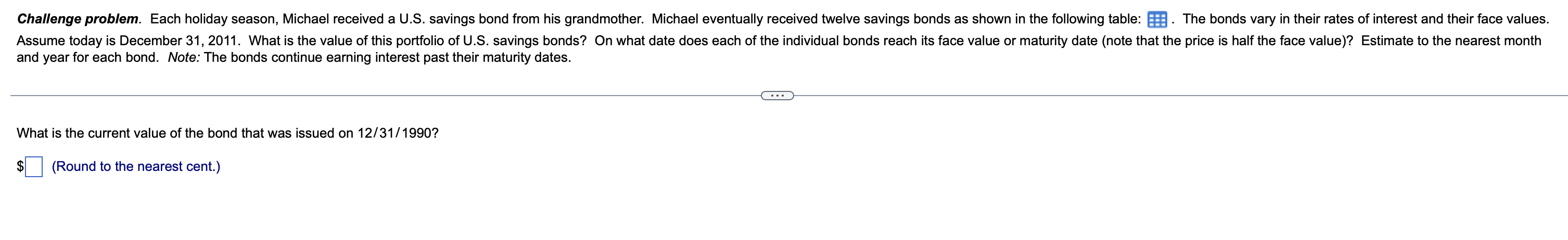

Question: date / price / Future Value / interest rate $25 $50 4.0% ? 12/31/1991 $50 $100 6.0% ? 12/31/1992 $50 $100 3.0% ? 12/31/1993 $25

date / price / Future Value / interest rate

| $25 | $50 | 4.0% | ? | |||

| 12/31/1991 | $50 | $100 | 6.0% | ? | ||

| 12/31/1992 | $50 | $100 | 3.0% | ? | ||

| 12/31/1993 | $25 | $50 | 4.0% | ? | ||

| 12/31/1994 | $25 | $50 | 5.0% | ? | ||

| 12/31/1995 | $50 | $100 | 3.0% | ? | ||

| 12/31/1996 | $50 | $100 | 4.0% | ? | ||

| 12/31/1997 | $25 | $50 | 3.0% | ? | ||

| 12/31/1998 | $25 | $50 | 6.0% | ? | ||

| 12/31/1999 | $25 | $50 | 6.0% | ? | ||

| 12/31/2000 | $50 | $100 | 5.0% | ? | ||

| 12/31/2001 | $50 | $100 | 3.0% | ? | ||

| TOTAL | $450 |

Table is above order of goes from left to right starting with date .

and year for each bond. Note: The bonds continue earning interest past their maturity dates. What is the current value of the bond that was issued on 12/31/1990? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts