payable 500 Utilities Expense 510 Salaries and Wages Expense Account CAPITAL (300 - 390) 520 Insurance Expense Number 300 Mr. A Capital 530 Transportation Expense 310 Mr. A Drawing 540 Depreciation Expense Figure 11-Chart ofAccounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts