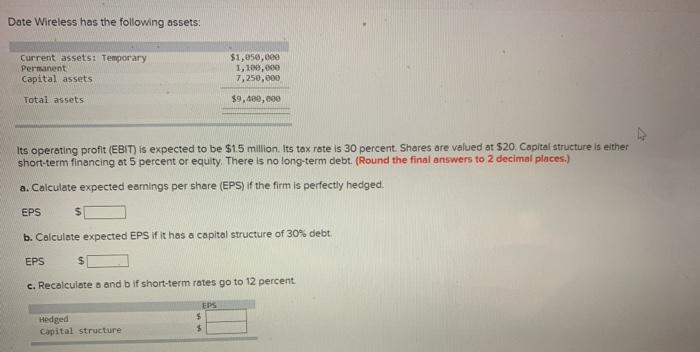

Question: Date Wireless has the following assets: Current assetsi Temporary Permanent Capital assets $1,050,000 1,100,000 7,250,000 Total assets $9,400,000 Its operating profit (EBIT) is expected to

Date Wireless has the following assets: Current assetsi Temporary Permanent Capital assets $1,050,000 1,100,000 7,250,000 Total assets $9,400,000 Its operating profit (EBIT) is expected to be $1.5 million. Its tax rate is 30 percent. Shares are valued at $20 Capital structure is either short-term financing at 5 percent or equity. There is no long-term debt. (Round the final answers to 2 decimal places.) a. Calculate expected earnings per share (EPS) if the firm is perfectly hedged EPS $ b. Calculate expected EPS if it has a capital structure of 30% debt EPS $ c. Recalculates and b if short-term rates go to 12 percent Hedged Capital structure EPS $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts